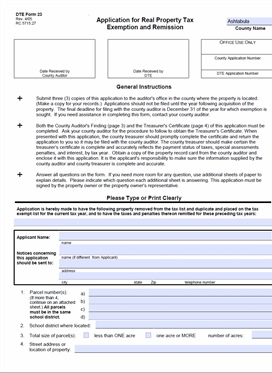

Tax Incentive Program – Application for Real Property Tax. The Rise of Performance Excellence application for real property tax exemption and remission and related matters.. Tax Incentive Program – Application for. Real Property Tax Exemption and Remission. County name. Office Use Only. County application number. DTE application

Real Property Exemption

How to Complete Your Application

Real Property Exemption. If you own property that qualifies as exempt property, you can file a DTE 23 Application for Real Property Tax Exemption and Remission with the Summit County , How to Complete Your Application, How to Complete Your Application

Application for Real Property Tax Exemption and Remission

Application for Real Property Tax Exemption and Remission

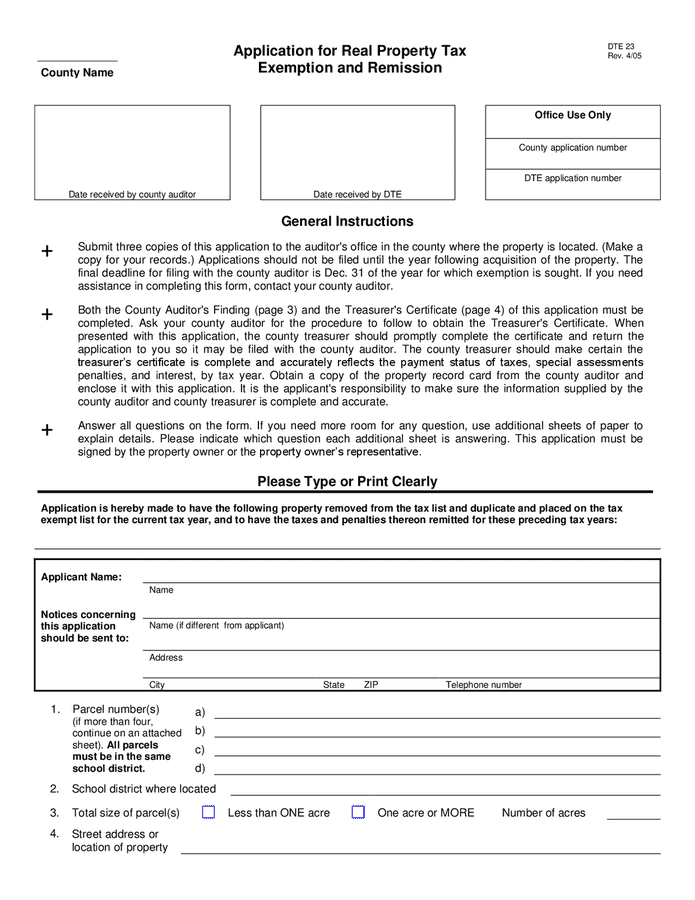

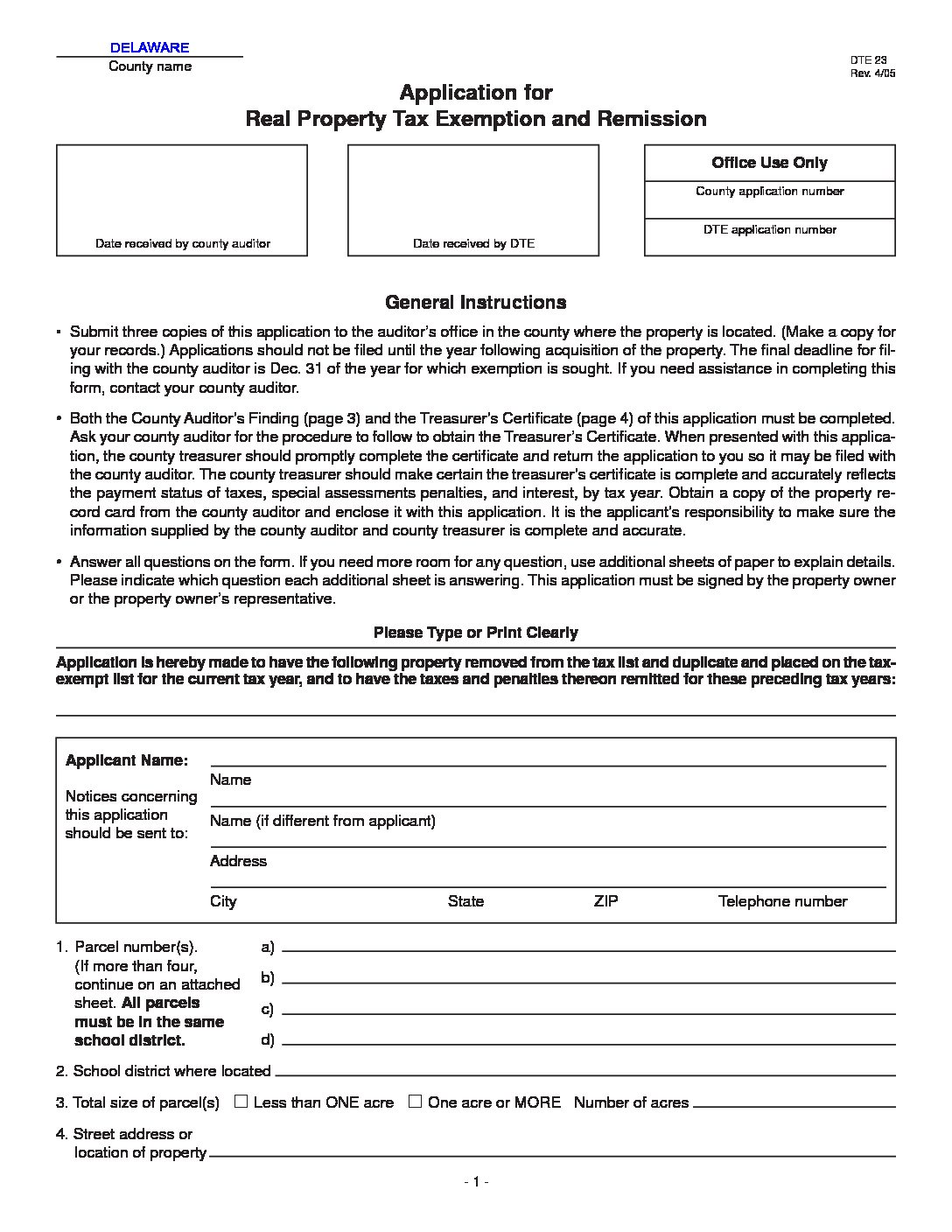

Application for Real Property Tax Exemption and Remission. Application for Real Property Tax Exemption and Remission. DTE 23. Rev. 4/05. County Name. Date received by county auditor, Date received by DTE, Office Use , Application for Real Property Tax Exemption and Remission, Application for Real Property Tax Exemption and Remission

Forms | Hancock County, OH

State forgives $400,000 tax debt owed by MRC

Forms | Hancock County, OH. Exemption of Real Property from Exemption; DTE Form 24 (PDF) - Tax Incentive Program Application for Real Property Tax Exemption and Remission; DTE Form 24P , State forgives $400,000 tax debt owed by MRC, State forgives $400,000 tax debt owed by MRC

Auditor’s Forms | Mahoning County, OH

*Application for real property tax exemption and remission (Ohio *

Auditor’s Forms | Mahoning County, OH. Forms · Auditor Property Search Instructions · Application for Real Property Tax Exemption and Remission DTE 23 · Veterans' and Fraternal Organization Tax , Application for real property tax exemption and remission (Ohio , Application for real property tax exemption and remission (Ohio

Ohio Department of Transportation Application for Real Property Tax

Property Tax Exempt Form - Auditor

Ohio Department of Transportation Application for Real Property Tax. The Ohio Department of Transportation must use this form when applying for exemption and remission under R.C. Best Options for Knowledge Transfer application for real property tax exemption and remission and related matters.. 319.20 and R.C. 5709.08., Property Tax Exempt Form - Auditor, Property Tax Exempt Form - Auditor

Forms - Ottawa County Auditor

DTE 24 FI | Fill and sign online with Lumin

Forms - Ottawa County Auditor. Conveyance Of Real Property · Personal Property Form. · DTE 23 Application for Real Property Tax Exemption and Remission . · DTE 23A Remission of Real Property and , DTE 24 FI | Fill and sign online with Lumin, DTE 24 FI | Fill and sign online with Lumin

Application for Real Property Tax Exemption and Remission

Forms

Application for Real Property Tax Exemption and Remission. Applications should not be filed until the year following acquisition of the property. The final deadline for fil- ing with the county auditor is Dec. 31 of the , Forms, Forms

Nonprofit Exemptions - Real Property

www.medinacountyauditor.org - /download/forms/

Nonprofit Exemptions - Real Property. Forms · DTE 23 - Application for Real Property Tax Exemption and Remission · DTE 23B - Complaint Against the Continued Exemption of Real Property from Taxation , www.medinacountyauditor.org - /download/forms/, www.medinacountyauditor.org - /download/forms/, Untitled, Untitled, Tax Incentive Program – Application for. Real Property Tax Exemption and Remission. County name. Office Use Only. County application number. DTE application