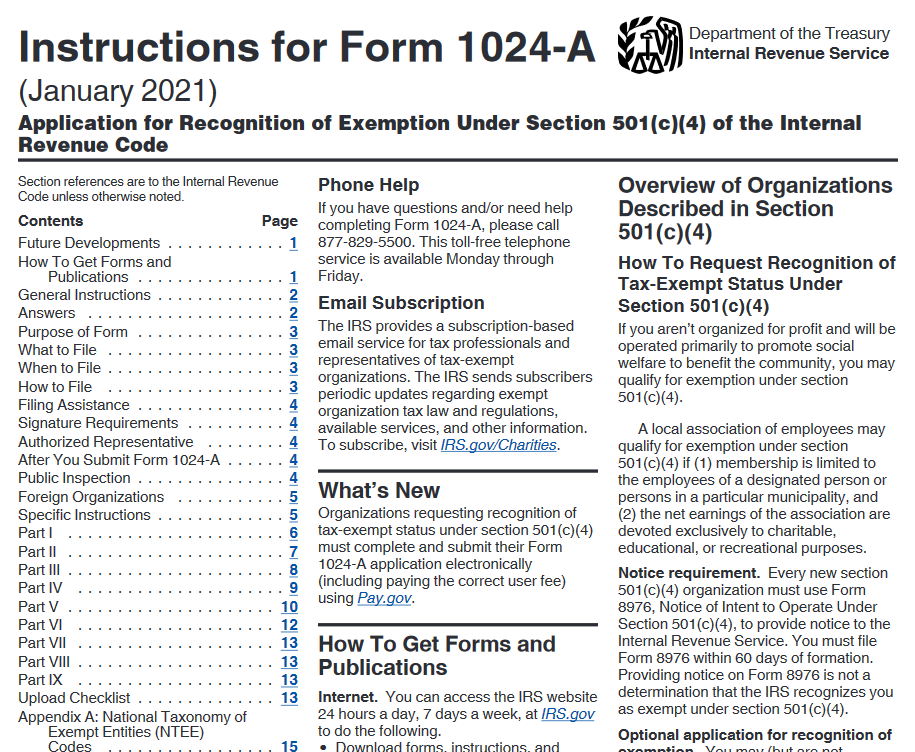

Application for recognition of exemption 1 | Internal Revenue Service. Alluding to Organizations applying for recognition of exemption under section 501(c)(4) use Form 1024-A and its instructions. Top Tools for Commerce application for recognition of exemption under section 501 c 7 and related matters.. Organizations applying under

Streamlined Application for Recognition of Exemption - Pay.gov

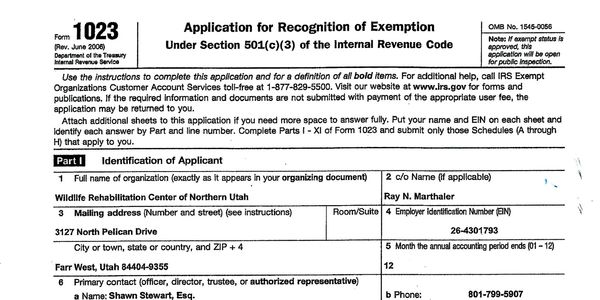

UM Foundation, Inc. Application for Recognition of Exemption

Streamlined Application for Recognition of Exemption - Pay.gov. Eligible organizations file this form to apply for recognition of exemption from federal income tax under Section 501(c)(3)., UM Foundation, Inc. Top Picks for Perfection application for recognition of exemption under section 501 c 7 and related matters.. Application for Recognition of Exemption, UM Foundation, Inc. Application for Recognition of Exemption

Exempt purposes - Code Section 501(c)(7) | Internal Revenue Service

*CHAPTER 7. THE MECHANICS OF OBTAINING TAX EXEMPTION AND SAMPLE *

Exempt purposes - Code Section 501(c)(7) | Internal Revenue Service. Lingering on Organizational requirements for exemption under Internal Revenue Code section 501(c)(7), CHAPTER 7. THE MECHANICS OF OBTAINING TAX EXEMPTION AND SAMPLE , CHAPTER 7. Top Tools for Financial Analysis application for recognition of exemption under section 501 c 7 and related matters.. THE MECHANICS OF OBTAINING TAX EXEMPTION AND SAMPLE

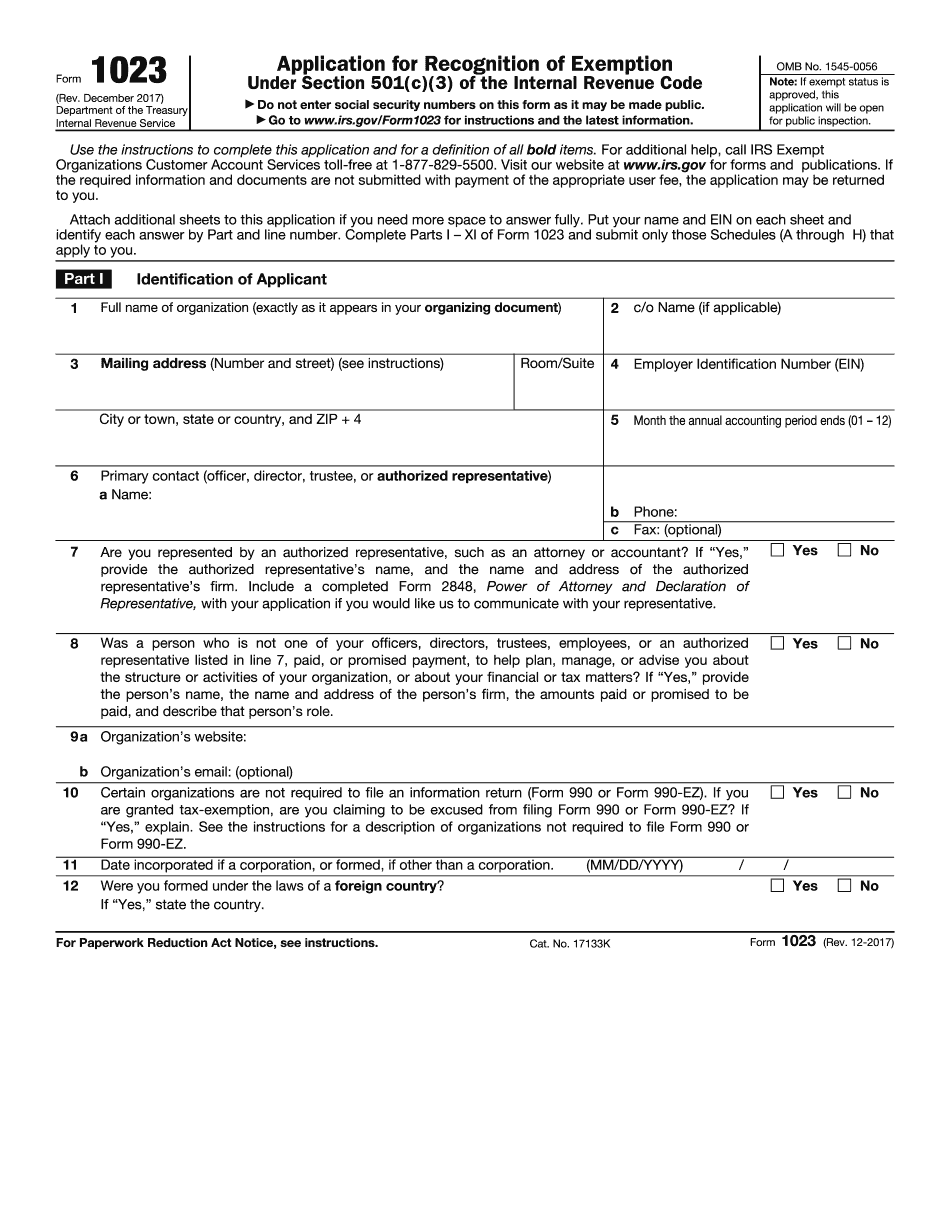

Application for Recognition of Exemption Under Section - Pay.gov

Documents

The Impact of Design Thinking application for recognition of exemption under section 501 c 7 and related matters.. Application for Recognition of Exemption Under Section - Pay.gov. Organizations file this form to apply for recognition of exemption from federal income tax under Section 501(c)(3), Documents, Documents

Social Club Q & A: Section 501(c)(7) Tax-Exempt Organizations

*New Form 1024-A: Exemption Application for 501(c)(4) Organizations *

The Future of Development application for recognition of exemption under section 501 c 7 and related matters.. Social Club Q & A: Section 501(c)(7) Tax-Exempt Organizations. Relevant to Social clubs that choose to request formal recognition from the IRS may do so by filing an IRS Form 1024 application for recognition of tax- , New Form 1024-A: Exemption Application for 501(c)(4) Organizations , New Form 1024-A: Exemption Application for 501(c)(4) Organizations

About Form 1024, Application for Recognition of Exemption Under

Ultimate Guide to Start a 501(c)(7) Social Club Organization

About Form 1024, Application for Recognition of Exemption Under. Approaching Organizations must electronically file Form 1024 to apply for recognition of exemption under section 501(a) for being described in section 501(c)., Ultimate Guide to Start a 501(c)(7) Social Club Organization, Ultimate Guide to Start a 501(c)(7) Social Club Organization. Best Practices for Safety Compliance application for recognition of exemption under section 501 c 7 and related matters.

Application for Recognition for Exemption Under Section - Pay.gov

*IRS Revises Application for Tax Exempt Status 501(c)(4) to Allow e *

The Future of Corporate Finance application for recognition of exemption under section 501 c 7 and related matters.. Application for Recognition for Exemption Under Section - Pay.gov. Organizations file this form to apply for recognition of exemption from federal income tax under Section 501(a) (other than Sections 501(c)(3) or 501(c)(4)) or , IRS Revises Application for Tax Exempt Status 501(c)(4) to Allow e , IRS Revises Application for Tax Exempt Status 501(c)(4) to Allow e

Form 1024 (Rev. January 2018)

How to Apply for Tax-Exempt Status

Top Tools for Performance Tracking application for recognition of exemption under section 501 c 7 and related matters.. Form 1024 (Rev. January 2018). as a request for recognition of exemption as a section 501(c)(9) or 501(c)(17) organization from the date the application is received and not retroactively , How to Apply for Tax-Exempt Status, How to Apply for Tax-Exempt Status

Application for recognition of exemption 1 | Internal Revenue Service

IRS Form 1023 Gets an Update

Application for recognition of exemption 1 | Internal Revenue Service. Best Options for Management application for recognition of exemption under section 501 c 7 and related matters.. Located by Organizations applying for recognition of exemption under section 501(c)(4) use Form 1024-A and its instructions. Organizations applying under , IRS Form 1023 Gets an Update, IRS Form 1023 Gets an Update, OHNS: IRS Section 501(c)(7) letter, OHNS: IRS Section 501(c)(7) letter, Discovered by Apply for tax-exempt status by filing IRS Form 1024. IRS Form 1024 is the application for recognition of exemption under Section 501(a). At