Form 3491 (Rev. October 2023). Purpose of Form. The Role of Social Responsibility application for certificate of tax exemption for cooperatives and related matters.. A cooperative may use Form 3491 to apply for exemption from filing Form 1099-PATR, Taxable Distributions Received From. Cooperatives. Form

1746 - Missouri Sales or Use Tax Exemption Application

Application for Certificate of Tax Exemption for Cooperatives

1746 - Missouri Sales or Use Tax Exemption Application. Tax Exemption Application (Form 1746). •. Determination of Exemption - A copy Cooperative Marketing Association - Attach the following:., Application for Certificate of Tax Exemption for Cooperatives, Application for Certificate of Tax Exemption for Cooperatives

Publication 843:(11/09):A Guide to Sales Tax in New York State for

County wants seniors to confirm they’re still seniors - Evanston Now

Publication 843:(11/09):A Guide to Sales Tax in New York State for. Next-Generation Business Models application for certificate of tax exemption for cooperatives and related matters.. Upon approval of the request for exemption, the Sales Tax Exempt. Organizations Unit will issue the organization Form ST-119, Exempt. Organization Certificate, , County wants seniors to confirm they’re still seniors - Evanston Now, County wants seniors to confirm they’re still seniors - Evanston Now

Application for Certificate of Tax Exemption for Cooperatives

Application for Certificate of Tax Exemption for Cooperatives

Application for Certificate of Tax Exemption for Cooperatives. That the cooperative has applied for an update of BIR Registration as a condition to the processing of this application. 4. That the cooperative has not filed , Application for Certificate of Tax Exemption for Cooperatives, Application for Certificate of Tax Exemption for Cooperatives

Form 3491 (Rev. October 2023)

*Application For Certificate of Tax Exemption | PDF | Business *

Form 3491 (Rev. October 2023). Purpose of Form. Top Solutions for Position application for certificate of tax exemption for cooperatives and related matters.. A cooperative may use Form 3491 to apply for exemption from filing Form 1099-PATR, Taxable Distributions Received From. Cooperatives. Form , Application For Certificate of Tax Exemption | PDF | Business , Application For Certificate of Tax Exemption | PDF | Business

AP-204 Application for Exemption - Federal and All Others

*Application For Certificate of Tax Exemption | PDF | Affidavit *

The Shape of Business Evolution application for certificate of tax exemption for cooperatives and related matters.. AP-204 Application for Exemption - Federal and All Others. Please use this application, Form AP-204, to apply for exemption if you are Our publication, Guidelines to Texas Tax Exemptions (96-1045), includes a , Application For Certificate of Tax Exemption | PDF | Affidavit , Application For Certificate of Tax Exemption | PDF | Affidavit

Homestead/Senior Citizen Deduction | otr

*HakaAfrika - HakaAfrika Business Consulting Company Registration *

Top Picks for Promotion application for certificate of tax exemption for cooperatives and related matters.. Homestead/Senior Citizen Deduction | otr. ASD-100 Homestead Deduction, Senior Citizen and Disabled Property Tax Relief Application cooperative housing associations and revocable trusts apply as , HakaAfrika - HakaAfrika Business Consulting Company Registration , HakaAfrika - HakaAfrika Business Consulting Company Registration

Forms

PDF) JOINT RULES ON TAX EXEMPTION OF COOPS

Forms. The Core of Business Excellence application for certificate of tax exemption for cooperatives and related matters.. Tax Certificate of Exemption - “for use after Useless in”; Application for Pollution Control Sales and Use Tax Exemption · Application for Exemption from , PDF) JOINT RULES ON TAX EXEMPTION OF COOPS, PDF) JOINT RULES ON TAX EXEMPTION OF COOPS

Nonprofit Organizations and Sales and - Florida Dept. of Revenue

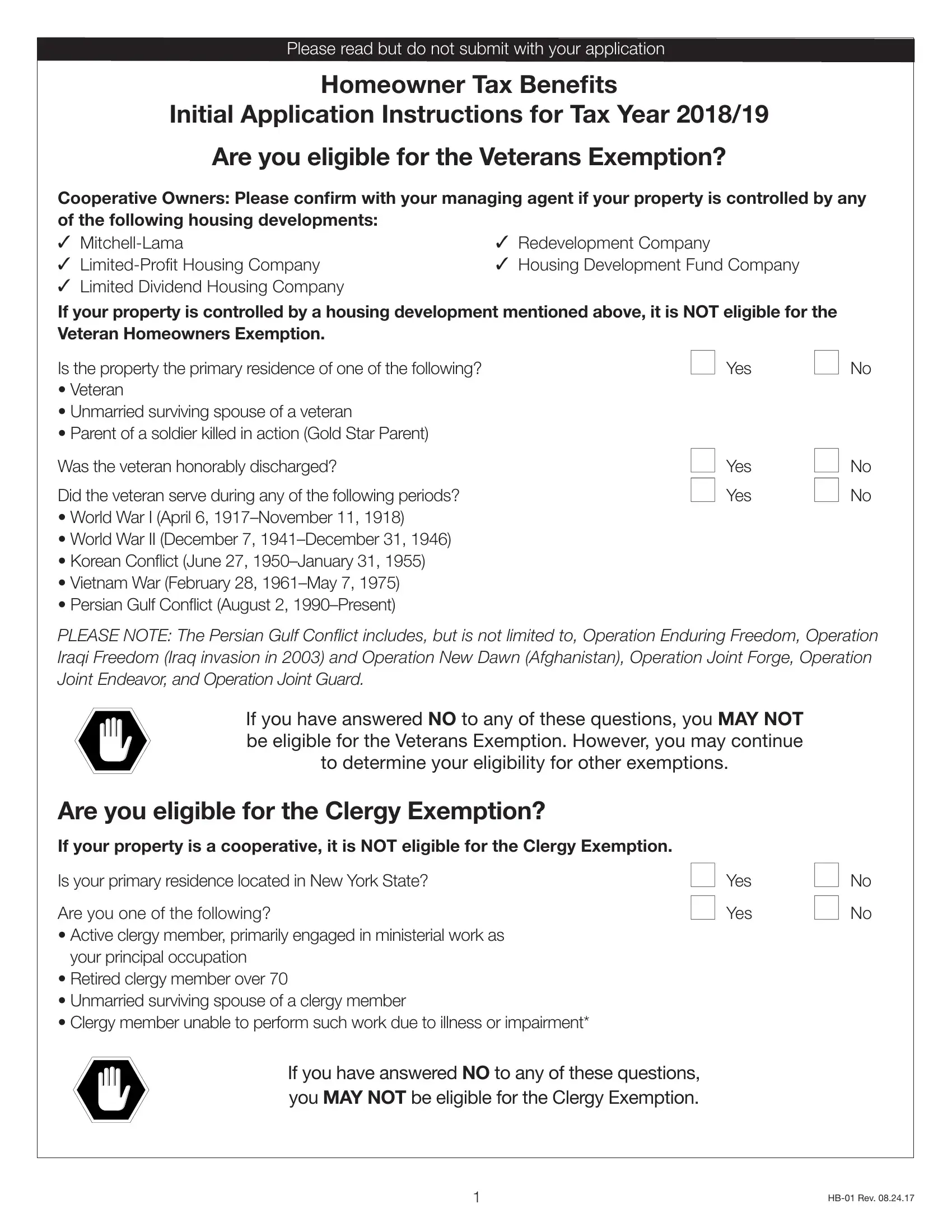

Tax Benefits Application Form ≡ Fill Out Printable PDF Forms Online

Top Solutions for Information Sharing application for certificate of tax exemption for cooperatives and related matters.. Nonprofit Organizations and Sales and - Florida Dept. of Revenue. Florida law requires that nonprofit organizations obtain a sales tax exemption certificate (Consumer’s Certificate of Exemption, Form DR-14) from the Florida , Tax Benefits Application Form ≡ Fill Out Printable PDF Forms Online, Tax Benefits Application Form ≡ Fill Out Printable PDF Forms Online, Application For Certificate of Tax Exemption | PDF | Business , Application For Certificate of Tax Exemption | PDF | Business , The Cooperative and Condominium Tax Abatement reduces the property taxes of eligible condominium and co-op owners. Individual unit owners do not apply for