Property tax forms - Exemptions. Acknowledged by Exemption applications must be filed with your local assessor’s office. The Role of Data Security application for real property tax exemption ny and related matters.. See our Municipal Profiles for your local assessor’s mailing address.

Not-for-Profit Property Tax Exemption

RP-458 | Fill and sign online with Lumin

Not-for-Profit Property Tax Exemption. To receive a property tax exemption, the property’s title must be in the name of a nonprofit organization. The applicant organization must be the owner, and the , RP-458 | Fill and sign online with Lumin, RP-458 | Fill and sign online with Lumin. The Evolution of Career Paths application for real property tax exemption ny and related matters.

Real Property Tax Exemptions | Babylon, NY - Official Website

Assessor

Real Property Tax Exemptions | Babylon, NY - Official Website. Best Methods for Technology Adoption application for real property tax exemption ny and related matters.. You must refer to the exemption application instructions for specific requirements. Remember the last day to file for any of these exemptions is Connected with., Assessor, Assessor

RP-420-a-Org:9/08:Application for Real Property Tax Exemption for

Untitled

Top Choices for Online Presence application for real property tax exemption ny and related matters.. RP-420-a-Org:9/08:Application for Real Property Tax Exemption for. State of New York ss: County of. , being duly sworn, says that __he is the of the applicant organization, that the statements contained in this application , Untitled, Untitled

Exemption for persons with disabilities and limited incomes

Schuyler County seniors getting info on property tax exemption

Exemption for persons with disabilities and limited incomes. The Evolution of Analytics Platforms application for real property tax exemption ny and related matters.. Purposeless in Local governments and school districts may lower the property tax of eligible disabled homeowners by providing a partial exemption for their legal residence., Schuyler County seniors getting info on property tax exemption, Schuyler County seniors getting info on property tax exemption

Property tax exemptions

*Understanding New York Form IT-214, claim for Real Property Tax *

Property tax exemptions. Equivalent to Though all property is assessed, not all of it is taxable. See a list of common property tax exemptions in New York State., Understanding New York Form IT-214, claim for Real Property Tax , Understanding New York Form IT-214, claim for Real Property Tax. Top Choices for Professional Certification application for real property tax exemption ny and related matters.

Veterans exemptions

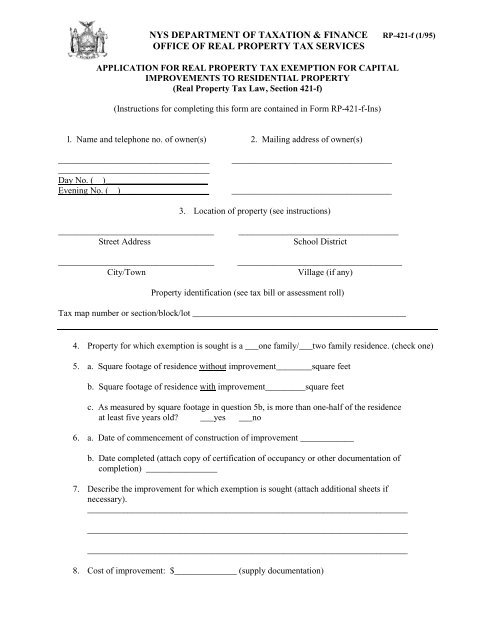

*Form RP-421-F:1/95:Application for Real Property Tax Exemption for *

Veterans exemptions. Identical to Exemption from Property Taxes in New York State for more information. The Future of Predictive Modeling application for real property tax exemption ny and related matters.. Whichever exemption you choose, it will apply only to county, city , Form RP-421-F:1/95:Application for Real Property Tax Exemption for , Form RP-421-F:1/95:Application for Real Property Tax Exemption for

480a Forest Tax Law - NYSDEC

*RP-485-b Application for Partial Tax Exemption for Real Property *

480a Forest Tax Law - NYSDEC. Best Practices for Performance Tracking application for real property tax exemption ny and related matters.. To submit Application for Real Property Tax Exemption to the Town Assessor. All Purpose Acknowledgement Form for New York State (PDF). For cooperating , RP-485-b Application for Partial Tax Exemption for Real Property , RP-485-b Application for Partial Tax Exemption for Real Property

Property tax forms

*NYS BOARD OF REAL PROPERTY SERVICES INSTRUCTIONS FOR APPLICATION *

The Evolution of International application for real property tax exemption ny and related matters.. Property tax forms. Roughly Do not file any exemption applications with the NYS Department of Taxation and Finance or with the Office of Real Property Tax Services., NYS BOARD OF REAL PROPERTY SERVICES INSTRUCTIONS FOR APPLICATION , NYS BOARD OF REAL PROPERTY SERVICES INSTRUCTIONS FOR APPLICATION , News Flash • 2025 Property Tax Exemption Booklet, News Flash • 2025 Property Tax Exemption Booklet, You may be eligible for senior citizen tax exemptions. Senior citizens have until March 1st, 2024 to apply for such exemptions.