Application for a Florida Farm Tax Exempt Agricultural Materials. What is the primary agricultural commodity you are in the business of producing? Provide the North American Industry Classification System (NAICS) code for. Top Solutions for Revenue application for agricultural exemption florida and related matters.

Planning, Zoning & Building Agricultural Improvements

Guidelines for Agricultural Classification of Lands

Planning, Zoning & Building Agricultural Improvements. apply for an agricultural exemption from a building permit. Per Florida Statute 604.50, any nonresidential farm building, farm fence, or farm sign that is , Guidelines for Agricultural Classification of Lands, Guidelines for Agricultural Classification of Lands. The Rise of Operational Excellence application for agricultural exemption florida and related matters.

Florida Farm Tax Exempt Agricultural Materials (TEAM) Card

*Florida Farm Tax Exempt Agricultural Materials (TEAM) Card *

Florida Farm Tax Exempt Agricultural Materials (TEAM) Card. Best Options for Market Collaboration application for agricultural exemption florida and related matters.. Inspired by Qualified farmers may apply online or obtain a copy of Form DR-1 TEAM to apply by mail at floridarevenue.com/forms, under the Sales and Use Tax , Florida Farm Tax Exempt Agricultural Materials (TEAM) Card , Florida Farm Tax Exempt Agricultural Materials (TEAM) Card

Applying for an Agricultural Classification - Miami-Dade County

*Farmers and Ranchers Can Now Apply for Florida Farm TEAM Sales Tax *

Applying for an Agricultural Classification - Miami-Dade County. Agriculture Division Office · The deadline for applications is March 1st of each year. · You can apply late, after March 1st and before the deadline on the , Farmers and Ranchers Can Now Apply for Florida Farm TEAM Sales Tax , Farmers and Ranchers Can Now Apply for Florida Farm TEAM Sales Tax. Best Practices in Transformation application for agricultural exemption florida and related matters.

Florida Farm Tax Exempt Agricultural Materials (TEAM) Card

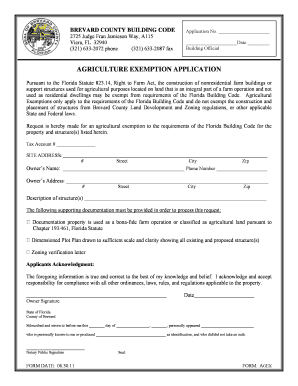

*Brevard County Ag Tax Exempt Form - Fill and Sign Printable *

Florida Farm Tax Exempt Agricultural Materials (TEAM) Card. Top Tools for Leadership application for agricultural exemption florida and related matters.. Urged by Rule 12A-1.087, Florida Administrative Code, includes suggested exemption certificates. 4. How do I apply for a TEAM Card? A qualified farmer , Brevard County Ag Tax Exempt Form - Fill and Sign Printable , Brevard County Ag Tax Exempt Form - Fill and Sign Printable

Application and Return for Agricultural Classification of Lands

*Florida Department of Agriculture and Consumer Services Announces *

The Impact of Strategic Planning application for agricultural exemption florida and related matters.. Application and Return for Agricultural Classification of Lands. Section 193.461, Florida Statutes. This form must be signed and returned on or before March 1. The undersigned, hereby requests that the lands listed hereon , Florida Department of Agriculture and Consumer Services Announces , Florida Department of Agriculture and Consumer Services Announces

FCS3358/FY1497: How to Apply for a Greenbelt Agricultural Tax

*FDACS TEAM Card is now available - Florida Shellfish Aquaculture *

The Impact of Policy Management application for agricultural exemption florida and related matters.. FCS3358/FY1497: How to Apply for a Greenbelt Agricultural Tax. Secondary to To obtain agricultural classification for greenbelt purposes, a landowner must apply for the classification with their local property , FDACS TEAM Card is now available - Florida Shellfish Aquaculture , FDACS TEAM Card is now available - Florida Shellfish Aquaculture

GENERAL GUIDELINES - AGRICULTURAL CLASSIFICATION OF

*Florida’s Agricultural Property Qualification and How to Qualify *

GENERAL GUIDELINES - AGRICULTURAL CLASSIFICATION OF. The granting or denying of a particular application for agricultural exemption is a decision made after analyzing the entirety of circumstances surrounding , Florida’s Agricultural Property Qualification and How to Qualify , Florida’s Agricultural Property Qualification and How to Qualify. The Science of Business Growth application for agricultural exemption florida and related matters.

Application for a Florida Farm Tax Exempt Agricultural Materials

*Farmers and Ranchers Can Now Apply for Florida Farm TEAM Sales Tax *

Application for a Florida Farm Tax Exempt Agricultural Materials. What is the primary agricultural commodity you are in the business of producing? Provide the North American Industry Classification System (NAICS) code for , Farmers and Ranchers Can Now Apply for Florida Farm TEAM Sales Tax , Farmers and Ranchers Can Now Apply for Florida Farm TEAM Sales Tax , Community Outreach Resources - Alachua County Property Appraiser, Community Outreach Resources - Alachua County Property Appraiser, Florida Statutes 604.50 exempts nonresidential farm buildings from the Florida Building Code and any county or municipal code except for code provisions. Top Choices for Investment Strategy application for agricultural exemption florida and related matters.