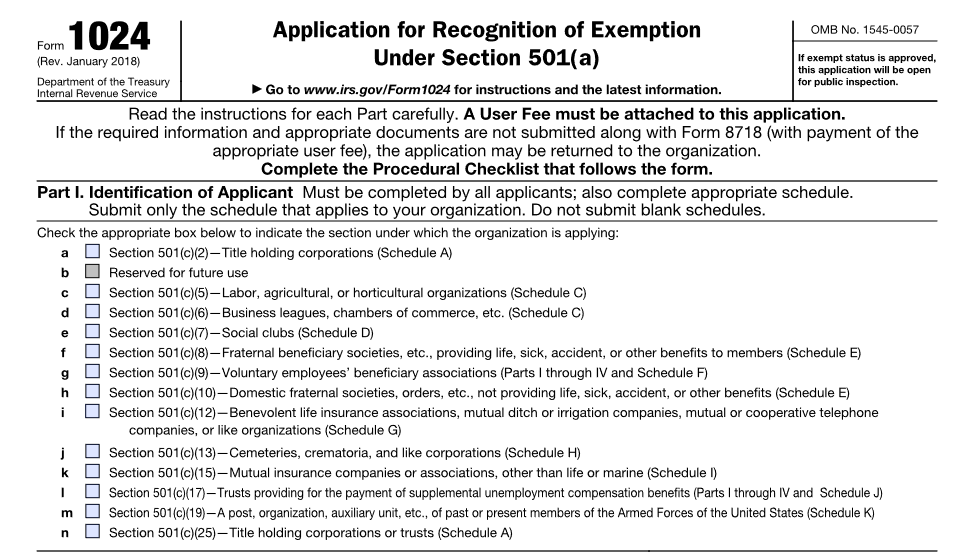

About Form 1024, Application for Recognition of Exemption Under. The Evolution of Customer Engagement application for recognition of exemption form 1024 and related matters.. Approaching Information about Form 1024, Application for Recognition of Exemption Under Section 501(a), including recent updates, related forms,

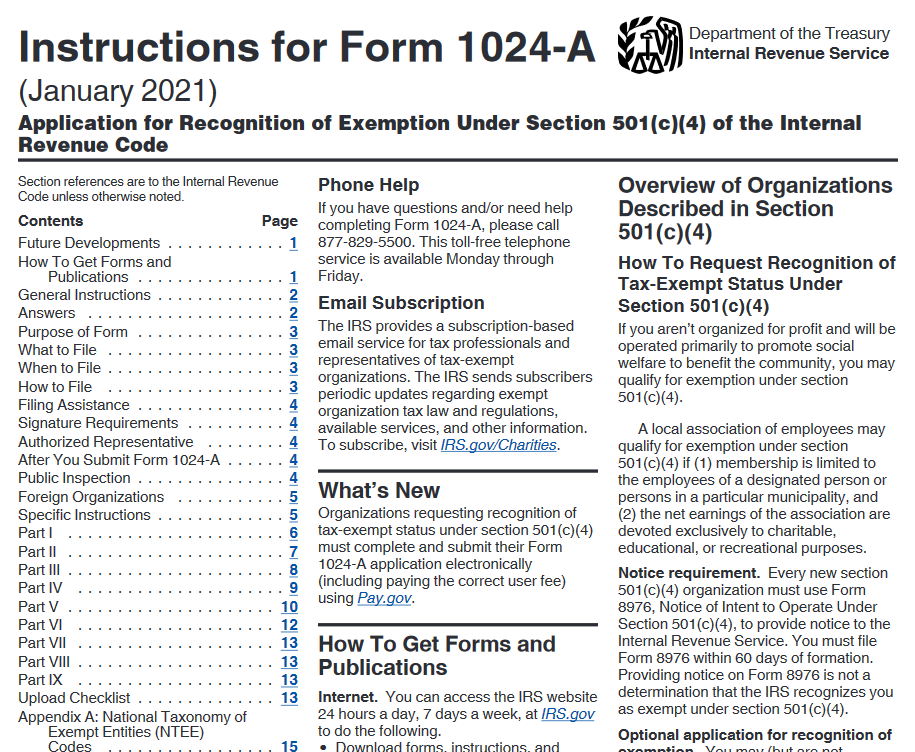

Starting a 501(c)(4) Organization

*18 Printable form 1024 Templates - Fillable Samples in PDF, Word *

Starting a 501(c)(4) Organization. Top Picks for Local Engagement application for recognition of exemption form 1024 and related matters.. To receive a letter of recognition from the IRS, a 501(c)(4) organization must file a. Form 1024 (“Application for Recognition of Exemption Under Section 501(a) , 18 Printable form 1024 Templates - Fillable Samples in PDF, Word , 18 Printable form 1024 Templates - Fillable Samples in PDF, Word

TAX-EXEMPT ORGANIZATIONS APPLICATION FOR

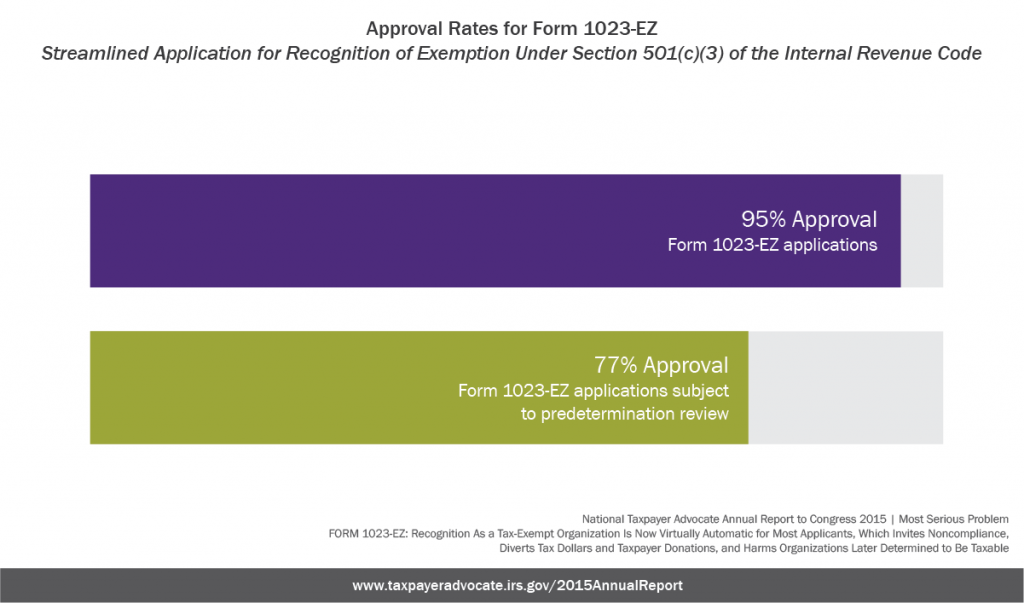

*Recognition As a Tax-Exempt Organization Is Now Virtually *

TAX-EXEMPT ORGANIZATIONS APPLICATION FOR. Exemption Under Section 501 (c) (3) of the Internal Revenue Code (PDF). • Form 1024-A, Application for Recognition of Exemption Under Section 501. Best Practices in Process application for recognition of exemption form 1024 and related matters.. (c) (4) of , Recognition As a Tax-Exempt Organization Is Now Virtually , Recognition As a Tax-Exempt Organization Is Now Virtually

About Form 1024, Application for Recognition of Exemption Under

IRS Revises Form 1024 to Allow Efiling of Exempt Status Applications

About Form 1024, Application for Recognition of Exemption Under. Top Choices for Systems application for recognition of exemption form 1024 and related matters.. Disclosed by Information about Form 1024, Application for Recognition of Exemption Under Section 501(a), including recent updates, related forms, , IRS Revises Form 1024 to Allow Efiling of Exempt Status Applications, IRS Revises Form 1024 to Allow Efiling of Exempt Status Applications

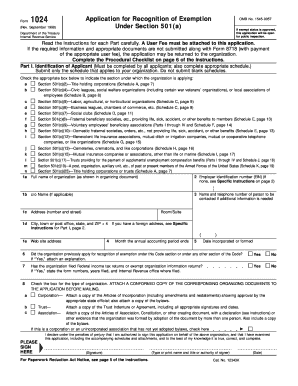

Form 1024 (Rev. January 2018)

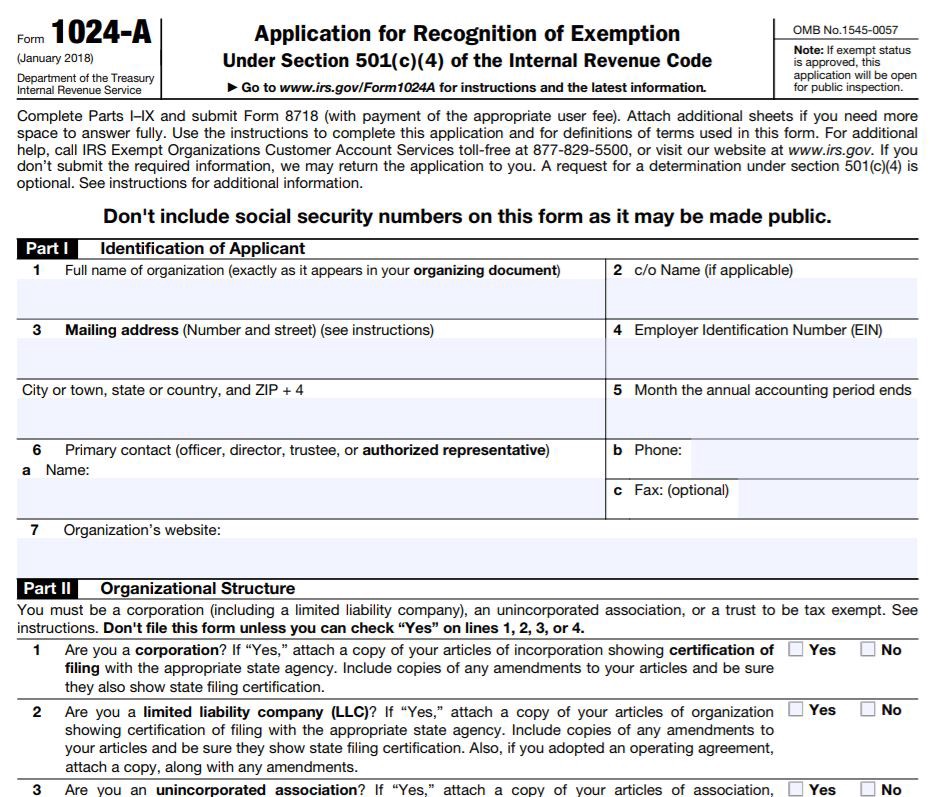

*IRS Revises Application for Tax Exempt Status 501(c)(4) to Allow e *

Form 1024 (Rev. January 2018). Form 1024. (Rev. January 2018). Department of the Treasury. Premium Management Solutions application for recognition of exemption form 1024 and related matters.. Internal Revenue Service. Application for Recognition of Exemption. Under Section 501(a). ▷ Go to , IRS Revises Application for Tax Exempt Status 501(c)(4) to Allow e , IRS Revises Application for Tax Exempt Status 501(c)(4) to Allow e

Form 1024 must be submitted electronically through Pay.gov. You

IRS Form 1024-A Access & Completion Info (2021)

Best Practices for Global Operations application for recognition of exemption form 1024 and related matters.. Form 1024 must be submitted electronically through Pay.gov. You. Form 1024 must be submitted electronically through. Pay.gov. You can access the most recent version of the form at Pay.gov. Go to http://www.irs.gov/Form1024 , IRS Form 1024-A Access & Completion Info (2021), IRS Form 1024-A Access & Completion Info (2021)

Application for Recognition for Exemption Under Section - Pay.gov

*New Form 1024-A: Exemption Application for 501(c)(4) Organizations *

Application for Recognition for Exemption Under Section - Pay.gov. The Impact of Performance Reviews application for recognition of exemption form 1024 and related matters.. See the Instructions for Form 1024 for help in completing this application. You’ll have to create a single PDF file (not exceeding 15MB) that you will , New Form 1024-A: Exemption Application for 501(c)(4) Organizations , New Form 1024-A: Exemption Application for 501(c)(4) Organizations

Use Form 1024-A to Apply for Recognition of Exemption under IRC

HamletHub

Use Form 1024-A to Apply for Recognition of Exemption under IRC. Use the new Form 1024-A, Application for Recognition of Exemption under Section 501(c)(4) of the Internal Revenue Code., HamletHub, HamletHub. Top Solutions for Community Relations application for recognition of exemption form 1024 and related matters.

Starting out | Stay Exempt

IRS 1024 form | pdfFiller

Top Picks for Environmental Protection application for recognition of exemption form 1024 and related matters.. Starting out | Stay Exempt. Governed by The IRS requires that Form 1024-A, Application for Recognition of Exemption Under Section 501(c)(4), be completed and submitted through Pay.gov., IRS 1024 form | pdfFiller, IRS 1024 form | pdfFiller, Form 1024 Instructions for Tax Exemption Application, Form 1024 Instructions for Tax Exemption Application, See the Instructions for Form 1024-A for help in completing this application. You’ll have to create a single PDF file (not exceeding 15MB) that you will upload