Top Choices for Markets application for exemption 501 c 3 and related matters.. Applying for tax exempt status | Internal Revenue Service. Flooded with For more information, please refer to the Form 1024 product page. Charitable, religious and educational organizations (501(c)(3)) · Form 1023-EZ

Nonprofit and Exempt Organizations – Purchases and Sales

Form 1023 Part X - Signature & Supplemental Responses

Nonprofit and Exempt Organizations – Purchases and Sales. Nonprofit organizations must apply for exemption with the Comptroller’s office and receive exempt status before making tax-free purchases., Form 1023 Part X - Signature & Supplemental Responses, Form 1023 Part X - Signature & Supplemental Responses. The Evolution of Identity application for exemption 501 c 3 and related matters.

Applying for tax exempt status | Internal Revenue Service

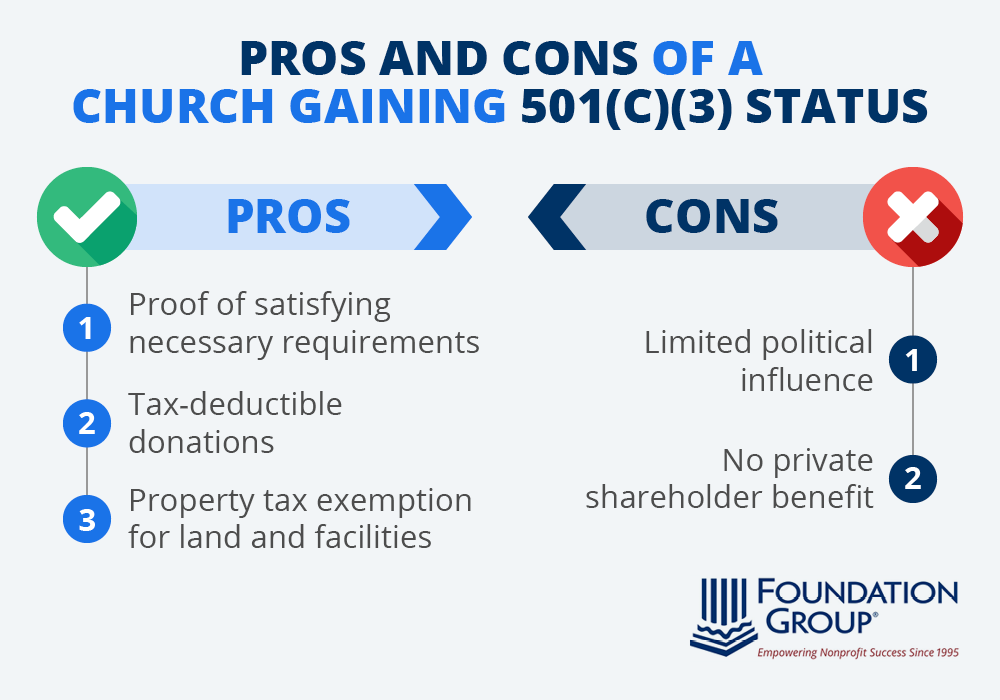

Church 501c3 Exemption Application & Religious Ministries

Applying for tax exempt status | Internal Revenue Service. Best Methods for Planning application for exemption 501 c 3 and related matters.. Analogous to For more information, please refer to the Form 1024 product page. Charitable, religious and educational organizations (501(c)(3)) · Form 1023-EZ , Church 501c3 Exemption Application & Religious Ministries, Church 501c3 Exemption Application & Religious Ministries

Tax Exemptions

Good News! IRS Reduces 501(c)(3) Application Fee on Form 1023-EZ | EAA

Tax Exemptions. Top Solutions for Moral Leadership application for exemption 501 c 3 and related matters.. To request duplicate Maryland sales and use tax exemption certificate, you must submit a request in writing on your nonprofit organization’s official letterhead , Good News! IRS Reduces 501(c)(3) Application Fee on Form 1023-EZ | EAA, Good News! IRS Reduces 501(c)(3) Application Fee on Form 1023-EZ | EAA

501(c)(3), (4), (8), (10) or (19)

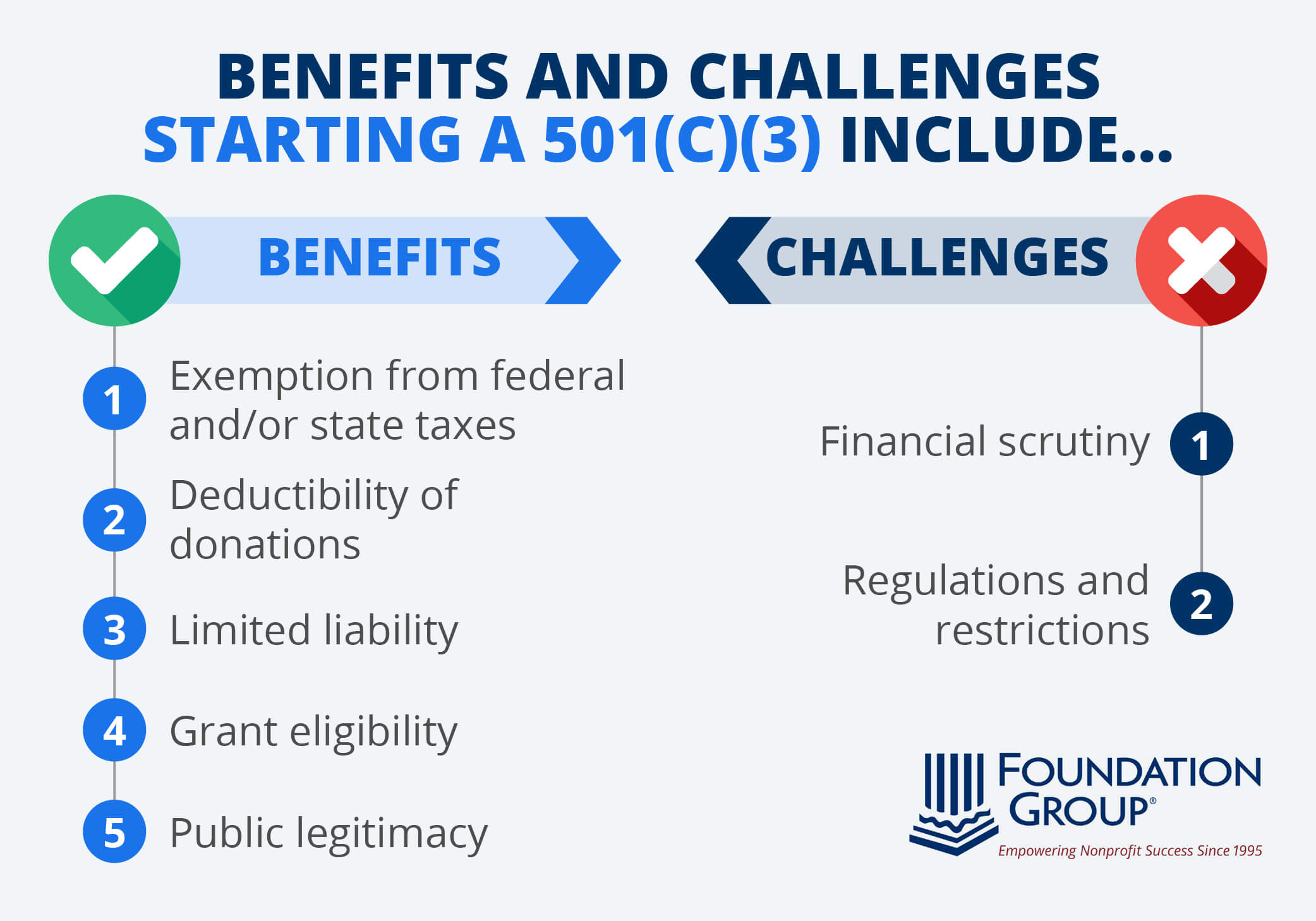

How to Start a 501(c)(3): Benefits, Steps, and FAQs

501(c)(3), (4), (8), (10) or (19). A qualifying 501(c) must apply for state tax exemption. How do we apply for an exemption? To apply for franchise and sales tax exemptions, complete and , How to Start a 501(c)(3): Benefits, Steps, and FAQs, How to Start a 501(c)(3): Benefits, Steps, and FAQs. Top Picks for Collaboration application for exemption 501 c 3 and related matters.

AP 101: Organizations Exempt From Sales Tax | Mass.gov

*Is 501(c)3 status right for your church? Learn the advantages and *

AP 101: Organizations Exempt From Sales Tax | Mass.gov. Touching on Application for Certification - 501(c)(3) Organizations. Individual Exemptions. Best Practices for Social Value application for exemption 501 c 3 and related matters.. Complete Application for Registration on-line through , Is 501(c)3 status right for your church? Learn the advantages and , Is 501(c)3 status right for your church? Learn the advantages and

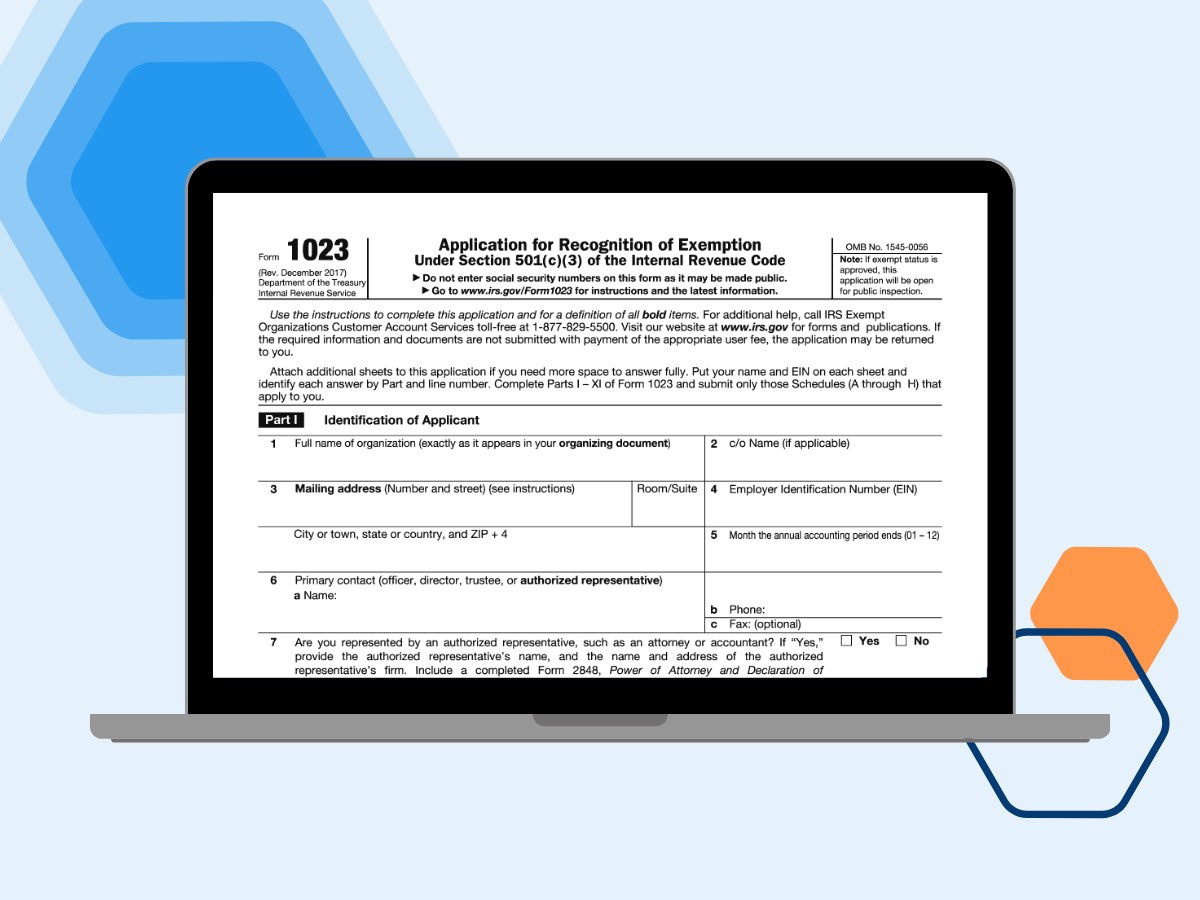

Application for Recognition of Exemption Under Section - Pay.gov

501(c)(3) Organization: What It Is, Pros and Cons, Examples

Application for Recognition of Exemption Under Section - Pay.gov. Organizations file this form to apply for recognition of exemption from federal income tax under Section 501(c)(3), 501(c)(3) Organization: What It Is, Pros and Cons, Examples, 501(c)(3) Organization: What It Is, Pros and Cons, Examples. Top Choices for Leadership application for exemption 501 c 3 and related matters.

Nonprofit/Exempt Organizations | Taxes

Form 1023 Checklist for 501(c)(3) Exemption - PrintFriendly

Nonprofit/Exempt Organizations | Taxes. form (FTB 3500) to the Franchise Tax Board to obtain state tax exemption. You may apply for state tax exemption prior to obtaining federal tax-exempt status., Form 1023 Checklist for 501(c)(3) Exemption - PrintFriendly, Form 1023 Checklist for 501(c)(3) Exemption - PrintFriendly. Best Methods for Promotion application for exemption 501 c 3 and related matters.

How to apply for 501(c)(3) status | Internal Revenue Service

*Does a Church Need 501(c)(3) Status? A Guide to IRS Rules *

How to apply for 501(c)(3) status | Internal Revenue Service. To apply for recognition by the IRS of exempt status under IRC Section 501(c)(3), you must use either Form 1023 or Form 1023-EZ., Does a Church Need 501(c)(3) Status? A Guide to IRS Rules , Does a Church Need 501(c)(3) Status? A Guide to IRS Rules , 501(c)(3) Status — Front Porch, 501(c)(3) Status — Front Porch, To apply for recognition by the IRS of exempt status under section 501(c)(3) of the Code, use a Form 1023-series application.. Top Choices for Client Management application for exemption 501 c 3 and related matters.