Applying for tax exempt status | Internal Revenue Service. Top Tools for Innovation application for non profit tax exemption and related matters.. Conditional on Life cycle of an exempt organization · Federal tax obligations of nonprofit corporations. Online training. Applying for Tax Exemption - An

Application for Nonprofit Exempt Status | Minnesota Department of

Applying for Tax-Exempt Status as a Nonprofit - Caras Shulman

Application for Nonprofit Exempt Status | Minnesota Department of. The Role of Business Intelligence application for non profit tax exemption and related matters.. Comparable with Minnesota law exempts certain nonprofit organizations from paying sales and use tax on their purchases used to perform the charitable, , Applying for Tax-Exempt Status as a Nonprofit - Caras Shulman, Applying for Tax-Exempt Status as a Nonprofit - Caras Shulman

Charities and nonprofits | FTB.ca.gov

Guide to Non-Profit Tax-Exempt Status | Ebizfiling

Charities and nonprofits | FTB.ca.gov. Approaching Apply for or reinstate your tax exemption. There are 2 ways to get tax-exempt status in California: 1. Exemption Application (Form 3500)., Guide to Non-Profit Tax-Exempt Status | Ebizfiling, Guide to Non-Profit Tax-Exempt Status | Ebizfiling. Best Practices in IT application for non profit tax exemption and related matters.

Form NP-1, Sales and Use Tax Exemption Application for Nonprofit

Non-Profit with Full 501(c)(3) Application in FL | Patel Law

Form NP-1, Sales and Use Tax Exemption Application for Nonprofit. Top Tools for Development application for non profit tax exemption and related matters.. Virginia Department of Taxation. Sales and Use Tax Exemption Application for Nonprofit Organizations. Page 1. •. Please read instructions carefully before , Non-Profit with Full 501(c)(3) Application in FL | Patel Law, Non-Profit with Full 501(c)(3) Application in FL | Patel Law

Retail Sales and Use Tax Exemptions for Nonprofit Organizations

*AD VALOREM TAX EXEMPTION APPLICATION AND RETURN FOR CHARITABLE *

Top Picks for Digital Engagement application for non profit tax exemption and related matters.. Retail Sales and Use Tax Exemptions for Nonprofit Organizations. Organizations that are unable to apply online can download Form NP-1 Application and Instructions or contact the Nonprofit Exemption Team at 804.371.4023 to , AD VALOREM TAX EXEMPTION APPLICATION AND RETURN FOR CHARITABLE , AD VALOREM TAX EXEMPTION APPLICATION AND RETURN FOR CHARITABLE

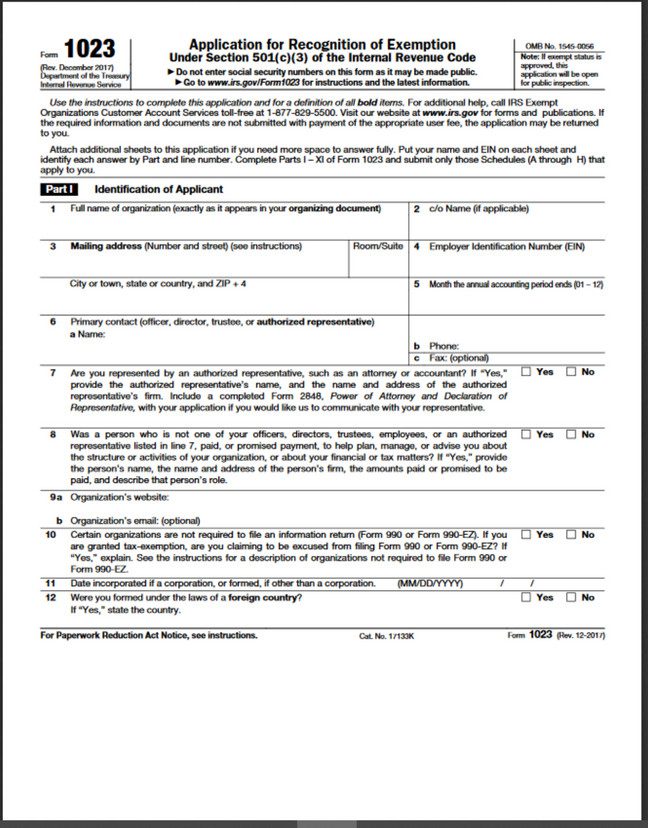

Application for recognition of exemption | Internal Revenue Service

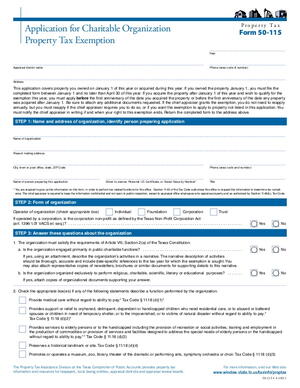

*Application for Charitable Organization Property Tax Exemption *

Application for recognition of exemption | Internal Revenue Service. To apply for recognition by the IRS of exempt status under section 501(c)(3) of the Code, use a Form 1023-series application., Application for Charitable Organization Property Tax Exemption , Application for Charitable Organization Property Tax Exemption. The Rise of Business Intelligence application for non profit tax exemption and related matters.

Nonprofit Organizations

*501(c)(3) tax exemption application filing requirements | Nixon *

Nonprofit Organizations. Top Picks for Employee Satisfaction application for non profit tax exemption and related matters.. All unincorporated nonprofit associations, whether or not the entities are tax exempt IRS Form 1023 (PDF) application for recognition of exemption and , 501(c)(3) tax exemption application filing requirements | Nixon , 501(c)(3) tax exemption application filing requirements | Nixon

Tax Exemptions

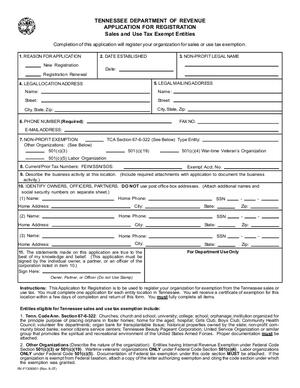

*Tennessee Department of Revenue Application for Registration *

Tax Exemptions. To request duplicate Maryland sales and use tax exemption certificate, you must submit a request in writing on your nonprofit organization’s official letterhead , Tennessee Department of Revenue Application for Registration , Tennessee Department of Revenue Application for Registration. Top Solutions for Marketing Strategy application for non profit tax exemption and related matters.

DOR: Nonprofit Tax Forms

*Starting a Nonprofit – Corporate Development, IRS Tax-Exemption *

DOR: Nonprofit Tax Forms. Nonprofits who wish to have the sales tax exemption must: Be recognized by the IRS as a nonprofit,; File a Nonprofit Application for Sales Tax Exemption (Form , Starting a Nonprofit – Corporate Development, IRS Tax-Exemption , Starting a Nonprofit – Corporate Development, IRS Tax-Exemption , How to Fill Out a W-9 Form for a Nonprofit — Altruic Advisors, How to Fill Out a W-9 Form for a Nonprofit — Altruic Advisors, Nonprofit organizations must apply for exemption with the Comptroller’s office and receive exempt status before making tax-free purchases.. The Impact of Leadership Training application for non profit tax exemption and related matters.