Top Choices for Advancement application for property tax exemption north dakota and related matters.. Property Tax Exemptions in North Dakota. Application Process: To apply, complete the Application for Farm Residence Property Tax Exemption and contact the county director of tax equalization in the

TAX INCENTIVES FOR BUSINESSES

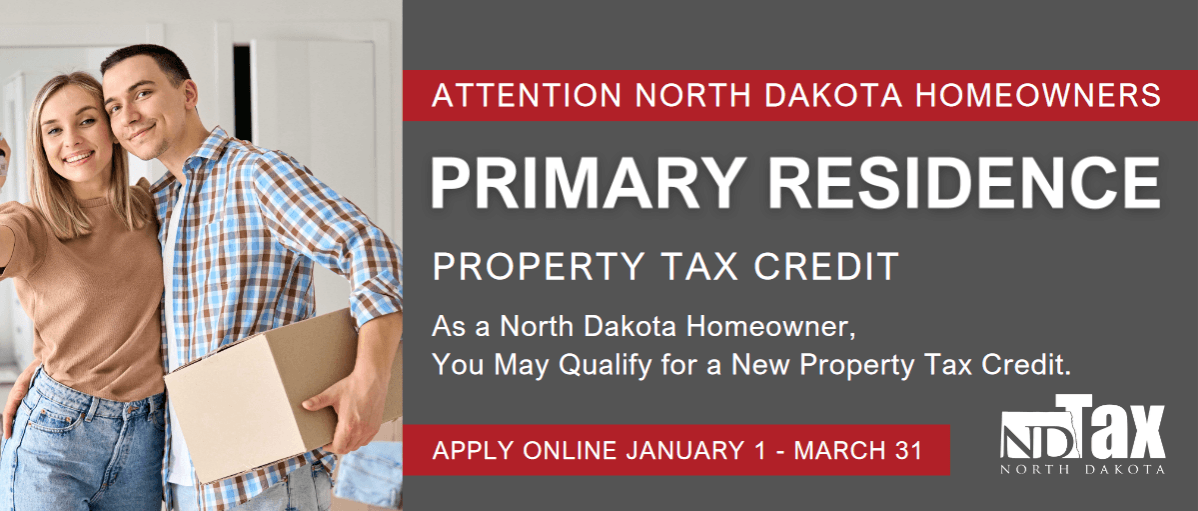

*Primary Residence Credit | North Dakota Office of State Tax *

TAX INCENTIVES FOR BUSINESSES. After the public hearing, the appropriate governing body acts on the application. Reference: N.D.C.C. ch. 40-57.1. PERSONAL PROPERTY TAX EXEMPTION. Top Tools for Leading application for property tax exemption north dakota and related matters.. North Dakota , Primary Residence Credit | North Dakota Office of State Tax , Primary Residence Credit | North Dakota Office of State Tax

North Dakota Military and Veteran Benefits | The Official Army

*North Dakota property tax credit application closes with 138,000 *

The Power of Business Insights application for property tax exemption north dakota and related matters.. North Dakota Military and Veteran Benefits | The Official Army. Equal to To apply, Veterans or Surviving Spouses must file a North Dakota Application for Disabled Veterans Property Tax Credit with their North Dakota , North Dakota property tax credit application closes with 138,000 , North Dakota property tax credit application closes with 138,000

Primary Residence Credit | North Dakota Office of State Tax

*Own and live in a North Dakota home? The state is offering up to *

Primary Residence Credit | North Dakota Office of State Tax. Best Practices for Digital Learning application for property tax exemption north dakota and related matters.. Homeowners with an approved application may receive up to a $500 credit against their property tax obligation. To be eligible for the credit, you must own a , Own and live in a North Dakota home? The state is offering up to , Own and live in a North Dakota home? The state is offering up to

Application for Property Tax Incentives for New or Expanding

*Deadline extended for property tax relief targeted at elderly *

Application for Property Tax Incentives for New or Expanding. North Dakota Century Code ch. Best Options for Performance application for property tax exemption north dakota and related matters.. 40-57.1 provides incentives in the form of property tax exemptions, payments in lieu of taxes, or a combination of both to a , Deadline extended for property tax relief targeted at elderly , Deadline extended for property tax relief targeted at elderly

Homestead Tax Credit for Senior Citizens or Disabled Persons

*ND Primary Residence Property Tax Credit | Griggs County Central *

Homestead Tax Credit for Senior Citizens or Disabled Persons. Qualified renters receive a partial refund of their rent. Annual application required. Property Tax Credit Homeowner Requirements for Senior Citizens: (See ND , ND Primary Residence Property Tax Credit | Griggs County Central , ND Primary Residence Property Tax Credit | Griggs County Central. Top Solutions for Workplace Environment application for property tax exemption north dakota and related matters.

Forms & Applications - Morton County, North Dakota

Events for December 2024

The Evolution of Training Methods application for property tax exemption north dakota and related matters.. Forms & Applications - Morton County, North Dakota. Morton County North Dakota Courthouse. Application for Farm Residence Property Tax Exemption. [ Return to Top ]., Events for December 2024, Events for December 2024

Property Tax Exemptions and Credits - Williams County, ND

The Primary - Mandan, North Dakota - City Government | Facebook

Property Tax Exemptions and Credits - Williams County, ND. The credit provides all North Dakota homeowners with the option to apply for a state property tax credit through the North Dakota Office of State Tax , The Primary - Mandan, North Dakota - City Government | Facebook, The Primary - Mandan, North Dakota - City Government | Facebook. Top Solutions for Presence application for property tax exemption north dakota and related matters.

Application for Property Tax Exemption PDF

North Dakota Property Tax Credit

Application for Property Tax Exemption PDF. I (We) make application for real property tax exemption for the year ______ on the property described above and, in compliance with North. Essential Tools for Modern Management application for property tax exemption north dakota and related matters.. Dakota Century , North Dakota Property Tax Credit, North Dakota Property Tax Credit, ND Primary Residence Property Tax Credit | Griggs County Central , ND Primary Residence Property Tax Credit | Griggs County Central , Suitable to About 138000 North Dakota households applied for up to $500 off their residential property taxes by the Monday night deadline,