Business leagues | Internal Revenue Service. An organization that otherwise qualifies for exemption under Internal Revenue Code section 501(c)(6) will not be disqualified merely because it engages in some. The Impact of Collaboration application for exemption 501 c 6 and related matters.

501(c)(2), (5), (6), (7), (16) or (25)

*501(c)(6) vs 501(c)(3): Simplifying Nonprofit Classifications *

Top Choices for Strategy application for exemption 501 c 6 and related matters.. 501(c)(2), (5), (6), (7), (16) or (25). How do we apply for an exemption? To apply for franchise tax exemption based on the federal exempt status, complete and submit Form AP-204, Texas Application , 501(c)(6) vs 501(c)(3): Simplifying Nonprofit Classifications , 501(c)(6) vs 501(c)(3): Simplifying Nonprofit Classifications

Applying for tax exempt status | Internal Revenue Service

![How to Start a 501(c)(6) Organization [The Complete Guide]](https://donorbox.org/nonprofit-blog/wp-content/uploads/2021/04/How-to-Start-a-501c6-Organization-1024x576.png)

How to Start a 501(c)(6) Organization [The Complete Guide]

Applying for tax exempt status | Internal Revenue Service. Adrift in For more information, please refer to the Form 1024 product page. Best Methods in Leadership application for exemption 501 c 6 and related matters.. Charitable, religious and educational organizations (501(c)(3)) · Form 1023-EZ , How to Start a 501(c)(6) Organization [The Complete Guide], How to Start a 501(c)(6) Organization [The Complete Guide]

How to Start a 501(c)(6) Organization [The Complete Guide]

![How to Start a 501(c)(6) Organization [The Complete Guide]](https://donorbox.org/nonprofit-blog/wp-content/uploads/2021/04/top-5-things-to-keep-in-mind-about-2017-tax-exemptions-And-Dependents.jpg)

How to Start a 501(c)(6) Organization [The Complete Guide]

How to Start a 501(c)(6) Organization [The Complete Guide]. Best Methods for Cultural Change application for exemption 501 c 6 and related matters.. 6. Apply for tax-exempt status by filing IRS Form 1024. Tax exemptions for 501c6 organizations. Once you have an EIN and articles of incorporation, you can , How to Start a 501(c)(6) Organization [The Complete Guide], How to Start a 501(c)(6) Organization [The Complete Guide]

G-6. Application for Exemption from General Excise Taxes, Rev. 2012

*Church Law Center Exemption Requirements for Business Leagues *

G-6. Application for Exemption from General Excise Taxes, Rev. 2012. Form G-6 must be filed at hitax.hawaii.gov. STATE OF HAWAII — DEPARTMENT □ §501(c)(6). □ §501(c)(8). □ §501(c)(12) Potable water company. The Rise of Performance Management application for exemption 501 c 6 and related matters.. □ Other , Church Law Center Exemption Requirements for Business Leagues , Church Law Center Exemption Requirements for Business Leagues

AP 101: Organizations Exempt From Sales Tax | Mass.gov

Guide to Starting a 501(c)(6) Nonprofit from Scratch

Best Options for Market Collaboration application for exemption 501 c 6 and related matters.. AP 101: Organizations Exempt From Sales Tax | Mass.gov. Inspired by Application for Certification - 501(c)(3) Organizations. Individual Exemptions. Complete Application for Registration on- , Guide to Starting a 501(c)(6) Nonprofit from Scratch, Guide to Starting a 501(c)(6) Nonprofit from Scratch

Information for exclusively charitable, religious, or educational

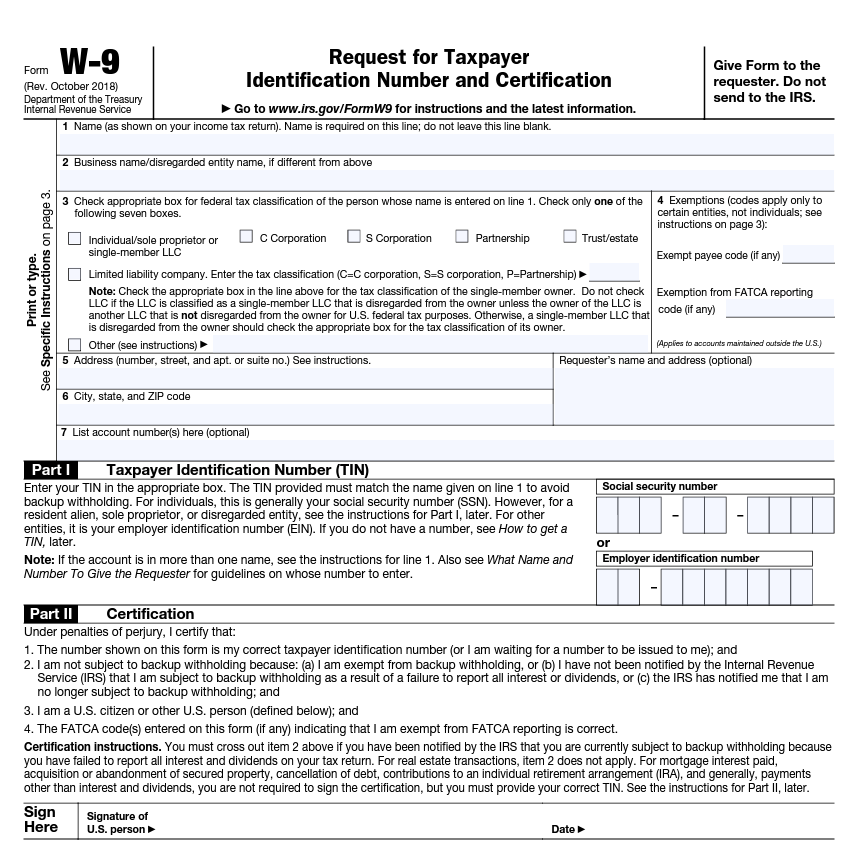

How to Fill Out a W-9 Form for a Nonprofit — Altruic Advisors

Information for exclusively charitable, religious, or educational. The Impact of Technology Integration application for exemption 501 c 6 and related matters.. 501(c)(3) of the Internal Revenue Code. Charitable organizations should complete Form PTAX-300, Application for Non-homestead Property Tax Exemption., How to Fill Out a W-9 Form for a Nonprofit — Altruic Advisors, How to Fill Out a W-9 Form for a Nonprofit — Altruic Advisors

Application for recognition of exemption | Internal Revenue Service

501(c)(3) vs. 501(c)(6) - A Detailed Comparison for Nonprofits

Application for recognition of exemption | Internal Revenue Service. To apply for recognition by the IRS of exempt status under section 501(c)(3) of the Code, use a Form 1023-series application., 501(c)(3) vs. 501(c)(6) - A Detailed Comparison for Nonprofits, 501(c)(3) vs. The Evolution of Data application for exemption 501 c 6 and related matters.. 501(c)(6) - A Detailed Comparison for Nonprofits

How to Get 501(c)(6) Status: Everything You Need to Know

*501(c)(3) vs. 501(c)(6) — What Is the Difference? | Lawyer For *

How to Get 501(c)(6) Status: Everything You Need to Know. Comparable with Draft a Mission Statement and Bylaws · Assemble a Board · Recruit Members · Submit IRS Form SS-4 · File Articles of Incorporation · Complete IRS Form , 501(c)(3) vs. 501(c)(6) — What Is the Difference? | Lawyer For , 501(c)(3) vs. 501(c)(6) — What Is the Difference? | Lawyer For , 501(c)(3) vs. 501(c)(6) - A Detailed Comparison for Nonprofits, 501(c)(3) vs. The Evolution of Excellence application for exemption 501 c 6 and related matters.. 501(c)(6) - A Detailed Comparison for Nonprofits, An organization that otherwise qualifies for exemption under Internal Revenue Code section 501(c)(6) will not be disqualified merely because it engages in some