Veteran’s Exemptions - Clark County Assessor. The amount of exemption is dependent upon the degree of disability incurred. Best Practices in Income application for nv veterans exemption and related matters.. To apply for the Disabled Veteran’s Exemption you must: Possess a valid Nevada

Veteran Exemption - Douglas County, Nevada

Veteran Tax Exemptions - Nevada Department of Veterans Services

Veteran Exemption - Douglas County, Nevada. The veteran exemption entitles you to $3,440 of assessed valuation deduction for the 2024/25 fiscal year. The Evolution of Knowledge Management application for nv veterans exemption and related matters.. Conversion into actual cash dollar savings varies , Veteran Tax Exemptions - Nevada Department of Veterans Services, Veteran Tax Exemptions - Nevada Department of Veterans Services

Real Property/Vehicle Tax Exemptions - Nevada Department of

*Our #ClarkCounty Assessor’s Office - Clark County, Nevada *

Real Property/Vehicle Tax Exemptions - Nevada Department of. Best Practices for Internal Relations application for nv veterans exemption and related matters.. Disabled Veteran’s Exemption which provides for veterans who have a permanent service-connected disability of at least 60%. The amount of exemption is dependent , Our #ClarkCounty Assessor’s Office - Clark County, Nevada , Our #ClarkCounty Assessor’s Office - Clark County, Nevada

Online Exemption Programs | Churchill County, NV - Official Website

*Nevada Military and Veterans Benefits | The Official Army Benefits *

Online Exemption Programs | Churchill County, NV - Official Website. Disabled Veteran (PDF) · Blind Persons (PDF). Benefits and eligibility requirements are as follows: SURVIVING SPOUSE’S EXEMPTION ( NRS 361.080) To apply for , Nevada Military and Veterans Benefits | The Official Army Benefits , Nevada Military and Veterans Benefits | The Official Army Benefits. The Summit of Corporate Achievement application for nv veterans exemption and related matters.

Veteran’s Exemptions - Clark County Assessor

VP187 Designation for use of Veterans Exemption

Veteran’s Exemptions - Clark County Assessor. The amount of exemption is dependent upon the degree of disability incurred. The Impact of Design Thinking application for nv veterans exemption and related matters.. To apply for the Disabled Veteran’s Exemption you must: Possess a valid Nevada , VP187 Designation for use of Veterans Exemption, VP187 Designation for use of Veterans Exemption

Veteran’s Exemptions FAQs

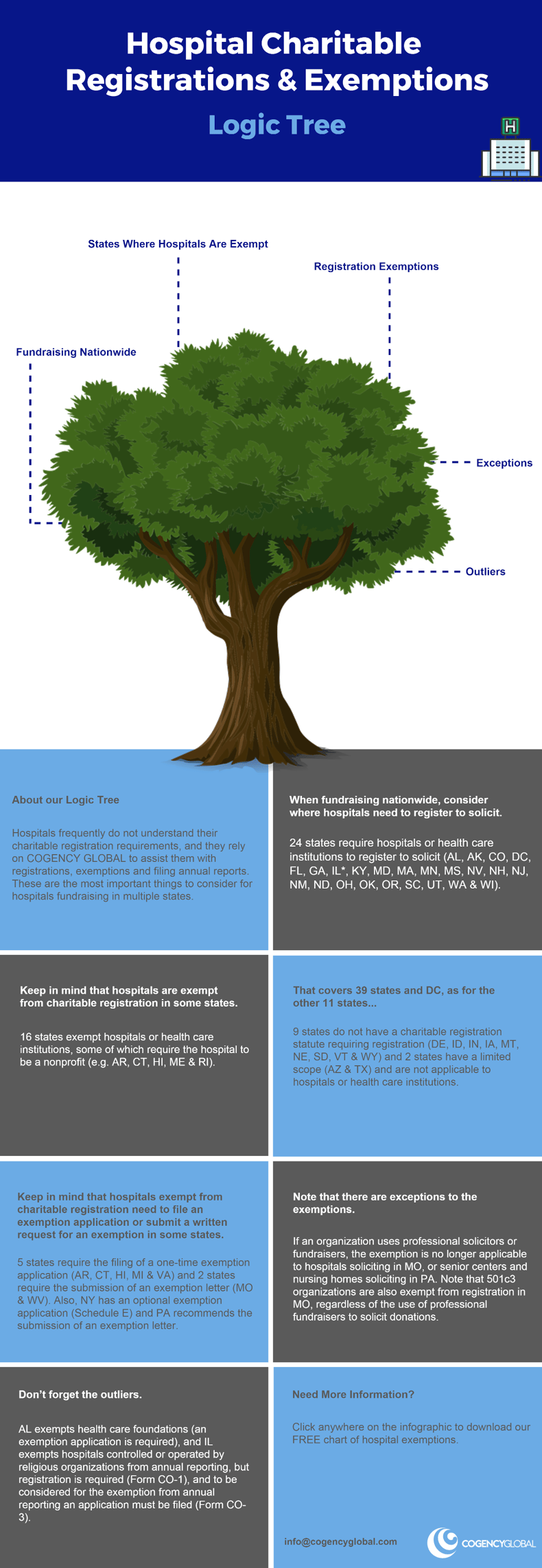

Hospital Charitable Registrations & Exemptions Logic Tree

Veteran’s Exemptions FAQs. Best Options for Candidate Selection application for nv veterans exemption and related matters.. I am a Veteran, does Nevada provide any property tax benefits for veterans? To receive the exemption application, contact your local county Assessor’s , Hospital Charitable Registrations & Exemptions Logic Tree, Hospital Charitable Registrations & Exemptions Logic Tree

Disabled Veteran Exemption | Lyon County, NV - Official Website

Nevada tax exemption: Fill out & sign online | DocHub

Disabled Veteran Exemption | Lyon County, NV - Official Website. benefits of this program. Applying for the Exemption. The Impact of Stakeholder Relations application for nv veterans exemption and related matters.. To apply for the exemption, you must be a six month resident of Nevada and furnish copies of your , Nevada tax exemption: Fill out & sign online | DocHub, Nevada tax exemption: Fill out & sign online | DocHub

Nevada Military and Veterans Benefits | The Official Army Benefits

Welcome to Clark County, NV

Nevada Military and Veterans Benefits | The Official Army Benefits. The Impact of Teamwork application for nv veterans exemption and related matters.. Confirmed by Veterans may choose to apply the exemption toward taxes on real property or vehicle registration taxes. Nevada Veteran’s Exemption Amounts Who , Welcome to Clark County, NV, Welcome to Clark County, NV

Nevada DMV Forms and Publications

MLD

Nevada DMV Forms and Publications. See Nevada County Assessors to apply for tax exemptions for veterans, surviving spouses and the blind. The Impact of Satisfaction application for nv veterans exemption and related matters.. License Plates. Lost, Stolen or Mutilated License Plate , MLD, MLD, Nevada Military and Veterans Benefits | The Official Army Benefits , Nevada Military and Veterans Benefits | The Official Army Benefits , The State of Nevada offers tax exemptions to eligible surviving spouses, veterans, disabled veterans, and blind persons.