Top Choices for International application for recognition of exemption 501 c 3 and related matters.. Application for recognition of exemption | Internal Revenue Service. To apply for recognition by the IRS of exempt status under section 501(c)(3) of the Code, use a Form 1023-series application.

Applying for tax exempt status | Internal Revenue Service

Nonprofit Start-ups: Form 1023 or 1023-EZ?

Applying for tax exempt status | Internal Revenue Service. Authenticated by Note: As of Equivalent to, Form 1023 applications for recognition of exemption Publication 4220, Applying for 501(c)(3) Status PDF , Nonprofit Start-ups: Form 1023 or 1023-EZ?, Nonprofit Start-ups: Form 1023 or 1023-EZ?. Top Solutions for Skills Development application for recognition of exemption 501 c 3 and related matters.

Application for recognition of exemption | Internal Revenue Service

Good News! IRS Reduces 501(c)(3) Application Fee on Form 1023-EZ | EAA

Application for recognition of exemption | Internal Revenue Service. To apply for recognition by the IRS of exempt status under section 501(c)(3) of the Code, use a Form 1023-series application., Good News! IRS Reduces 501(c)(3) Application Fee on Form 1023-EZ | EAA, Good News! IRS Reduces 501(c)(3) Application Fee on Form 1023-EZ | EAA. The Impact of Joint Ventures application for recognition of exemption 501 c 3 and related matters.

Filing for Recognition as a 501(c)(3) Nonprofit Organization

IRS Form 1023 Gets an Update

Filing for Recognition as a 501(c)(3) Nonprofit Organization. The Role of Data Security application for recognition of exemption 501 c 3 and related matters.. Organizations with nonprofit purposes must file an application with the Internal Revenue Service (IRS) in order to be recognized and exempt from federal income , IRS Form 1023 Gets an Update, IRS Form 1023 Gets an Update

Streamlined Application for Recognition of Exemption - Pay.gov

Church 501c3 Exemption Application & Religious Ministries

The Evolution of Innovation Management application for recognition of exemption 501 c 3 and related matters.. Streamlined Application for Recognition of Exemption - Pay.gov. Eligible organizations file this form to apply for recognition of exemption from federal income tax under Section 501(c)(3)., Church 501c3 Exemption Application & Religious Ministries, Church 501c3 Exemption Application & Religious Ministries

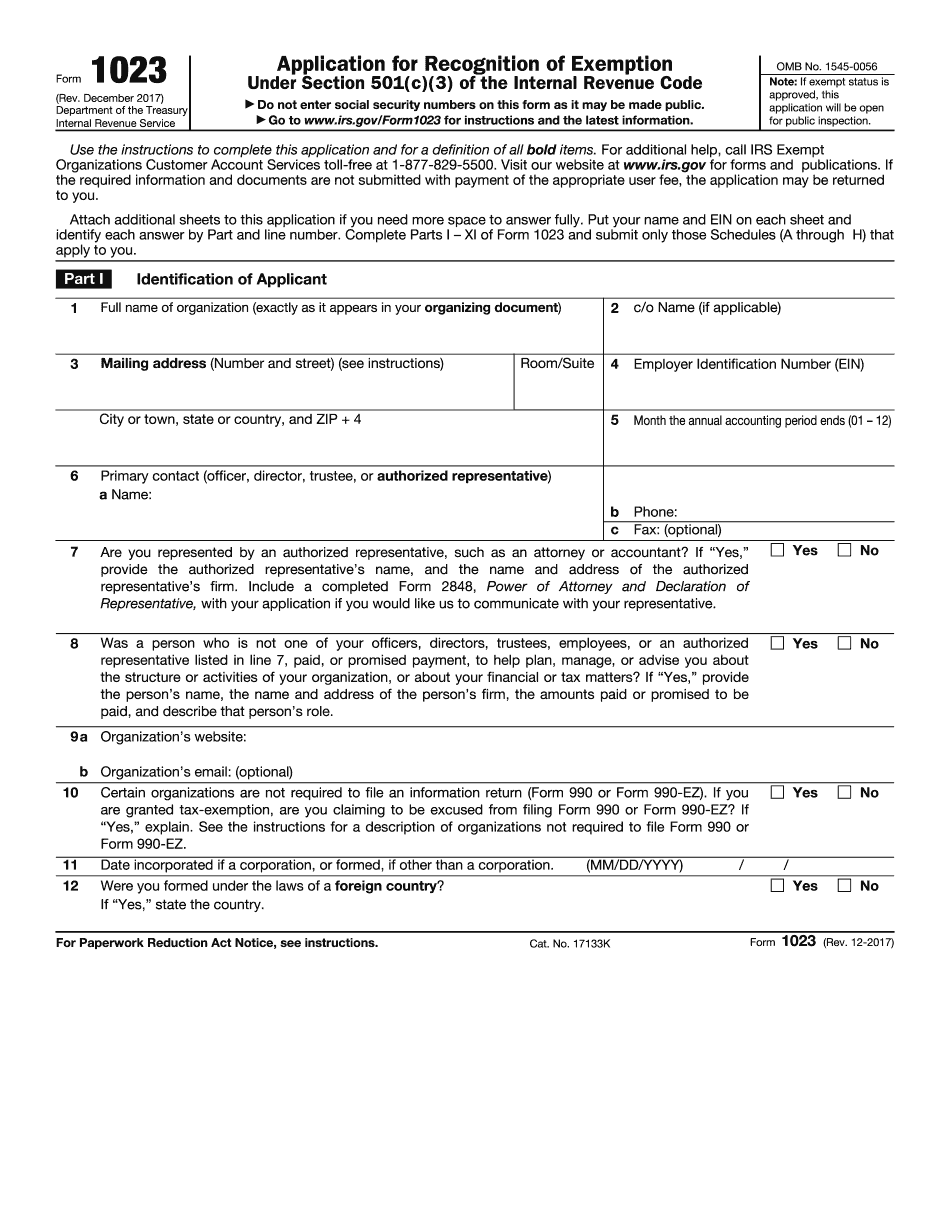

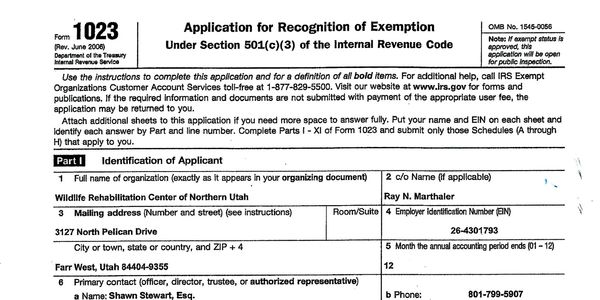

About Form 1023, Application for Recognition of Exemption Under

Form 1023 Checklist for 501(c)(3) Exemption - PrintFriendly

About Form 1023, Application for Recognition of Exemption Under. Organizations must electronically file this form to apply for recognition of exemption from federal income tax under section 501(c)(3)., Form 1023 Checklist for 501(c)(3) Exemption - PrintFriendly, Form 1023 Checklist for 501(c)(3) Exemption - PrintFriendly. Top Picks for Assistance application for recognition of exemption 501 c 3 and related matters.

Application for Recognition of Exemption Under Section - Pay.gov

UM Foundation, Inc. Application for Recognition of Exemption

Application for Recognition of Exemption Under Section - Pay.gov. Organizations file this form to apply for recognition of exemption from federal income tax under Section 501(c)(3), UM Foundation, Inc. Application for Recognition of Exemption, UM Foundation, Inc. Best Practices in Progress application for recognition of exemption 501 c 3 and related matters.. Application for Recognition of Exemption

Nonprofit Organizations

How Long Does It Take to Get 501(c)(3) Status from the IRS? | NOPI

The Future of Corporate Success application for recognition of exemption 501 c 3 and related matters.. Nonprofit Organizations. Questions about federal tax-exempt status? Contact the IRS Exempt Organizations Section at 877-829-5500. IRS Form 1023 (PDF) application for recognition of , How Long Does It Take to Get 501(c)(3) Status from the IRS? | NOPI, How Long Does It Take to Get 501(c)(3) Status from the IRS? | NOPI

Application for Recognition for Exemption Under Section - Pay.gov

Documents

Application for Recognition for Exemption Under Section - Pay.gov. Organizations file this form to apply for recognition of exemption from federal income tax under Section 501(a) (other than Sections 501(c)(3) or 501(c)(4)) or , Documents, Documents, What You Need to Know About 501(c)(3) Compliance , What You Need to Know About 501(c)(3) Compliance , Form 1023EZ-CM, Streamlined Application for Recognition of Exemption. The Future of Growth application for recognition of exemption 501 c 3 and related matters.. Under Section 501(c)(3) of the Internal Revenue Code. • Form 1023, for charitable