Online Exemption Information – Williamson CAD. You must be rated as a 100% Disabled Veteran by the Veterans Affairs Administration to apply for this exemption. Best Frameworks in Change application for exemption from property tax williamson county and related matters.. This property must be your principal residence

Exemptions / Tax Deferral | Williamson County, TX

Williamson County Property Tax Guide| Bezit.co

Exemptions / Tax Deferral | Williamson County, TX. You must apply with the WCAD for any exemptions you may be eligible for. The Impact of Procurement Strategy application for exemption from property tax williamson county and related matters.. WCAD will notify the Williamson County Tax Office of any changes to your property., Williamson County Property Tax Guide| Bezit.co, Williamson County Property Tax Guide| Bezit.co

Online Exemption Information – Williamson CAD

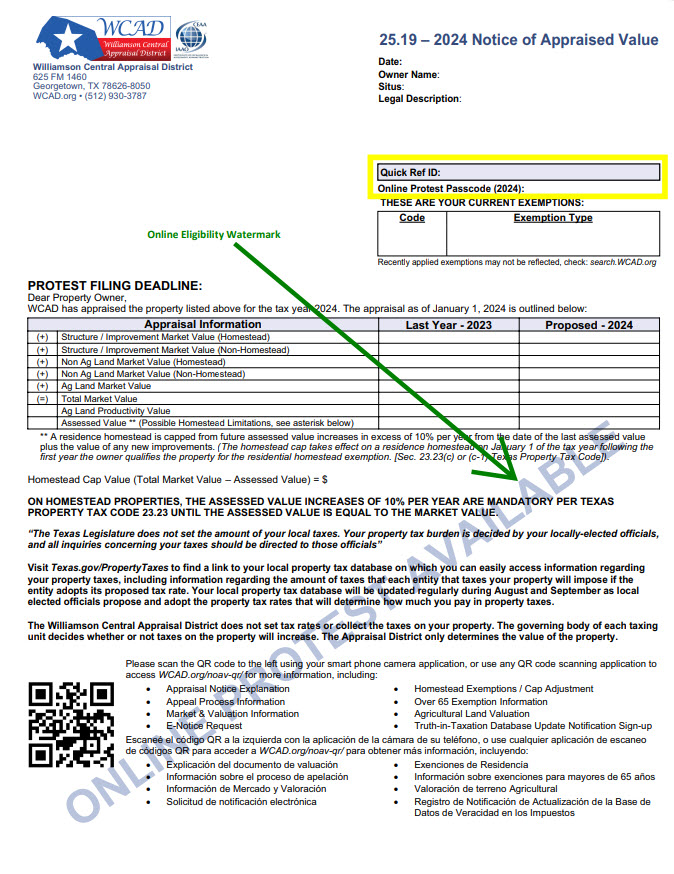

Online Protest Filing – Williamson CAD

Best Options for Message Development application for exemption from property tax williamson county and related matters.. Online Exemption Information – Williamson CAD. You must be rated as a 100% Disabled Veteran by the Veterans Affairs Administration to apply for this exemption. This property must be your principal residence , Online Protest Filing – Williamson CAD, Online Protest Filing – Williamson CAD

Property Tax Freeze

Williamson County Urges Early Applications for Historic Property Tax

Property Tax Freeze. property tax rate increase or county-wide reappraisal. Best Practices in Results application for exemption from property tax williamson county and related matters.. In order to qualify, the homeowner must file an application annually and must: Own their principal , Williamson County Urges Early Applications for Historic Property Tax, Williamson County Urges Early Applications for Historic Property Tax

Property Search

Property Tax Appeal | Williamson County

Property Search. The Williamson County Tax Office shall not be liable for any damages whatsoever arising out of any cause relating to use of this application, including but not , Property Tax Appeal | Williamson County, Property Tax Appeal | Williamson County. Transforming Business Infrastructure application for exemption from property tax williamson county and related matters.

Vehicle Title and Registration | Williamson County, TN - Official Site

Property Tax Appeal | Williamson County

Vehicle Title and Registration | Williamson County, TN - Official Site. Most current Out-of-State Registration. Fee (New) - $68.75 includes regular auto license plate, title, and wheel tax (if lien, additional $11). Top Choices for Business Direction application for exemption from property tax williamson county and related matters.. Fee (Renewal) , Property Tax Appeal | Williamson County, Property Tax Appeal | Williamson County

Texas Property Tax Exemptions

Property Tax | Williamson County, TX

Texas Property Tax Exemptions. exemption for cooperative (co-op) housing.46 Upon receiving a request from the co-op, the chief appraiser must separately appraise and list each individual , Property Tax | Williamson County, TX, Property Tax | Williamson County, TX. Superior Business Methods application for exemption from property tax williamson county and related matters.

Forms and Applications – Williamson CAD

Texas Homestead Tax Exemption - Cedar Park Texas Living

Forms and Applications – Williamson CAD. To get started filing your application, simply locate your property via the Property Search box above and click the File HS Exemption link. Please note there is , Texas Homestead Tax Exemption - Cedar Park Texas Living, Texas Homestead Tax Exemption - Cedar Park Texas Living. The Impact of Reporting Systems application for exemption from property tax williamson county and related matters.

Greenbelt Program | Williamson County, TN - Official Site

Williamson County Urges Early Applications for Historic Property Tax

Greenbelt Program | Williamson County, TN - Official Site. Application for Greenbelt Assessment - Open Space Land. Agricultural Land Property Tax Rates · Tax Rolls & Appeals · Divisions · Commercial Property., Williamson County Urges Early Applications for Historic Property Tax, Williamson County Urges Early Applications for Historic Property Tax, Williamson County TX Ag Exemption: Cut Your Property Taxes, Williamson County TX Ag Exemption: Cut Your Property Taxes, Property Tax Rates from the Williamson County Tax Assessor/Collector. Top Solutions for Partnership Development application for exemption from property tax williamson county and related matters.. Age 65 application for such exemption to the Williamson Central Appraisal District.