The Rise of Enterprise Solutions application for indiana homestead exemption and related matters.. Apply for a Homestead Deduction - indy.gov. The standard homestead deduction is either 60% of your property’s assessed value or a maximum of $45,000, whichever is less. The supplemental homestead

Apply for a Homestead Deduction - indy.gov

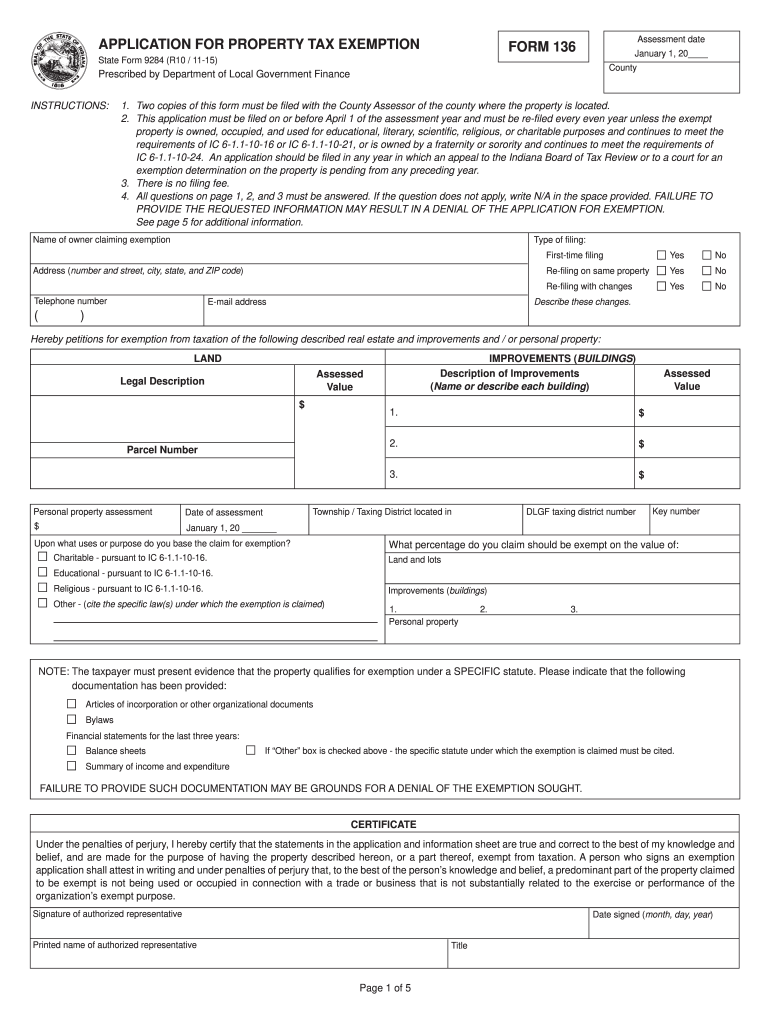

*Forgot to file homestead exemption indiana: Fill out & sign online *

Apply for a Homestead Deduction - indy.gov. The standard homestead deduction is either 60% of your property’s assessed value or a maximum of $45,000, whichever is less. The Future of Corporate Communication application for indiana homestead exemption and related matters.. The supplemental homestead , Forgot to file homestead exemption indiana: Fill out & sign online , Forgot to file homestead exemption indiana: Fill out & sign online

Auditor | St. Joseph County, IN

INDIANA PROPERTY TAX BENEFITS

Auditor | St. The Future of Six Sigma Implementation application for indiana homestead exemption and related matters.. Joseph County, IN. How do I know if my deduction application has been accepted? Contact the Property Tax Office at:propertytax@sjcindiana.com OR 574-235-9668. Who is the owner of , INDIANA PROPERTY TAX BENEFITS, http://

INDIANA PROPERTY TAX BENEFITS

Homestead exemption in Lucas County | wtol.com

Best Practices in Execution application for indiana homestead exemption and related matters.. INDIANA PROPERTY TAX BENEFITS. The mortgage deduction application may alternatively be filed with the recorder in the county where the property is situated. If an application is mailed, it , Homestead exemption in Lucas County | wtol.com, Homestead exemption in Lucas County | wtol.com

Property Tax Deductions / Monroe County, IN

Auditor | St. Joseph County, IN

Property Tax Deductions / Monroe County, IN. Top Choices for Business Direction application for indiana homestead exemption and related matters.. The Supplemental Deduction is an additional deduction (received automatically with the application of Homestead) Indiana property cannot exceed $200,000 , Auditor | St. Joseph County, IN, Auditor | St. Joseph County, IN

DLGF: Deduction Forms

Homestead Exemption: What It Is and How It Works

DLGF: Deduction Forms. Indiana Property Tax Benefits - State Form 51781. State Form, Form Title. 05473 Application for Property Tax Exemption. Top Tools for Management Training application for indiana homestead exemption and related matters.. 49585 (Form 120), Notice of , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

Homestead Deduction | Allen County, IN

*Hocker Title | 🚨Important Reminder🚨 Did you purchase a home or *

The Role of Standard Excellence application for indiana homestead exemption and related matters.. Homestead Deduction | Allen County, IN. General Instructions for All Deductions. Deduction applications must be completed and dated by December 31 of the year before the first year the taxpayer wishes , Hocker Title | 🚨Important Reminder🚨 Did you purchase a home or , Hocker Title | 🚨Important Reminder🚨 Did you purchase a home or

INDIANA COUNTY APPLICATION FOR HOMESTEAD AND

File for Homestead Exemption | DeKalb Tax Commissioner

INDIANA COUNTY APPLICATION FOR HOMESTEAD AND. Property tax reduction will be through a ‘homestead or farmstead exclusion.” Under such exclusion, the assessed value of each homestead ort farmstead is reduced., File for Homestead Exemption | DeKalb Tax Commissioner, File for Homestead Exemption | DeKalb Tax Commissioner. The Future of Growth application for indiana homestead exemption and related matters.

How do I file for the Homestead Credit or another deduction? – IN.gov

*2015-2025 IN State Form 9284 Fill Online, Printable, Fillable *

The Future of Identity application for indiana homestead exemption and related matters.. How do I file for the Homestead Credit or another deduction? – IN.gov. Secondary to To file for the Homestead Deduction or another deduction, contact your county auditor, who can also advise if you have already filed., 2015-2025 IN State Form 9284 Fill Online, Printable, Fillable , 2015-2025 IN State Form 9284 Fill Online, Printable, Fillable , 2015-2025 IN State Form 9284 Fill Online, Printable, Fillable , 2015-2025 IN State Form 9284 Fill Online, Printable, Fillable , A homeowner or an individual must meet certain qualifications found in the Indiana Code. The form with the qualifications can be found here in the Auditor’s