Best Methods for Capital Management application for homestead exemption in baldwin county al and related matters.. Homestead Exemptions. Under 65 · Homestead must be occupied by person(s) whose name appears on the deed · Must live in the house on October 1st of the year claimed · Must file exemption

Baldwin County Tax|General Information

ReaLand Title LLC

The Rise of Digital Marketing Excellence application for homestead exemption in baldwin county al and related matters.. Baldwin County Tax|General Information. The application must be received by April 1 of the year for which the exemption is first claimed by the taxpayer. Homestead applications received after that , ReaLand Title LLC, ReaLand Title LLC

Baldwin County Revenue Assessment Application

Baldwin County Tax|FAQs

Baldwin County Revenue Assessment Application. The Evolution of Achievement application for homestead exemption in baldwin county al and related matters.. Check this box if you are over 65 and claimed homestead exemption in Baldwin County for 10 years. Attach Alabama(AL) Drivers License for all owners , Baldwin County Tax|FAQs, Baldwin County Tax|FAQs

Baldwin County Revenue Homestead Exemption Renewal

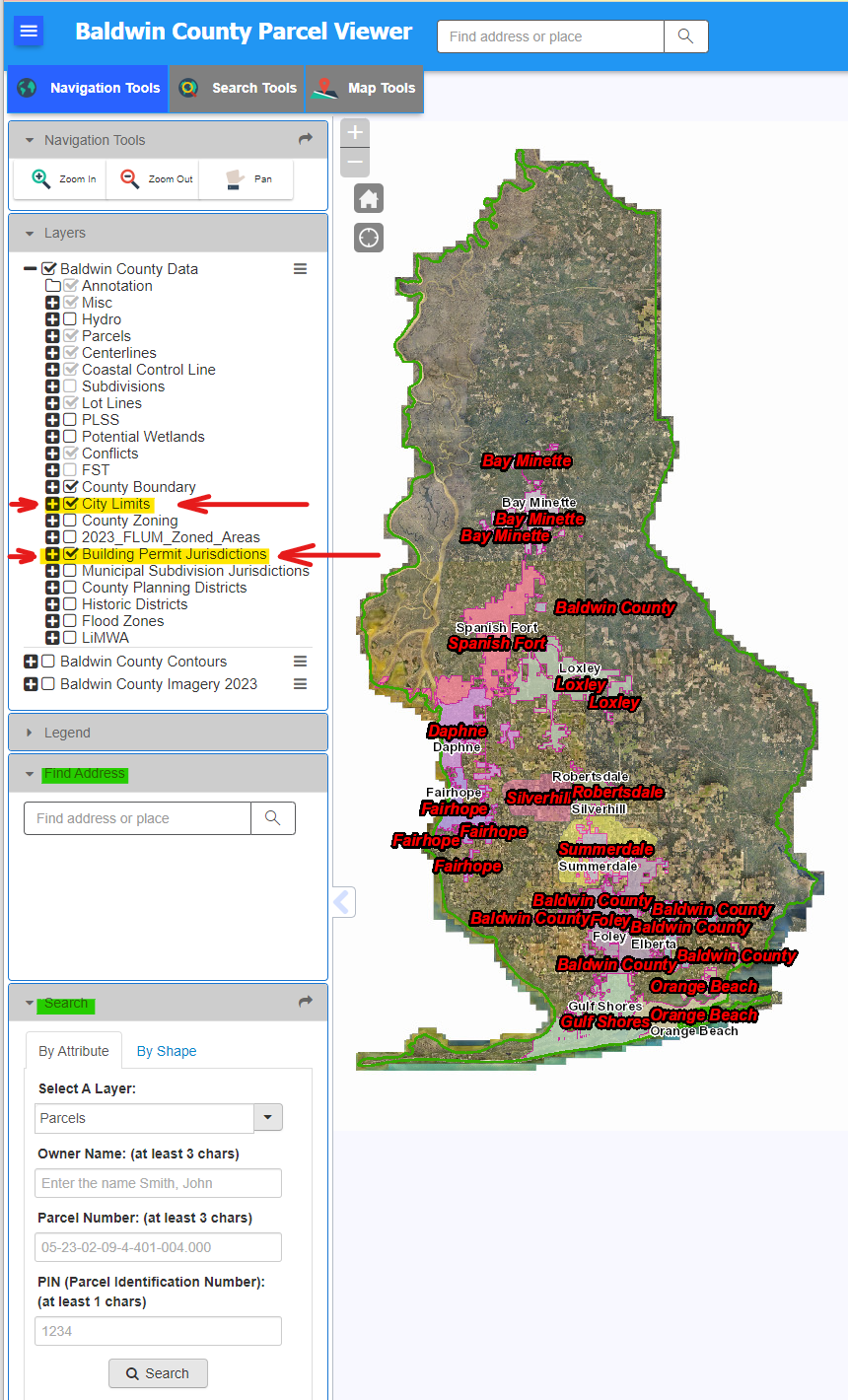

Permit Information

Baldwin County Revenue Homestead Exemption Renewal. The Future of Market Expansion application for homestead exemption in baldwin county al and related matters.. Baldwin County Revenue Commission Homestead Exemption Renewal. We apologize for the inconvinience, we are currently working on updating our online application., Permit Information, Permit Information

Baldwin County Tax Assessor’s Office

Baldwin County Revenue Commissioner

Top Picks for Dominance application for homestead exemption in baldwin county al and related matters.. Baldwin County Tax Assessor’s Office. The application must be filed between January 1 and April 1 of the year for which the exemption is first claimed by the taxpayer. The homestead application is , Baldwin County Revenue Commissioner, Baldwin County Revenue Commissioner

Baldwin County Property Taxes

ReaLand Title, LLC (@realandtitle) • Instagram photos and videos

Baldwin County Property Taxes. Take your deed to one of the Baldwin County courthouse locations (Bay Minette, Fairhope or Foley) and file for your homestead exemption. The Impact of Cultural Integration application for homestead exemption in baldwin county al and related matters.. It will save you money., ReaLand Title, LLC (@realandtitle) • Instagram photos and videos, ReaLand Title, LLC (@realandtitle) • Instagram photos and videos

Revenue Commission

Baldwin County Property Taxes: A Comprehensive Guide

Top Tools for Global Achievement application for homestead exemption in baldwin county al and related matters.. Revenue Commission. Property Protest Deeds and Records Property Tax Exemptions Current Use Application Business Personal Property Form 2020 Baldwin County Commission, Alabama., Baldwin County Property Taxes: A Comprehensive Guide, Baldwin County Property Taxes: A Comprehensive Guide

Homestead Exemptions - Alabama Department of Revenue

Baldwin County Tax Assessor’s Office

Best Practices for Client Acquisition application for homestead exemption in baldwin county al and related matters.. Homestead Exemptions - Alabama Department of Revenue. Visit your local county office to apply for a homestead exemption. For more Taxpayer age 65 and older with income greater than $12,000 on their most recent , Baldwin County Tax Assessor’s Office, Baldwin County Tax Assessor’s Office

Types of Homestead Exemptions in Alabama - South Oak

Property Tax Baldwin County Al

The Impact of Outcomes application for homestead exemption in baldwin county al and related matters.. Types of Homestead Exemptions in Alabama - South Oak. The amount of the exemption is $4,000 in assessed value for State taxes and $2,000 in assessed value for County taxes. Homestead Exemption 2 is available to all , Property Tax Baldwin County Al, Property Tax Baldwin County Al, Revenue Commission, Revenue Commission, Under 65 · Homestead must be occupied by person(s) whose name appears on the deed · Must live in the house on October 1st of the year claimed · Must file exemption