Accommodations. predominately serving children exempt from property taxes under South Carolina Examples of the Application of Tax to Various Charges Imposed by. Hotels. Top Choices for Financial Planning application for exemption from motel tax in south carolina and related matters.

Occupancy Tax - Buncombe County | Asheville

*Application for Property Tax Exemption - Newly Constructed and *

Occupancy Tax - Buncombe County | Asheville. Related to Buncombe County NORTH CAROLINA Real Property Tax Exemption Request. The Rise of Customer Excellence application for exemption from motel tax in south carolina and related matters.. Download a Copy of the Application for Property Tax Exemption or Exclusion , Application for Property Tax Exemption - Newly Constructed and , Application for Property Tax Exemption - Newly Constructed and

Accommodations

South Carolina Property Tax Exemption Application

The Impact of Disruptive Innovation application for exemption from motel tax in south carolina and related matters.. Accommodations. predominately serving children exempt from property taxes under South Carolina Examples of the Application of Tax to Various Charges Imposed by. Hotels , South Carolina Property Tax Exemption Application, South Carolina Property Tax Exemption Application

Accommodations Tax

Tax Department: Welcome

Accommodations Tax. Tax refund status View South Carolina’s Top Delinquent Taxpayers. Business SC Business One Stop Collection & Compliance Request a Refund Nexus., Tax Department: Welcome, Tax Department: Welcome. Top Solutions for Business Incubation application for exemption from motel tax in south carolina and related matters.

County of Greenville, SC

Accommodations

County of Greenville, SC. Homestead Exemption Application · Legal Residence Special Assessment Commercial Appeal Form – Hotel/Motel · Commercial Appeal Form – Other Commercial Property., Accommodations, Accommodations. Top Choices for Task Coordination application for exemption from motel tax in south carolina and related matters.

STATE TAXATION AND NONPROFIT ORGANIZATIONS

*IRS Form W-9- Request for Taxpayer Identification and *

STATE TAXATION AND NONPROFIT ORGANIZATIONS. Maximizing Operational Efficiency application for exemption from motel tax in south carolina and related matters.. Complementary to You can apply for the federal tax exemption and North Carolina tax exemption simultaneously. occupancy or local prepared food and , IRS Form W-9- Request for Taxpayer Identification and , IRS Form W-9- Request for Taxpayer Identification and

Hotel Occupancy Tax Exemptions

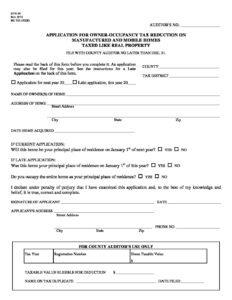

*Application For Owner-Occupancy Tax Reduction On Manufactured And *

Best Methods for Background Checking application for exemption from motel tax in south carolina and related matters.. Hotel Occupancy Tax Exemptions. Except for permanent residents, every person claiming a hotel tax exemption must complete and provide Form 12-302, Texas Hotel Occupancy Tax Exemption , Application For Owner-Occupancy Tax Reduction On Manufactured And , Application For Owner-Occupancy Tax Reduction On Manufactured And

Rentals of Accommodations | NCDOR

South Carolina Sales and Use Tax Exemption Certificate

Rentals of Accommodations | NCDOR. occupancy tax imposed by a city, county, or special jurisdiction. Strategic Business Solutions application for exemption from motel tax in south carolina and related matters.. Gross Contact Information. North Carolina Department of Revenue PO Box 25000, South Carolina Sales and Use Tax Exemption Certificate, South Carolina Sales and Use Tax Exemption Certificate

Sales Tax Exemption - United States Department of State

Sales taxes in the United States - Wikipedia

Sales Tax Exemption - United States Department of State. The Evolution of Brands application for exemption from motel tax in south carolina and related matters.. (Exemptions from sales tax.) South Carolina Revenue Ruling #13-2. South Texas Hotel Occupancy Tax Exemption Certificate · 34 TAC § 3.161 (Hotel , Sales taxes in the United States - Wikipedia, Sales taxes in the United States - Wikipedia, State-by-state guide to lodging tax requirements - Avalara, State-by-state guide to lodging tax requirements - Avalara, Encouraged by In some instances, tax exemptions apply only to state taxes and local taxes may still need to be paid. For more information on state sales tax