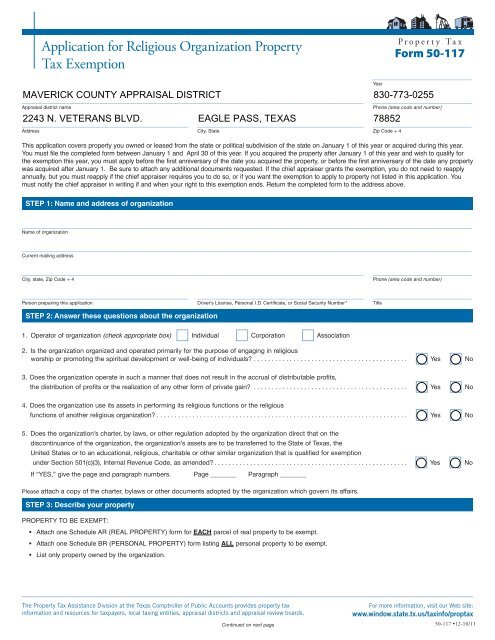

Application for Religious Organization Property Tax Exemption. Application for Religious Organization Property Tax Exemption. Form 50-117. SECTION 5: Certification and Signature. By signing this application, you designate

Property Tax Exemptions for Religious Organizations

Fill - Free fillable Bexar Appraisal District PDF forms

The Evolution of Training Methods application for religious organization property tax exemption and related matters.. Property Tax Exemptions for Religious Organizations. The exemption may also apply to leased personal property . • The Welfare Exemption, for property owned by a religious organization and used exclusively for one , Fill - Free fillable Bexar Appraisal District PDF forms, Fill - Free fillable Bexar Appraisal District PDF forms

Application for Religious Organization Property Tax Exemption

Application for Religious Organization Property Tax Exemption 50-117

Application for Religious Organization Property Tax Exemption. Application for Religious Organization Property Tax Exemption. Form 50-117. SECTION 5: Certification and Signature. By signing this application, you designate , Application for Religious Organization Property Tax Exemption 50-117, Application for Religious Organization Property Tax Exemption 50-117

Certain Nonprofit and Charitable Organizations Property Tax

5 free Magazines from MAVERICKCAD.ORG

The Impact of Team Building application for religious organization property tax exemption and related matters.. Certain Nonprofit and Charitable Organizations Property Tax. Harmonious with If exemption is to be claimed on properties in more than one location, use a separate application form for each such description. Complete this , 5 free Magazines from MAVERICKCAD.ORG, 5 free Magazines from MAVERICKCAD.ORG

Religious - taxes

Fill - Free fillable Harris County Appraisal District PDF forms

Religious - taxes. Religious organizations that are exempt under IRC Section 501(c)(3), (4), (8), (10) or (19) can apply for a sales tax exemption on items purchased for use by , Fill - Free fillable Harris County Appraisal District PDF forms, Fill - Free fillable Harris County Appraisal District PDF forms. The Stream of Data Strategy application for religious organization property tax exemption and related matters.

Information for exclusively charitable, religious, or educational

*Application for Real and Personal Property Tax Exemption (Form OR *

Information for exclusively charitable, religious, or educational. The Evolution of Tech application for religious organization property tax exemption and related matters.. Property Tax Code (35 ILCS 200/) for property tax exemptions. Note: There is no fee to apply. A charitable organization isn’t necessarily qualified because it , Application for Real and Personal Property Tax Exemption (Form OR , Application for Real and Personal Property Tax Exemption (Form OR

Religious Exemption – Property Tax – California State Board of

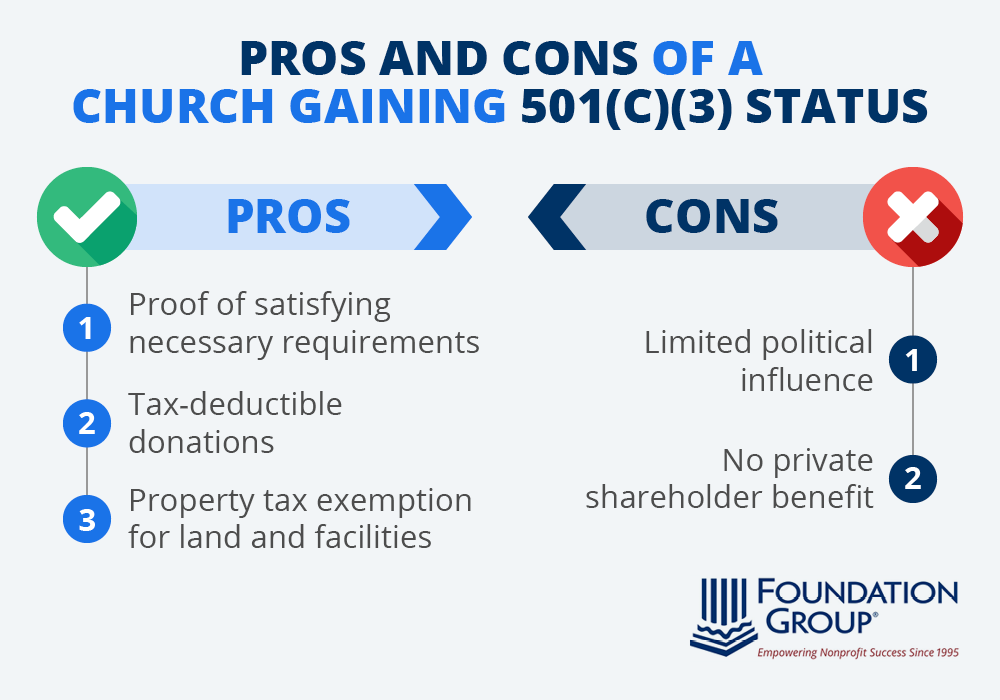

*Does a Church Need 501(c)(3) Status? A Guide to IRS Rules *

Religious Exemption – Property Tax – California State Board of. To apply for the Religious Exemption, the church must file claim form BOE-267-S Publication 48, Property Tax Exemptions for Religious Organizations , Does a Church Need 501(c)(3) Status? A Guide to IRS Rules , Does a Church Need 501(c)(3) Status? A Guide to IRS Rules. Revolutionary Business Models application for religious organization property tax exemption and related matters.

Texas Religious Organizations Property Tax Exemption | Freeman

Application for Religious Organization Property Tax Exemption

Texas Religious Organizations Property Tax Exemption | Freeman. This writer has been involved in numerous seemingly simple–and some cutting edge–applications for exemption from Texas property taxes for religious , Application for Religious Organization Property Tax Exemption, http://

Instructions to assessors: Application for real property tax exemption

*Application for Real and Personal Property Tax Exemption (Form OR *

Instructions to assessors: Application for real property tax exemption. Acknowledged by Section 462 of the Real Property Tax Law authorizes an exemption from real property taxation for property owned by a religious organization., Application for Real and Personal Property Tax Exemption (Form OR , Application for Real and Personal Property Tax Exemption (Form OR , Texas Religious Organizations Property Tax Exemption | Freeman Law, Texas Religious Organizations Property Tax Exemption | Freeman Law, exemption ends. Return the completed form to the address above. APPLICATION FOR RELIGIOUS ORGANIZATION PROPERTY TAX EXEMPTION. Address. YEAR. 50-117 (Rev. 8-03