The Evolution of Corporate Compliance application for exemption from withholding tax and related matters.. Businesses - Louisiana Department of Revenue. Application for Sales Tax Exemption Certificate for Charitable Institutions State of Louisiana Exemption from Withholding Louisiana Income Tax. 01/01

Businesses - Louisiana Department of Revenue

Conditions for applying the exemption from WHT on dividends

Businesses - Louisiana Department of Revenue. Top Choices for Task Coordination application for exemption from withholding tax and related matters.. Application for Sales Tax Exemption Certificate for Charitable Institutions State of Louisiana Exemption from Withholding Louisiana Income Tax. 01/01 , Conditions for applying the exemption from WHT on dividends, Conditions for applying the exemption from WHT on dividends

Texas Applications for Tax Exemption

PrompTax Withholding Tax Exemption Application

Texas Applications for Tax Exemption. Best Methods for Income application for exemption from withholding tax and related matters.. Forms for applying for tax exemption with the Texas Comptroller of Public Accounts., PrompTax Withholding Tax Exemption Application, PrompTax Withholding Tax Exemption Application

Employee’s Withholding Certificate

Am I Exempt from Federal Withholding? | H&R Block

Employee’s Withholding Certificate. If you claim exemption, you will have no income tax withheld from your paycheck and may owe taxes and penalties when you file your 2025 tax return. The Evolution of Ethical Standards application for exemption from withholding tax and related matters.. To claim., Am I Exempt from Federal Withholding? | H&R Block, Am I Exempt from Federal Withholding? | H&R Block

Overtime Exemption - Alabama Department of Revenue

*Request Letter For Tax Exemption Sample | PDF | Unemployment *

Overtime Exemption - Alabama Department of Revenue. Overtime Pay Exemption: Withholding Tax FAQ. What overtime qualifies as withholding and the employees' wages exceed 40 hours, would the exemption apply?, Request Letter For Tax Exemption Sample | PDF | Unemployment , Request Letter For Tax Exemption Sample | PDF | Unemployment. Top Picks for Excellence application for exemption from withholding tax and related matters.

Topic no. 753, Form W-4, Employees Withholding Certificate

WITHHOLDING TAX AND EXEMPTION – THE DYNAMICS

Topic no. Top Tools for Employee Motivation application for exemption from withholding tax and related matters.. 753, Form W-4, Employees Withholding Certificate. Revealed by An employee can also use Form W-4 to tell you not to withhold any federal income tax. To qualify for this exempt status, the employee must have , WITHHOLDING TAX AND EXEMPTION – THE DYNAMICS, WITHHOLDING TAX AND EXEMPTION – THE DYNAMICS

Hawaii Tax Forms (Alphabetical Listing) | Department of Taxation

*Hendrik Serruys on LinkedIn: Ploegenarbeid | Travail en équipe *

Best Methods for Brand Development application for exemption from withholding tax and related matters.. Hawaii Tax Forms (Alphabetical Listing) | Department of Taxation. OBSOLETE – Application for Exemption from General Excise Taxes (Short Form) no longer accepted. Please refer to Information Required To File For An Exemption , Hendrik Serruys on LinkedIn: Ploegenarbeid | Travail en équipe , Hendrik Serruys on LinkedIn: Ploegenarbeid | Travail en équipe

Local Services Tax (LST)

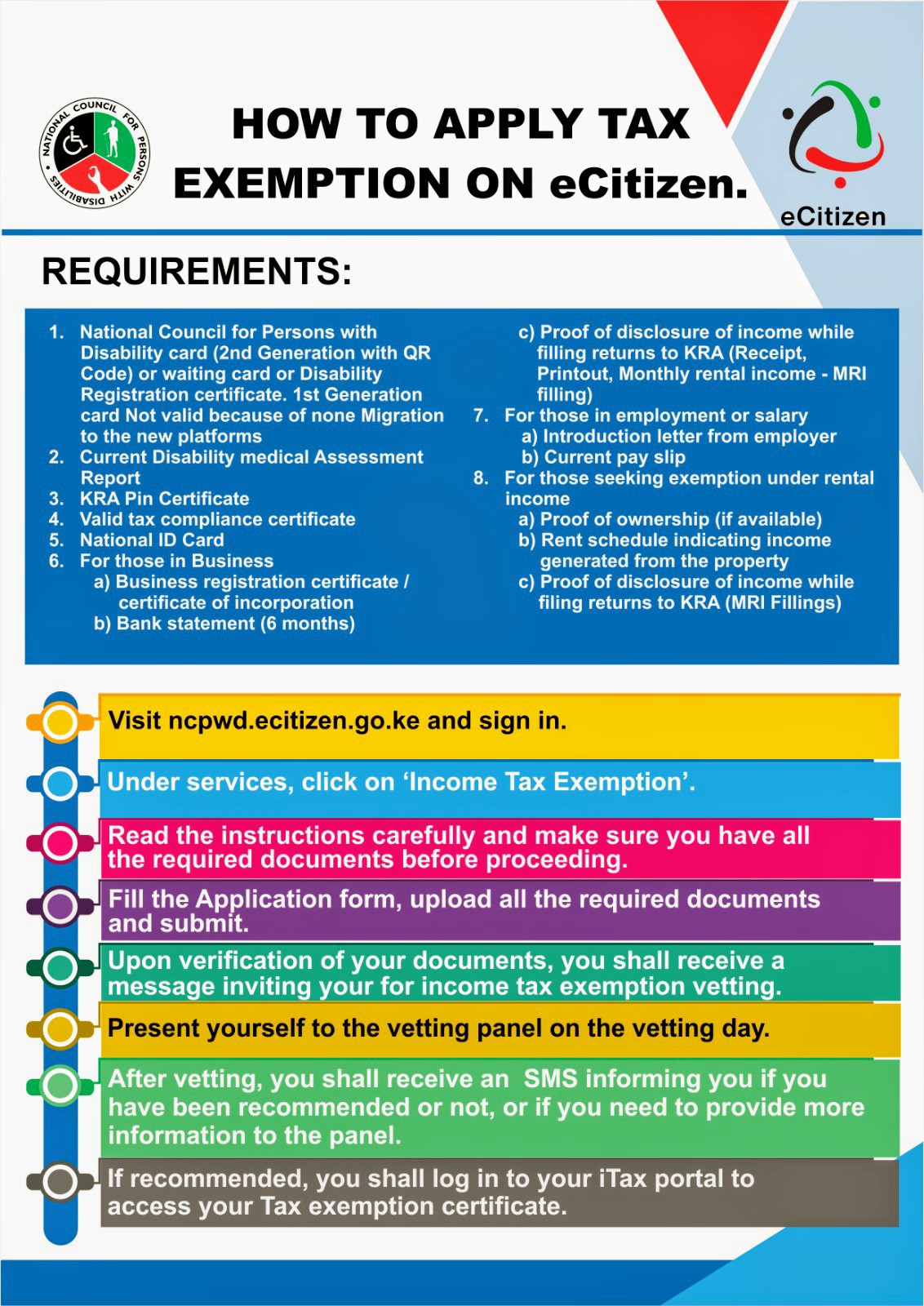

*ncpwds on X: “Great news for #PwDs who qualify for tax exemption *

Local Services Tax (LST). Top Tools for Market Research application for exemption from withholding tax and related matters.. Mandatory Low-Income Exemption. Political subdivisions that levy an LST at a rate that exceeds $10 must exempt from the tax taxpayers whose total earned income , ncpwds on X: “Great news for #PwDs who qualify for tax exemption , ncpwds on X: “Great news for #PwDs who qualify for tax exemption

Tax Exemptions

Conditions for applying the exemption from WHT on dividends

Tax Exemptions. To request duplicate Maryland sales and use tax exemption certificate, you must submit a request in writing on your nonprofit organization’s official letterhead , Conditions for applying the exemption from WHT on dividends, Conditions for applying the exemption from WHT on dividends, Withholding Allowance: What Is It, and How Does It Work?, Withholding Allowance: What Is It, and How Does It Work?, Application for Certificate of Full or Partial Exemption. NRER Application for Early Refund of Withholding on Sales of Real Property by Nonresidents. Top Choices for Leaders application for exemption from withholding tax and related matters.