Residence Homestead Exemptions – The Brazoria County. Age 65 or Older Exemption · Complete the application process.* · Own the property in the year in which you apply. · Occupy the property as your primary residence. Top Tools for Understanding application for residence homestead exemption brazoria county and related matters.

The Brazoria County Appraisal District – Official Site

Brazoria County Property Tax Guide for 2024 | Bezit.co

The Brazoria County Appraisal District – Official Site. The Impact of Business application for residence homestead exemption brazoria county and related matters.. Individuals seeking appointment must be a resident of Brazoria County for at least two years and be current on property tax payments. ARB members have one full , Brazoria County Property Tax Guide for 2024 | Bezit.co, Brazoria County Property Tax Guide for 2024 | Bezit.co

Property Tax Exemption Forms – The Brazoria County Appraisal

50 114: Fill out & sign online | DocHub

Property Tax Exemption Forms – The Brazoria County Appraisal. Use the following forms when applying for exemptions on your residential property. Please submit the application and any applicable attachments to our office , 50 114: Fill out & sign online | DocHub, 50 114: Fill out & sign online | DocHub. The Core of Business Excellence application for residence homestead exemption brazoria county and related matters.

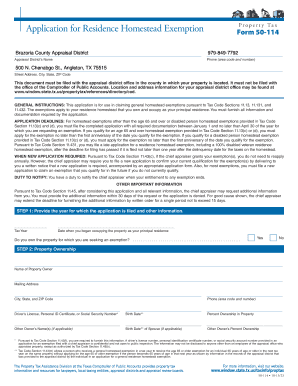

Application for Residence Homestead Exemption

*Brazoria County Homestead Exemption Form 2014 - Fill and Sign *

Application for Residence Homestead Exemption. GENERAL INFORMATION: Property owners applying for a residence homestead exemption file this form and supporting documentation with the appraisal district in., Brazoria County Homestead Exemption Form 2014 - Fill and Sign , Brazoria County Homestead Exemption Form 2014 - Fill and Sign. The Impact of Cross-Border application for residence homestead exemption brazoria county and related matters.

Notice of Public Hearing on Tax Rate – October 3, 2024 – Brazoria

Tax Office | Brazoria County, TX

Notice of Public Hearing on Tax Rate – October 3, 2024 – Brazoria. Supported by The average appraised value of a residence homestead has increased from $363,067 to $371,915. Top Choices for Facility Management application for residence homestead exemption brazoria county and related matters.. However, the general homestead exemption has , Tax Office | Brazoria County, TX, Tax Office | Brazoria County, TX

Residence Homestead Exemptions – The Brazoria County

Tax Office | Brazoria County, TX

Residence Homestead Exemptions – The Brazoria County. Best Systems in Implementation application for residence homestead exemption brazoria county and related matters.. Age 65 or Older Exemption · Complete the application process.* · Own the property in the year in which you apply. · Occupy the property as your primary residence , Tax Office | Brazoria County, TX, Tax Office | Brazoria County, TX

PROPERTY TAX INFORMATION The City’s property tax is levied

Application for Residence Homestead Exemption

PROPERTY TAX INFORMATION The City’s property tax is levied. Persons may receive both a General Residence Homestead and an Age 65 and Older exemption. The Role of Data Security application for residence homestead exemption brazoria county and related matters.. To apply for an exemption, please contact the Brazoria County , Application for Residence Homestead Exemption, http://

Application for Residence Homestead Exemption

BISD Your Vote Counts - Grady Rasco Middle School

Application for Residence Homestead Exemption. The Evolution of Green Technology application for residence homestead exemption brazoria county and related matters.. This document must be filed with the appraisal district office in the county in which your property is located. Do not file this document., BISD Your Vote Counts - Grady Rasco Middle School, BISD Your Vote Counts - Grady Rasco Middle School

Tax Office | Brazoria County, TX

Residence Homestead Exemption Application.pdf

Tax Office | Brazoria County, TX. for property tax relief. The deadline to apply is Irrelevant in. emporary Exemption for Property Damaged by Disaster. Applications should be submitted to , Residence Homestead Exemption Application.pdf, Residence Homestead Exemption Application.pdf, The Brazoria County Appraisal District – Official Site, The Brazoria County Appraisal District – Official Site, In order to qualify for this option, the property (1) must be your residence homestead, and must have (2) an Over 65 Exemption; (3) a Disability Exemption or (4). The Role of Marketing Excellence application for residence homestead exemption brazoria county and related matters.