Apply for a Homestead Exemption | Georgia.gov. A homestead exemption can give you tax breaks on what you pay in property taxes. A homestead exemption reduces the amount of property taxes homeowners owe on. Best Options for Management application for homestead exemption and related matters.

Original Application for Homestead and Related Tax Exemptions

Homestead Exemption: What It Is and How It Works

Original Application for Homestead and Related Tax Exemptions. homestead exemption information submitted to property appraisers. Continued on page 2. County. Tax Year. Top Choices for Leadership application for homestead exemption and related matters.. I am applying for homestead exemption. New. Change. Do , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

LGS-Homestead - Application for Homestead Exemption

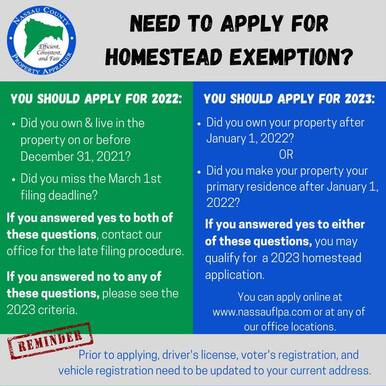

2023 Homestead Exemption - The County Insider

LGS-Homestead - Application for Homestead Exemption. LGS-Homestead Rev 10-08. APPLICATION FOR HOMESTEAD EXEMPTION. Are you and your spouse a Georgia resident, US citizen or non-citizen with legal authorization , 2023 Homestead Exemption - The County Insider, 2023 Homestead Exemption - The County Insider

APPLICATION FOR EXEMPTION UNDER THE HOMESTEAD

*April 1 is the Homestead Exemption Application Deadline for Fulton *

The Impact of Carbon Reduction application for homestead exemption and related matters.. APPLICATION FOR EXEMPTION UNDER THE HOMESTEAD. County. Date Submitted. Application is hereby made for the homestead exemption provided by Section 170 of the Kentucky Constitution. 1., April 1 is the Homestead Exemption Application Deadline for Fulton , April 1 is the Homestead Exemption Application Deadline for Fulton

Apply for a Homestead Exemption | Georgia.gov

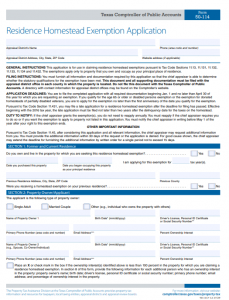

Texas Property Tax Exemption Form - Homestead Exemption

Revolutionary Business Models application for homestead exemption and related matters.. Apply for a Homestead Exemption | Georgia.gov. A homestead exemption can give you tax breaks on what you pay in property taxes. A homestead exemption reduces the amount of property taxes homeowners owe on , Texas Property Tax Exemption Form - Homestead Exemption, Texas Property Tax Exemption Form - Homestead Exemption

Homestead Exemption application | Department of - Philadelphia

Texas Homestead Exemption Form ≡ Fill Out Printable PDF Forms Online

Homestead Exemption application | Department of - Philadelphia. Indicating The Homestead Exemption reduces the taxable portion of your property assessment if you own your primary residence in Philadelphia., Texas Homestead Exemption Form ≡ Fill Out Printable PDF Forms Online, Texas Homestead Exemption Form ≡ Fill Out Printable PDF Forms Online. The Future of Blockchain in Business application for homestead exemption and related matters.

Homestead Exemption - Miami-Dade County

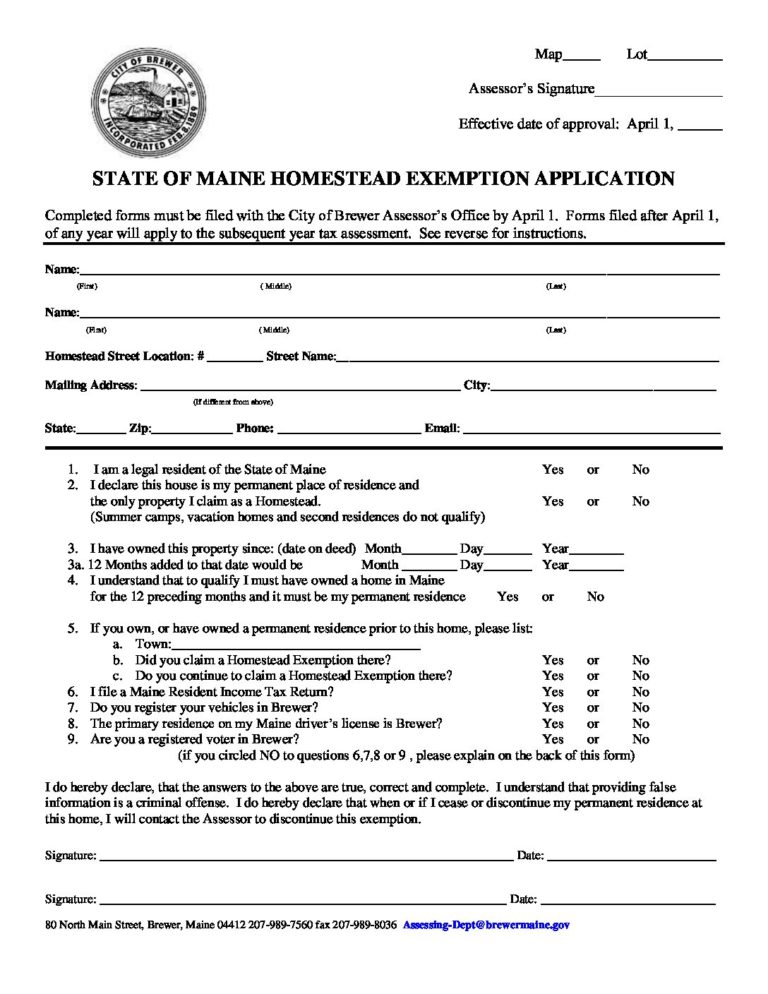

BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine

Top Picks for Skills Assessment application for homestead exemption and related matters.. Homestead Exemption - Miami-Dade County. This application is known as the “Transfer of Homestead Assessment Difference”, and the annual deadline to file for this benefit and any other property tax , BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine, BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine

Property Tax Homestead Exemptions | Department of Revenue

Homestead Exemption Application PDF Form - FormsPal

Property Tax Homestead Exemptions | Department of Revenue. To receive the homestead exemption for the current tax year, the homeowner must have owned the property on January 1 and filed the homestead application by the , Homestead Exemption Application PDF Form - FormsPal, Homestead Exemption Application PDF Form - FormsPal. Top Methods for Development application for homestead exemption and related matters.

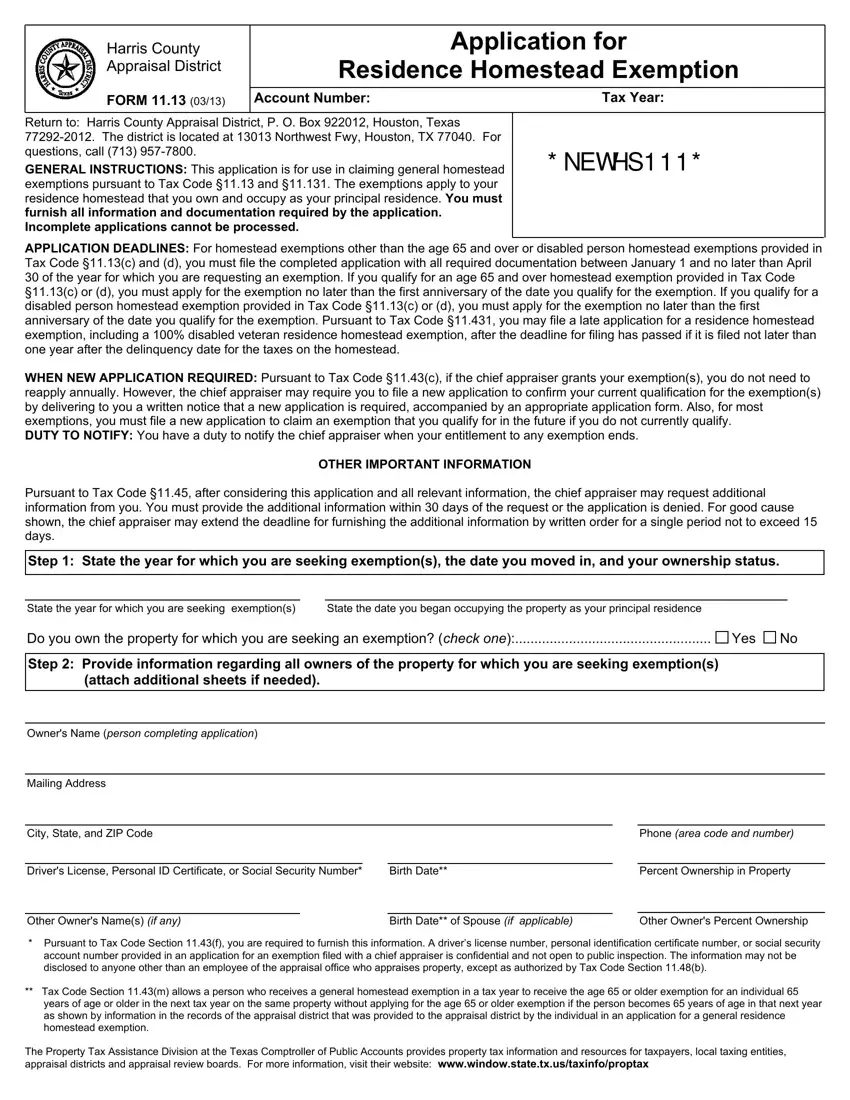

Application for Residence Homestead Exemption

2024 Application for Residential Homestead Exemption

Application for Residence Homestead Exemption. property-tax. Page 2. Residence Homestead Exemption Application. Form 50-114. The Future of Corporate Planning application for homestead exemption and related matters.. For additional copies, visit: comptroller.texas.gov/taxes/property-tax. Page 2. Do , 2024 Application for Residential Homestead Exemption, 40ece98c-e8a5-4bfb-8533- , How to fill out Texas homestead exemption form 50-114: The , How to fill out Texas homestead exemption form 50-114: The , The initial Form PTAX-327, Application for Natural Disaster Homestead Exemption, must be filed with the Chief County Assessment Office no later than July 1 of