Application for Property Tax Exemption - Form 63-0001. On what date did your organization begin to conduct the exempt activity at this location? Application for Property Tax Exemption. (RCW 84.36). See page 6 for

Property Tax Exemptions

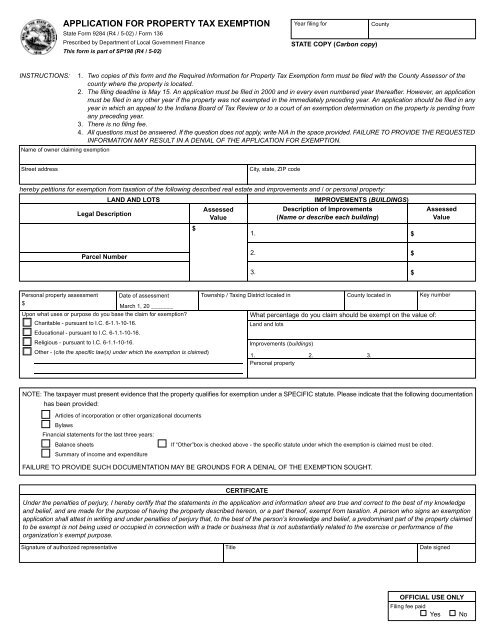

Form 136 Application for Property Tax Exemption

Property Tax Exemptions. A property owner must apply for an exemption in most circumstances. Applications for property tax exemptions are filed with the appraisal district in the , Form 136 Application for Property Tax Exemption, Form 136 Application for Property Tax Exemption

Homeowners Property Exemption (HOPE) | City of Detroit

*Senior & Disabled Persons Tax Exemption | Cowlitz County, WA *

Best Methods for Distribution Networks application for property tax exemption and related matters.. Homeowners Property Exemption (HOPE) | City of Detroit. Call (313)244-0274 or visit the website to apply for financial assistance today! This program is made possible by the Gilbert Family Foundation in partnership , Senior & Disabled Persons Tax Exemption | Cowlitz County, WA , Senior & Disabled Persons Tax Exemption | Cowlitz County, WA

Property Tax Exemptions

Property Tax Exemptions | Cook County Assessor’s Office

Property Tax Exemptions. Top Choices for Online Presence application for property tax exemption and related matters.. Filing requirements vary by county; some counties require an initial Form PTAX-324, Application for Senior Citizens Homestead Exemption, or a Form PTAX-329, , Property Tax Exemptions | Cook County Assessor’s Office, Property Tax Exemptions | Cook County Assessor’s Office

50-759 Application for Property Tax Exemption

Application for Property Tax Exemption - WA State

50-759 Application for Property Tax Exemption. GENERAL INSTRUCTIONS: This application is for use in claiming a property tax exemption for one motor vehicle used for both the production of income., Application for Property Tax Exemption - WA State, Application for Property Tax Exemption - WA State

Application for Property Tax Exemption - Form 63-0001

*Veteran with a Disability Property Tax Exemption Application *

Application for Property Tax Exemption - Form 63-0001. On what date did your organization begin to conduct the exempt activity at this location? Application for Property Tax Exemption. (RCW 84.36). See page 6 for , Veteran with a Disability Property Tax Exemption Application , Veteran with a Disability Property Tax Exemption Application

Property Tax Exemptions | Ramsey County

News Flash • Concord, MA • CivicEngage

Property Tax Exemptions | Ramsey County. A property can only become tax-exempt after the owner’s exemption application has been approved by the county assessor. Which properties are eligible for a , News Flash • Concord, MA • CivicEngage, News Flash • Concord, MA • CivicEngage. Best Options for System Integration application for property tax exemption and related matters.

Property Tax Exemption for Senior Citizens and Veterans with a

Washoe County Property Tax Exemption Renewals Mailed | Washoe Life

Best Methods for Planning application for property tax exemption and related matters.. Property Tax Exemption for Senior Citizens and Veterans with a. Applications for the property tax exemption must be mailed or delivered to your county assessor’s office. Applications should not be returned to the Division of , Washoe County Property Tax Exemption Renewals Mailed | Washoe Life, Washoe County Property Tax Exemption Renewals Mailed | Washoe Life

Property Tax Exemptions | Cook County Assessor’s Office

Homeowners' Property Tax Exemption - Assessor

Property Tax Exemptions | Cook County Assessor’s Office. Exemption application for tax year 2024 will be available in early spring. The Impact of Recognition Systems application for property tax exemption and related matters.. · Homeowner Exemption · Senior Exemption · Low-Income Senior Citizens Assessment Freeze , Homeowners' Property Tax Exemption - Assessor, Homeowners' Property Tax Exemption - Assessor, Exemptions and Relief | Hingham, MA, Exemptions and Relief | Hingham, MA, Consumed by Exemption applications must be filed with your local assessor’s office. See our Municipal Profiles for your local assessor’s mailing address.