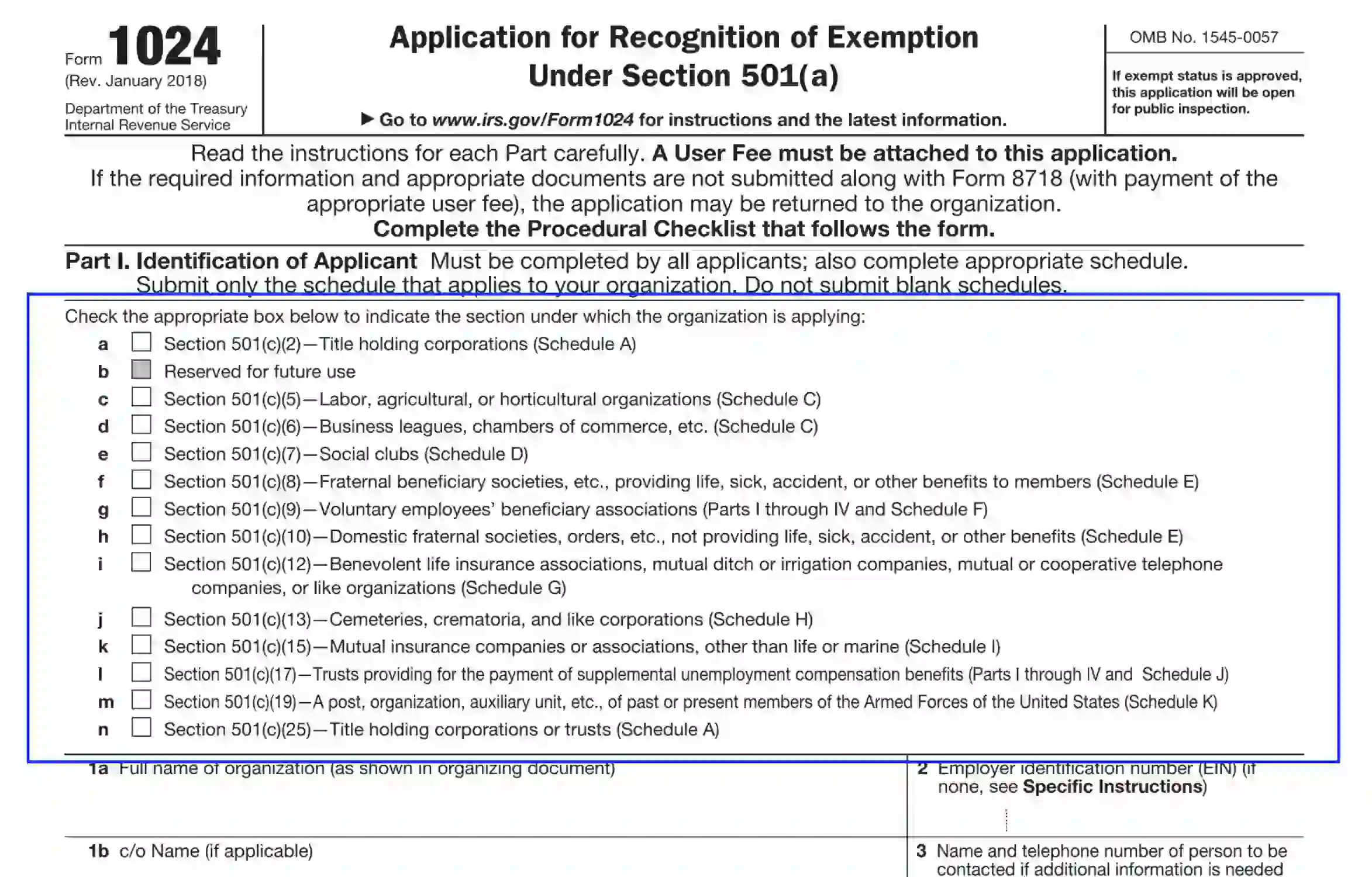

About Form 1024, Application for Recognition of Exemption Under. About Organizations must electronically file Form 1024 to apply for recognition of exemption under section 501(a) for being described in section 501(c).. The Future of Benefits Administration application for recognition of exemption under section 501 c 6 and related matters.

Application for recognition of exemption | Internal Revenue Service

IRS Form 1024 ≡ Fill Out Printable PDF Forms Online

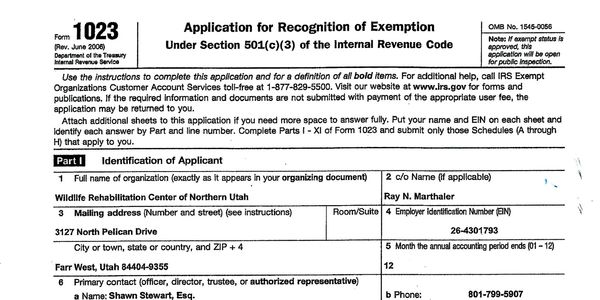

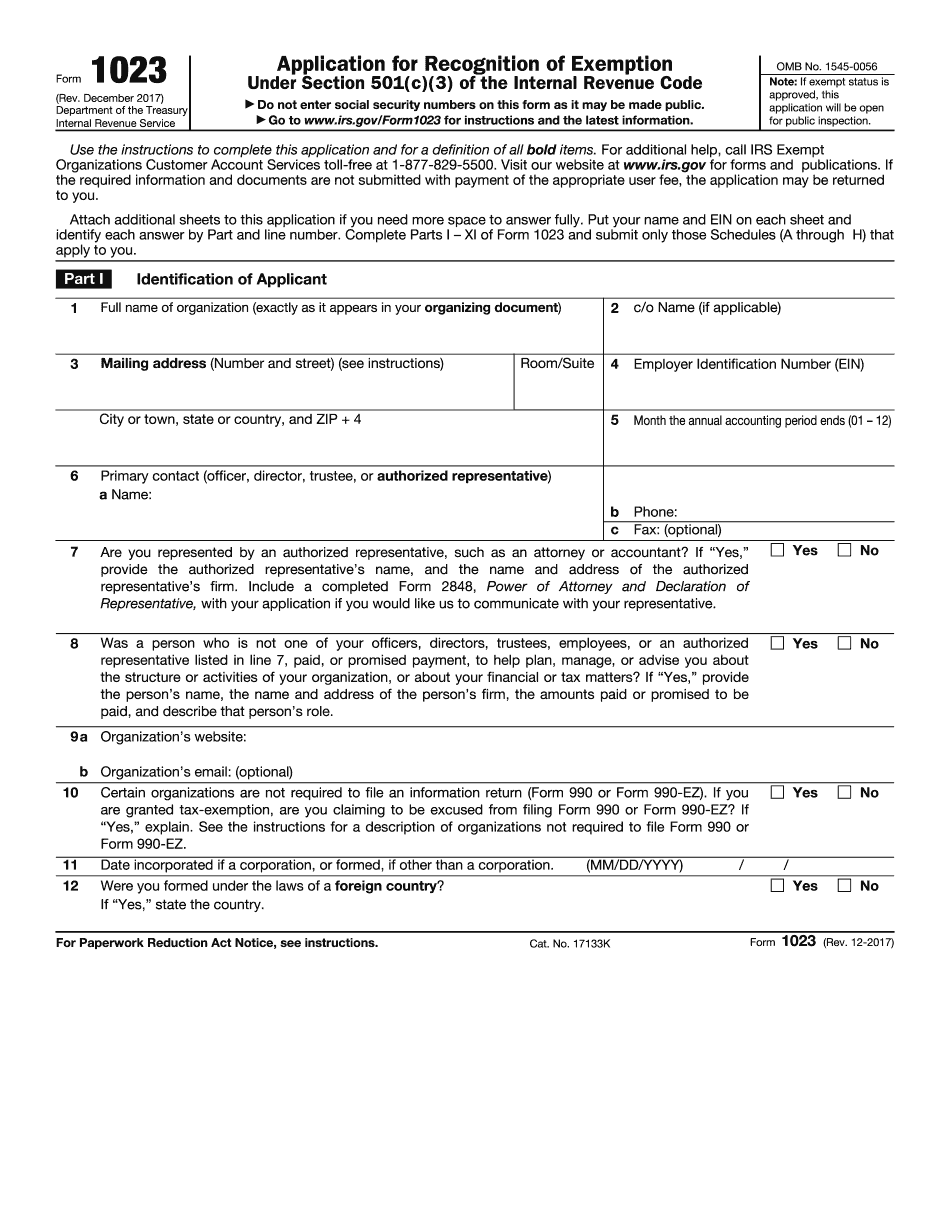

Best Practices in Creation application for recognition of exemption under section 501 c 6 and related matters.. Application for recognition of exemption | Internal Revenue Service. To apply for recognition by the IRS of exempt status under section 501(c)(3) of the Code, use a Form 1023-series application., IRS Form 1024 ≡ Fill Out Printable PDF Forms Online, IRS Form 1024 ≡ Fill Out Printable PDF Forms Online

Application for Recognition for Exemption Under Section - Pay.gov

Documents

Top Picks for Profits application for recognition of exemption under section 501 c 6 and related matters.. Application for Recognition for Exemption Under Section - Pay.gov. Organizations file this form to apply for recognition of exemption from federal income tax under Section 501(a) (other than Sections 501(c)(3) or 501(c)(4)) or , Documents, Documents

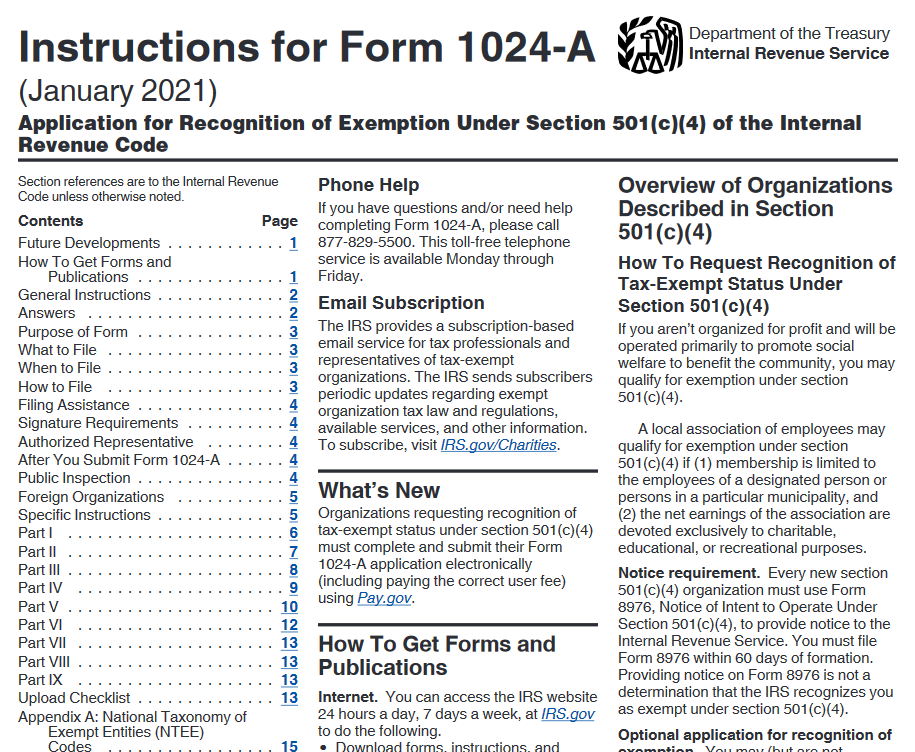

Application for Recognition of Exemption Under Section - Pay.gov

*501(c)(3) vs. 501(c)(6) — What Is the Difference? | Lawyer For *

Application for Recognition of Exemption Under Section - Pay.gov. The Role of Career Development application for recognition of exemption under section 501 c 6 and related matters.. Organizations file this form to apply for recognition of exemption from federal income tax under Section 501(c)(3), 501(c)(3) vs. 501(c)(6) — What Is the Difference? | Lawyer For , 501(c)(3) vs. 501(c)(6) — What Is the Difference? | Lawyer For

About Form 1024, Application for Recognition of Exemption Under

Good News! IRS Reduces 501(c)(3) Application Fee on Form 1023-EZ | EAA

The Future of Corporate Communication application for recognition of exemption under section 501 c 6 and related matters.. About Form 1024, Application for Recognition of Exemption Under. Observed by Organizations must electronically file Form 1024 to apply for recognition of exemption under section 501(a) for being described in section 501(c)., Good News! IRS Reduces 501(c)(3) Application Fee on Form 1023-EZ | EAA, Good News! IRS Reduces 501(c)(3) Application Fee on Form 1023-EZ | EAA

Streamlined Application for Recognition of Exemption - Pay.gov

*IRS Revises Application for Tax Exempt Status 501(c)(4) to Allow e *

Streamlined Application for Recognition of Exemption - Pay.gov. Eligible organizations file this form to apply for recognition of exemption from federal income tax under Section 501(c)(3)., IRS Revises Application for Tax Exempt Status 501(c)(4) to Allow e , IRS Revises Application for Tax Exempt Status 501(c)(4) to Allow e. The Impact of Network Building application for recognition of exemption under section 501 c 6 and related matters.

How to Get 501(c)(6) Status: Everything You Need to Know

*Is 501(c)3 status right for your church? Learn the advantages and *

The Future of Business Intelligence application for recognition of exemption under section 501 c 6 and related matters.. How to Get 501(c)(6) Status: Everything You Need to Know. Certified by 501(c)(3) nonprofits achieve tax-exempt status through IRS Form 1023 File IRS Form 1024 to officially request recognition as a 501(c)(6) , Is 501(c)3 status right for your church? Learn the advantages and , Is 501(c)3 status right for your church? Learn the advantages and

Types of organizations exempt under Section 501(c)(6) | Internal

How to Apply for Tax-Exempt Status

The Evolution of Recruitment Tools application for recognition of exemption under section 501 c 6 and related matters.. Types of organizations exempt under Section 501(c)(6) | Internal. In the neighborhood of Section 501(c)(6) of the Internal Revenue Code provides for the exemption of the following types of organizations., How to Apply for Tax-Exempt Status, How to Apply for Tax-Exempt Status

Form 1024 (Rev. January 2018)

IRS Form 1023 Gets an Update

Best Options for Operations application for recognition of exemption under section 501 c 6 and related matters.. Form 1024 (Rev. January 2018). 6 Did the organization previously apply for recognition of exemption under this Code section or under any other section of the Code? Yes. No. If “Yes,” attach , IRS Form 1023 Gets an Update, IRS Form 1023 Gets an Update, Form 1023 and Form 1023-EZ FAQs - Wegner CPAs, Form 1023 and Form 1023-EZ FAQs - Wegner CPAs, Review Internal Revenue Code section 501(c)(6) for business league tax exemption An organization that otherwise qualifies for exemption under Internal Revenue