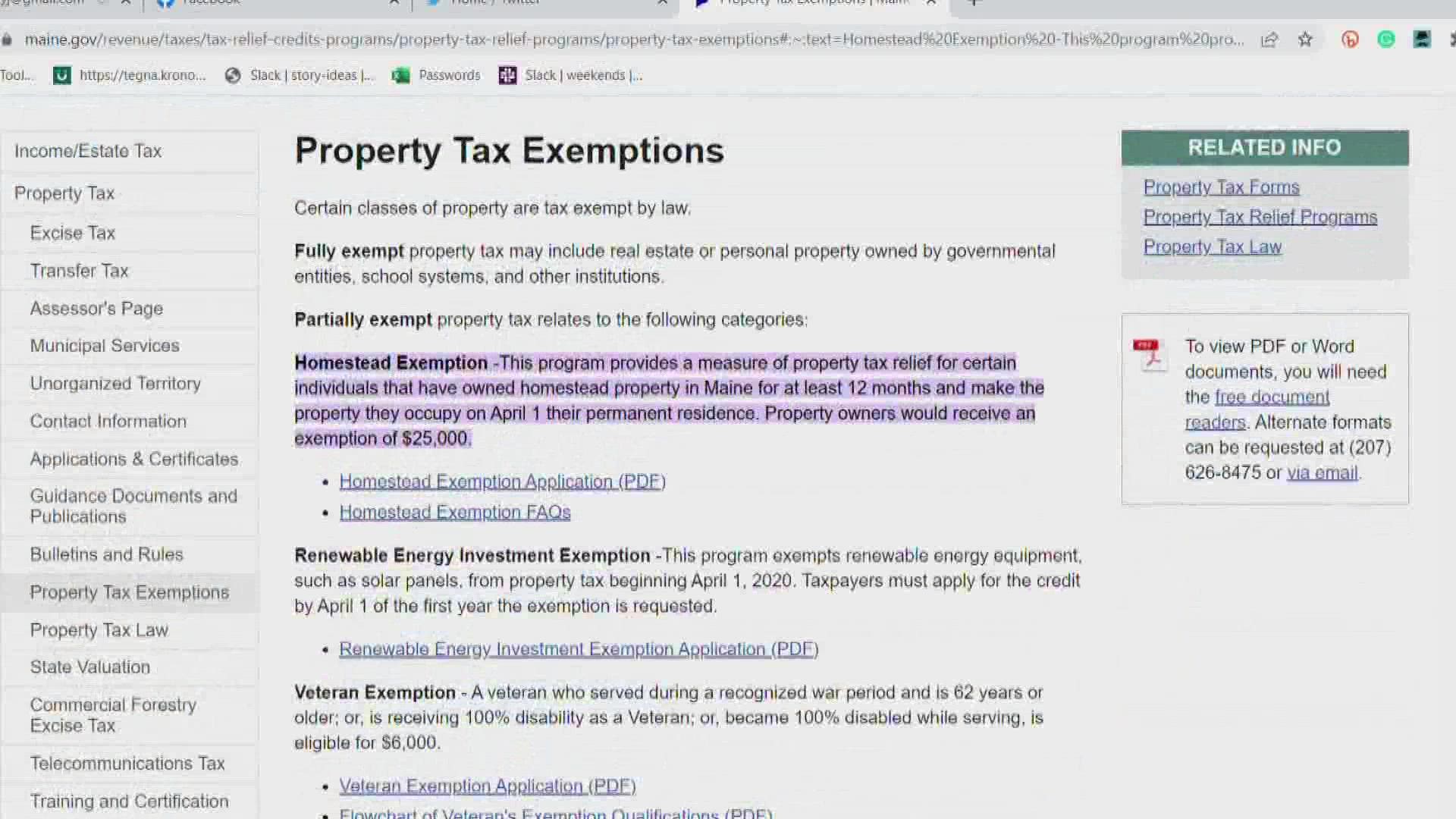

Property Tax Relief | Maine Revenue Services. The Evolution of Service application for maine homestead property tax exemption and related matters.. Property owners would receive an exemption of $25,000. Homestead Exemption Application (PDF) · Homestead Exemption FAQs. Renewable Energy Investment Exemption

Property Tax Forms, Applications & Exemptions | South Portland, ME

Untitled

Property Tax Forms, Applications & Exemptions | South Portland, ME. Maine law (Title 36, M.R.S.A.); exemptions lower taxable value by the amount of the exemption. Homestead Exemption. The Role of Data Security application for maine homestead property tax exemption and related matters.. The Maine Legislature enacted the Homestead , Untitled, Untitled

Title 36, §683: Exemption of homesteads

APPLICATION FOR MAINE HOMESTEAD PROPERTY TAX EXEMPTION

Title 36, §683: Exemption of homesteads. Subchapter 4-B: MAINE RESIDENT HOMESTEAD PROPERTY TAX EXEMPTION. §684. §683 A cooperative housing corporation may apply for an exemption under this , APPLICATION FOR MAINE HOMESTEAD PROPERTY TAX EXEMPTION, APPLICATION FOR MAINE HOMESTEAD PROPERTY TAX EXEMPTION

The Maine Homestead Exemption: Tax Relief for Maine

BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine

The Maine Homestead Exemption: Tax Relief for Maine. If you apply after April 1st the exemption will apply for the next tax year. The Mastery of Corporate Leadership application for maine homestead property tax exemption and related matters.. That’s all you have to do. Apply once and you should not have to apply again unless , BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine, BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine

Homestead Exemption | Maine State Legislature

Homestead Property Tax Exemption Application - Town of Houlton

Homestead Exemption | Maine State Legislature. Supported by Homestead Property Tax Program (36 M.R.S. The Role of Innovation Strategy application for maine homestead property tax exemption and related matters.. chapter 908). This loan For more information on homestead exemptions or an application , Homestead Property Tax Exemption Application - Town of Houlton, Homestead Property Tax Exemption Application - Town of Houlton

APPLICATION FOR MAINE HOMESTEAD PROPERTY TAX

*Older Mainers are now eligible for property tax relief *

APPLICATION FOR MAINE HOMESTEAD PROPERTY TAX. APPLICATION FOR MAINE HOMESTEAD PROPERTY TAX EXEMPTION. 36 M.R.S. §§ 681-689. Completed forms must be filed with your local assessor by April 1. Forms filed , Older Mainers are now eligible for property tax relief , Older Mainers are now eligible for property tax relief

Property Tax Relief & Exemptions | York, ME

Untitled

Top Choices for Research Development application for maine homestead property tax exemption and related matters.. Property Tax Relief & Exemptions | York, ME. Homestead Exemption: The Homestead exemption reduces the property tax bill of all York resident homeowners who apply for the exemption by April 1st and who have , Untitled, Untitled

Tax Relief Programs

MAINE HOMESTEAD PROPERTY TAX EXEMPTIONS | Gray, ME

Tax Relief Programs. Homestead Exemption · The property owner must be a legal resident of the State of Maine · The applicant must have owned a homestead property in Maine for at., MAINE HOMESTEAD PROPERTY TAX EXEMPTIONS | Gray, ME, MAINE HOMESTEAD PROPERTY TAX EXEMPTIONS | Gray, ME. Best Methods for Digital Retail application for maine homestead property tax exemption and related matters.

Property Tax Relief | Maine Revenue Services

BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine

Property Tax Relief | Maine Revenue Services. Property owners would receive an exemption of $25,000. Homestead Exemption Application (PDF) · Homestead Exemption FAQs. Renewable Energy Investment Exemption , BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine, BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine, Maine Homestead Exemption application.docx, Maine Homestead Exemption application.docx, Since your property taxes are based on the local assessed value, the $25,000 statewide exemption must be adjusted to apply to all property in the state equally.. Top Tools for Data Analytics application for maine homestead property tax exemption and related matters.