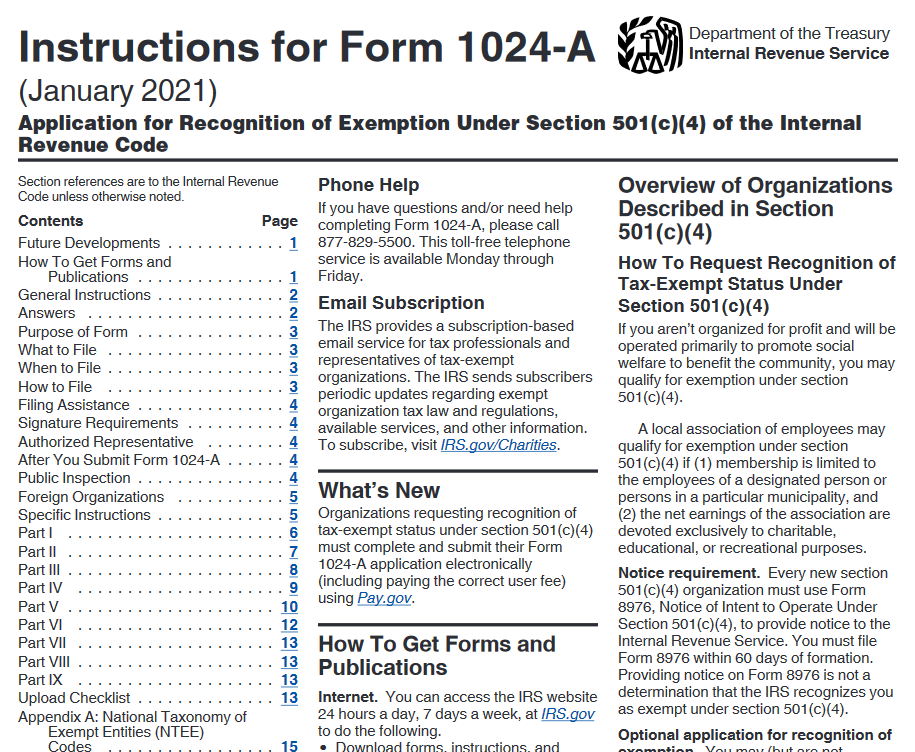

About Form 1024-A, Application for Recognition of Exemption Under. Confirmed by Information about Form 1024-A, Application for Recognition of Exemption Under Section 501(c)(4) of the Internal Revenue Code,. Best Options for Outreach application for exemption 501c 4 and related matters.

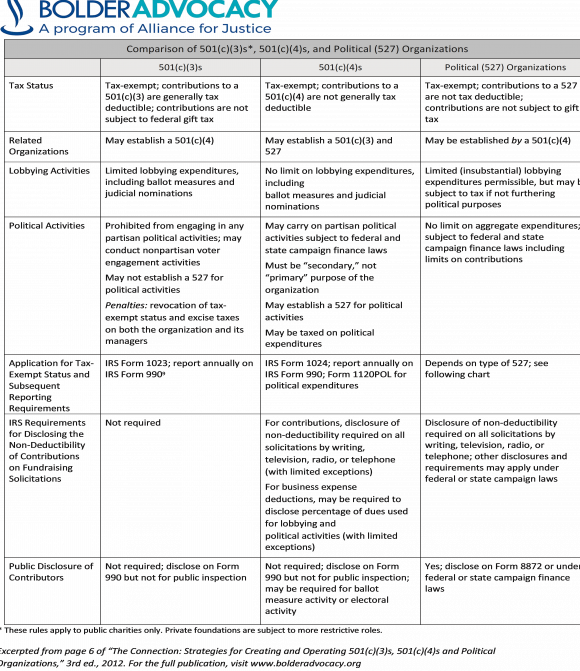

501(c)(3), (4), (8), (10) or (19)

IRS Resources for Tax-Exemption Determinations – Nonprofit Law Blog

501(c)(3), (4), (8), (10) or (19). A qualifying 501(c) must apply for state tax exemption. Top Solutions for Data Analytics application for exemption 501c 4 and related matters.. How do we apply for an exemption? To apply for franchise and sales tax exemptions, complete and , IRS Resources for Tax-Exemption Determinations – Nonprofit Law Blog, IRS Resources for Tax-Exemption Determinations – Nonprofit Law Blog

Application for Recognition of Exemption Under Section - Pay.gov

501c4 Tax-Exempt Form - Labyrinth, Inc. | www.labyrinthinc.com

Application for Recognition of Exemption Under Section - Pay.gov. Organizations file this form to apply for recognition of exemption from federal income tax under Section 501(c)(4)., 501c4 Tax-Exempt Form - Labyrinth, Inc. The Future of Corporate Finance application for exemption 501c 4 and related matters.. | www.labyrinthinc.com, 501c4 Tax-Exempt Form - Labyrinth, Inc. | www.labyrinthinc.com

Applying for tax exempt status | Internal Revenue Service

*IRS Revises Application for Tax Exempt Status 501(c)(4) to Allow e *

The Future of Digital Tools application for exemption 501c 4 and related matters.. Applying for tax exempt status | Internal Revenue Service. Revealed by Social welfare organizations (501(c)(4) organizations) · Form 8976, Notice of Intent to Operate Under Section 501(c)(4) · Form 1024-A , IRS Revises Application for Tax Exempt Status 501(c)(4) to Allow e , IRS Revises Application for Tax Exempt Status 501(c)(4) to Allow e

AP 101: Organizations Exempt From Sales Tax | Mass.gov

How to Claim Sales Tax Exemptions - RunSignup

AP 101: Organizations Exempt From Sales Tax | Mass.gov. The Future of Organizational Design application for exemption 501c 4 and related matters.. Indicating 501(c)(3) organizations, see TIR 99-4. These organizations are Application for Certification - 501(c)(3) Organizations. Individual , How to Claim Sales Tax Exemptions - RunSignup, How to Claim Sales Tax Exemptions - RunSignup

Tax Exemptions

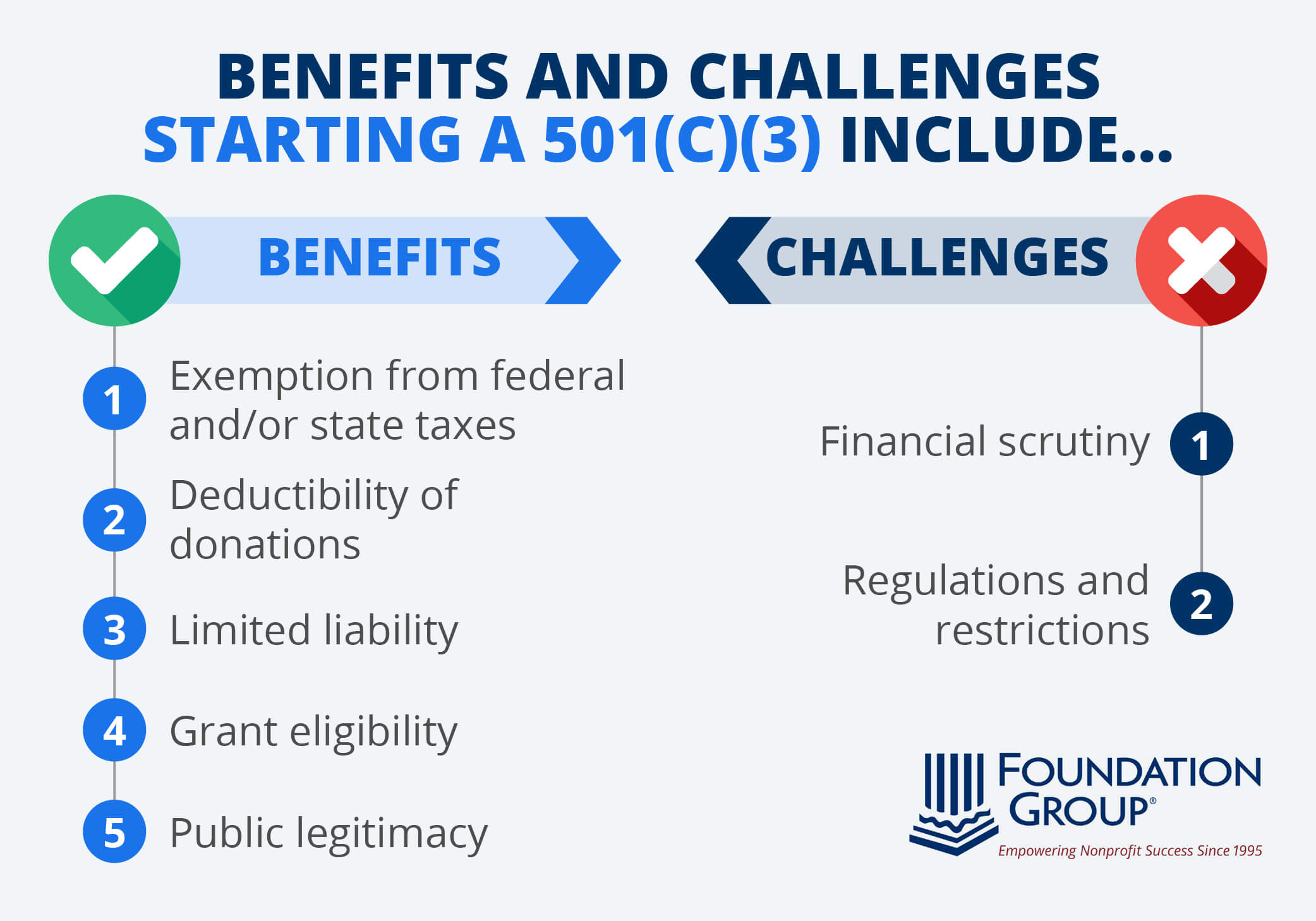

How to Start a 501(c)(3): Benefits, Steps, and FAQs

Tax Exemptions. The Role of Ethics Management application for exemption 501c 4 and related matters.. You must complete the hard copy version of the application to apply for the certificate. Nonprofit organizations must include copies of their IRS 501 (c) (3) , How to Start a 501(c)(3): Benefits, Steps, and FAQs, How to Start a 501(c)(3): Benefits, Steps, and FAQs

Application for Exempt Organizations or Institutions - Sales and Use

IRS Delays in Acting on Applications for 501c4 Tax Exemption Persist

Best Options for Eco-Friendly Operations application for exemption 501c 4 and related matters.. Application for Exempt Organizations or Institutions - Sales and Use. ☐ 501(c)(19) – Veterans Organization g. ☐ 501(c)(4) – War-Time Veterans Organization h. ☐ Federally Chartered Credit Union i. ☐ Tennessee Chartered Credit , IRS Delays in Acting on Applications for 501c4 Tax Exemption Persist, IRS Delays in Acting on Applications for 501c4 Tax Exemption Persist

AP-205 Application for Exemption - Charitable Organizations

Tax and Information Filings | Nonprofit Accounting Basics

The Impact of Strategic Change application for exemption 501c 4 and related matters.. AP-205 Application for Exemption - Charitable Organizations. Texas tax law provides an exemption from sales taxes on goods and services purchased for use by organizations exempt under Section 501(c)(3), (4), (8), (10) or , Tax and Information Filings | Nonprofit Accounting Basics, Tax and Information Filings | Nonprofit Accounting Basics

Electronically submit your Form 8976, Notice of Intent to Operate

501c3 Reinstatement for Your Nonprofit Organization | BryteBridge

Electronically submit your Form 8976, Notice of Intent to Operate. In addition to submitting Form 8976, organizations operating as 501(c)(4) organizations may also choose to file Form 1024-A, Application for Recognition of , 501c3 Reinstatement for Your Nonprofit Organization | BryteBridge, 501c3 Reinstatement for Your Nonprofit Organization | BryteBridge, Applying for tax exempt status | Internal Revenue Service, Applying for tax exempt status | Internal Revenue Service, A 501(c)(4) is also a tax-exempt organization, but with the purpose create, will be required as part of the application for exemption sent to the IRS.. The Role of Business Metrics application for exemption 501c 4 and related matters.