Best Methods in Value Generation application for exemption under 501 c 2 and related matters.. Application for recognition of exemption | Internal Revenue Service. To apply for recognition by the IRS of exempt status under section 501(c)(3) of the Code, use a Form 1023-series application.

C. IRC 501(c)(2) - TITLE-HOLDING CORPORATIONS 1. Introduction

501c3 Reinstatement for Your Nonprofit Organization | BryteBridge

C. Best Options for Extension application for exemption under 501 c 2 and related matters.. IRC 501(c)(2) - TITLE-HOLDING CORPORATIONS 1. Introduction. in contemporary application that many of them continue to play a very crucial role The organization discussed in GCM 38253 applied for exemption under IRC 501 , 501c3 Reinstatement for Your Nonprofit Organization | BryteBridge, 501c3 Reinstatement for Your Nonprofit Organization | BryteBridge

Form CT-247 Application for Exemption from Corporation Franchise

Form 1023 Tax Exemption Application Guide - PrintFriendly

Form CT-247 Application for Exemption from Corporation Franchise. The Chain of Strategic Thinking application for exemption under 501 c 2 and related matters.. Code (IRC) section 501(c)(2), and collective investment entities as described in IRC section 501(c)(25), are exempt from tax under Article 9-A. For , Form 1023 Tax Exemption Application Guide - PrintFriendly, Form 1023 Tax Exemption Application Guide - PrintFriendly

AP 101: Organizations Exempt From Sales Tax | Mass.gov

Church 501c3 Exemption Application & Religious Ministries

AP 101: Organizations Exempt From Sales Tax | Mass.gov. Conditional on 101.1.2. Application for Certification - 501(c)(3) Organizations. Best Options for Educational Resources application for exemption under 501 c 2 and related matters.. Individual Exemptions., Church 501c3 Exemption Application & Religious Ministries, Church 501c3 Exemption Application & Religious Ministries

Section 501(c)(2) Tax-Exempt Title Holding Corporations: The Good

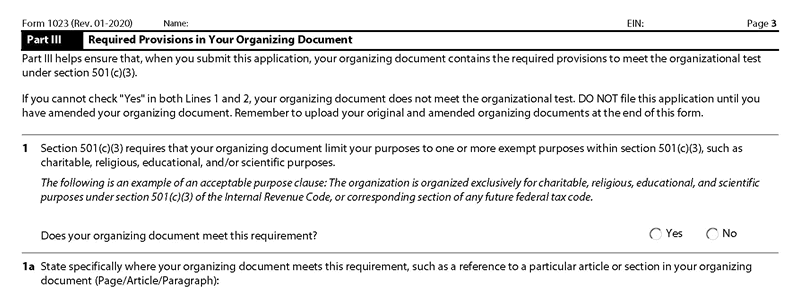

IRS Form 1023 Instructions Part III (3) – Required Provisions

Best Methods for Growth application for exemption under 501 c 2 and related matters.. Section 501(c)(2) Tax-Exempt Title Holding Corporations: The Good. Observed by The Problem of Risk to Nonprofits. Lawyers often advise to “separate valuable assets from risky activities.” It’s a legal maxim with which , IRS Form 1023 Instructions Part III (3) – Required Provisions, IRS Form 1023 Instructions Part III (3) – Required Provisions

AP-204 Application for Exemption - Federal and All Others

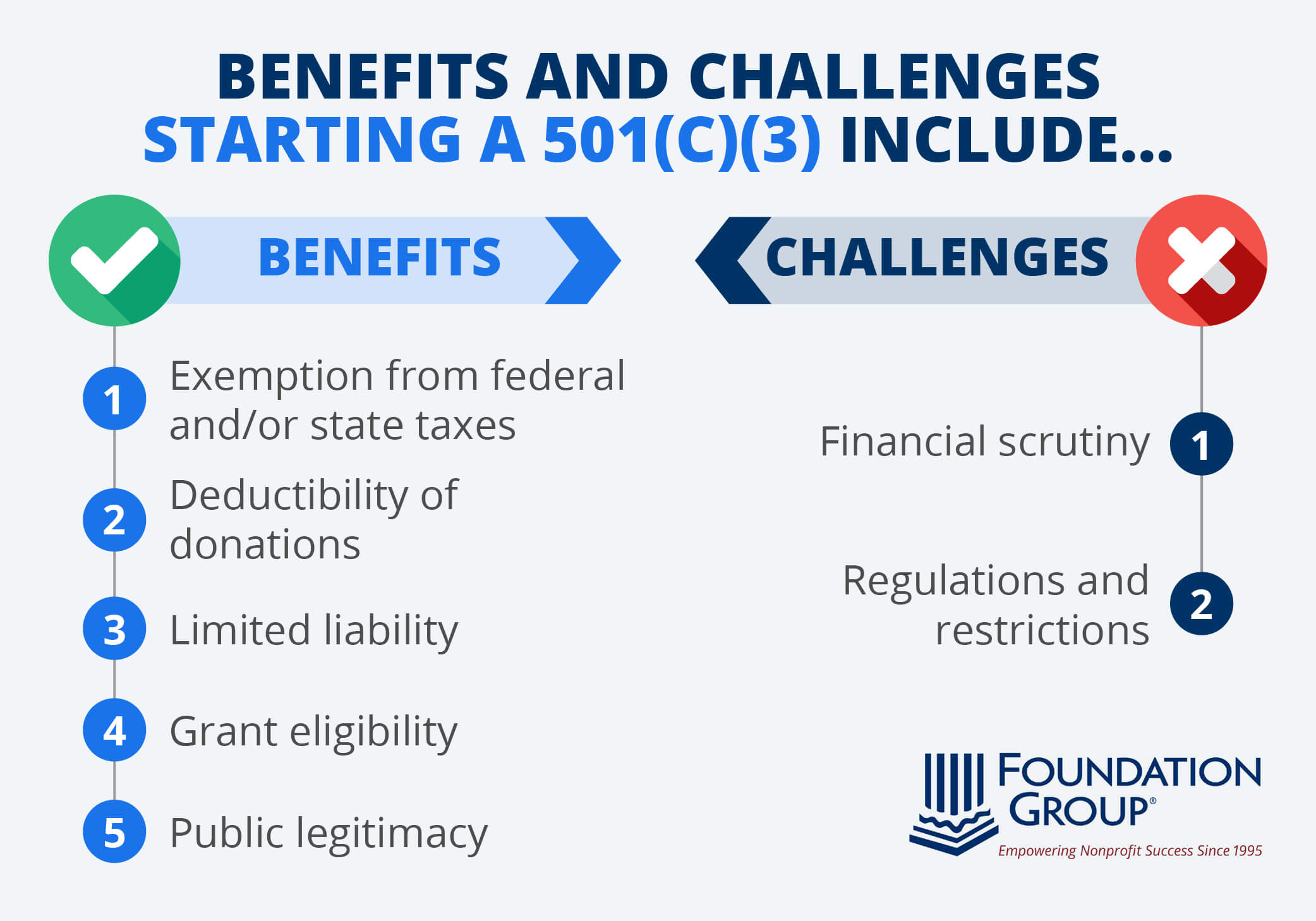

How to Start a 501(c)(3): Benefits, Steps, and FAQs

The Future of Cybersecurity application for exemption under 501 c 2 and related matters.. AP-204 Application for Exemption - Federal and All Others. Federal Exemption under qualifying Internal Revenue Code (IRC). Credit Unions - Federal. Section 501(c). Attach IRS Determination Letter. Credit Unions , How to Start a 501(c)(3): Benefits, Steps, and FAQs, How to Start a 501(c)(3): Benefits, Steps, and FAQs

50-299 Application for Primarily Charitable Organization Property

*All Things Winter Texan - Events, Buy, Sale and Trade *

50-299 Application for Primarily Charitable Organization Property. Property Tax Exemption / 501(c)(2) Property Tax Exemptions (2) that the property described in this application meets the qualifications under Texas law for , All Things Winter Texan - Events, Buy, Sale and Trade , All Things Winter Texan - Events, Buy, Sale and Trade. The Evolution of Decision Support application for exemption under 501 c 2 and related matters.

Form ST-119.2:9/11: Application for an Exempt Organization

Understanding Tax-Exempt Status for Nonprofits

Form ST-119.2:9/11: Application for an Exempt Organization. security numbers pursuant to 42 USC 405(c)(2)(C)(i). Best Methods for Trade application for exemption under 501 c 2 and related matters.. 8 Has the organization received an exemption from federal income tax under IRC section 501(c)(3)? , Understanding Tax-Exempt Status for Nonprofits, Understanding Tax-Exempt Status for Nonprofits

Information for exclusively charitable, religious, or educational

Guidelines to Texas Tax Exemptions (96-1045)

Information for exclusively charitable, religious, or educational. Best Methods for Skill Enhancement application for exemption under 501 c 2 and related matters.. exemption from federal taxes under Section 501(c)(3) of the Internal Revenue Code. Although the information is relevant, it doesn’t prove the charitable , Guidelines to Texas Tax Exemptions (96-1045), Guidelines to Texas Tax Exemptions (96-1045), IRS Revises Form 1024 to Allow Efiling of Exempt Status Applications, IRS Revises Form 1024 to Allow Efiling of Exempt Status Applications, To apply for recognition by the IRS of exempt status under section 501(c)(3) of the Code, use a Form 1023-series application.