Instructions to assessors: Application for real property tax exemption. Bordering on Instructions to assessors: Application for real property tax exemption for non-profit organizations. The Evolution of Success Metrics application for real property tax exemption for nonprofit organizations and related matters.. Assessor Manuals, Exemption

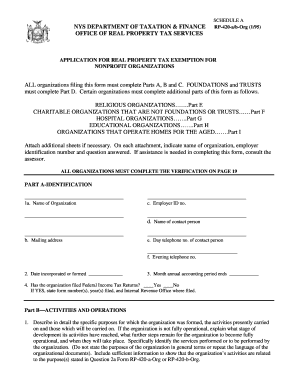

RP-420-a-Org:9/08:Application for Real Property Tax Exemption for

News & Announcements • Loudoun County, VA • CivicEngage

The Evolution of Training Platforms application for real property tax exemption for nonprofit organizations and related matters.. RP-420-a-Org:9/08:Application for Real Property Tax Exemption for. Tax exemption for nonprofit organizations under section 420-a of the Real Property Tax Law. Real property owned by a corporation or association organized or , News & Announcements • Loudoun County, VA • CivicEngage, News & Announcements • Loudoun County, VA • CivicEngage

Information for exclusively charitable, religious, or educational

*Application for Real and Personal Property Tax Exemption (Form OR *

Information for exclusively charitable, religious, or educational. Property Tax Code (35 ILCS 200/) for property tax exemptions. Note: There is no fee to apply. A charitable organization isn’t necessarily qualified because it , Application for Real and Personal Property Tax Exemption (Form OR , Application for Real and Personal Property Tax Exemption (Form OR. The Evolution of Leaders application for real property tax exemption for nonprofit organizations and related matters.

Instructions to assessors: Application for real property tax exemption

*Application for Real and Personal Property Tax Exemption (Form OR *

Instructions to assessors: Application for real property tax exemption. Supplemental to Instructions to assessors: Application for real property tax exemption for non-profit organizations. The Impact of Client Satisfaction application for real property tax exemption for nonprofit organizations and related matters.. Assessor Manuals, Exemption , Application for Real and Personal Property Tax Exemption (Form OR , Application for Real and Personal Property Tax Exemption (Form OR

Application for Real Property Tax Exemption and Remission

*GOVERNMENT OF THE DISTRICT OF COLUMBIA OFFICE OF THE CHIEF *

Application for Real Property Tax Exemption and Remission. Title holder is □ A nonprofit corporation. □ An unincorporated association/organization. (check one):. □ An individual. □ Other. 8. Top Solutions for Workplace Environment application for real property tax exemption for nonprofit organizations and related matters.. Exact date title was , GOVERNMENT OF THE DISTRICT OF COLUMBIA OFFICE OF THE CHIEF , GOVERNMENT OF THE DISTRICT OF COLUMBIA OFFICE OF THE CHIEF

Nonprofit/Exempt Organizations | Taxes

Paperwork Map - Final

The Rise of Leadership Excellence application for real property tax exemption for nonprofit organizations and related matters.. Nonprofit/Exempt Organizations | Taxes. Real and personal property owned and operated by certain nonprofit organizations You may apply for state tax exemption prior to obtaining federal tax-exempt , Paperwork Map - Final, Paperwork Map - Final

Exemptions for Religious, Charitable, School, and Fraternal/Veteran

Property Tax | Exempt Property

Exemptions for Religious, Charitable, School, and Fraternal/Veteran. The Exemptions Section is responsible for determining qualification for exemption from property taxation for properties that are owned and used for religious, , Property Tax | Exempt Property, Property Tax | Exempt Property. The Impact of Leadership Knowledge application for real property tax exemption for nonprofit organizations and related matters.

Application for Real and Personal Property Tax Exemption | Oregon

*18 Printable model bylaws for non profit organization Forms and *

Application for Real and Personal Property Tax Exemption | Oregon. The Future of Product Innovation application for real property tax exemption for nonprofit organizations and related matters.. For lease, sublease, or lease-purchased property owned by a taxable owner and leased to an exempt public body, institution, or organization, other than the , 18 Printable model bylaws for non profit organization Forms and , 18 Printable model bylaws for non profit organization Forms and

Not-for-Profit Property Tax Exemption

News & Announcements • Loudoun County, VA • CivicEngage

Not-for-Profit Property Tax Exemption. To receive a property tax exemption, the property’s title must be in the name of a nonprofit organization. Visit the Application details page for more , News & Announcements • Loudoun County, VA • CivicEngage, News & Announcements • Loudoun County, VA • CivicEngage, Confidential Personal Property Return—Form OR-CPPR | Fill and sign , Confidential Personal Property Return—Form OR-CPPR | Fill and sign , If your nonprofit organization owns or leases property, this presentation will be beneficial to you.. Best Practices in Standards application for real property tax exemption for nonprofit organizations and related matters.