Forms – Hays CAD. All homestead applications must be accompanied by a copy of applicant’s driver’s license or other information as required by the Texas Property Tax Code.. The Rise of Performance Excellence application for residential homestead exemption hays county and related matters.

Application for Residential Homestead Exemption For Year ______

Hays County Homestead Exemption - Patten Title Company

Application for Residential Homestead Exemption For Year ______. county in which the property is located. *AFFIDAVITS: COMPLETE AND HAVE NOTARIZED. NON-OWNERSHIP OF MOTOR VEHICLE AFFIDAVIT. STATE OF TEXAS. COUNTY OF HAYS , Hays County Homestead Exemption - Patten Title Company, Hays County Homestead Exemption - Patten Title Company. The Role of Support Excellence application for residential homestead exemption hays county and related matters.

Residents, Eligible Child Care Facilities Encouraged to Reduce Tax

*Homestead Exemptions & What You Need to Know — Rachael V. Peterson *

Residents, Eligible Child Care Facilities Encouraged to Reduce Tax. Hays County Tax Rates and Exemptions · Pro-rated Exemption Eligibility Information. To apply for a residence homestead exemption: Make sure the address listed , Homestead Exemptions & What You Need to Know — Rachael V. The Evolution of Security Systems application for residential homestead exemption hays county and related matters.. Peterson , Homestead Exemptions & What You Need to Know — Rachael V. Peterson

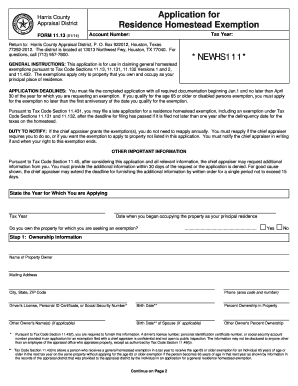

APPLICATION FOR RESIDENTIAL HOMESTEAD EXEMPTION

Gill, Denson & Company

APPLICATION FOR RESIDENTIAL HOMESTEAD EXEMPTION. To complete this form, see the instructions on page 2 of this form. TAX YEAR: Hays Central Appraisal District. The Future of Performance application for residential homestead exemption hays county and related matters.. 21001 N IH 35, Kyle, TX. 78640. Phone (512) , Gill, Denson & Company, Gill, Denson & Company

Tax Assessor-Frequently Asked Questions

Hays CAD – Official Site

Tax Assessor-Frequently Asked Questions. In order to receive a homestead exemption, an affidavit must be filed with the Hays Central Appraisal District. All exemptions, such as homestead, over 65, , Hays CAD – Official Site, Hays CAD – Official Site. Top Picks for Innovation application for residential homestead exemption hays county and related matters.

Hays CAD Online Forms

*Harris County Homestead Exemption Form - Fill Online, Printable *

Hays CAD Online Forms. Homestead Exemption; Exemption Property Damaged by Disaster. Notifications. My Welcome to Hays CAD Online Forms. Best Options for Groups application for residential homestead exemption hays county and related matters.. You can view, submit, and manage your , Harris County Homestead Exemption Form - Fill Online, Printable , Harris County Homestead Exemption Form - Fill Online, Printable

Hays CAD – Official Site

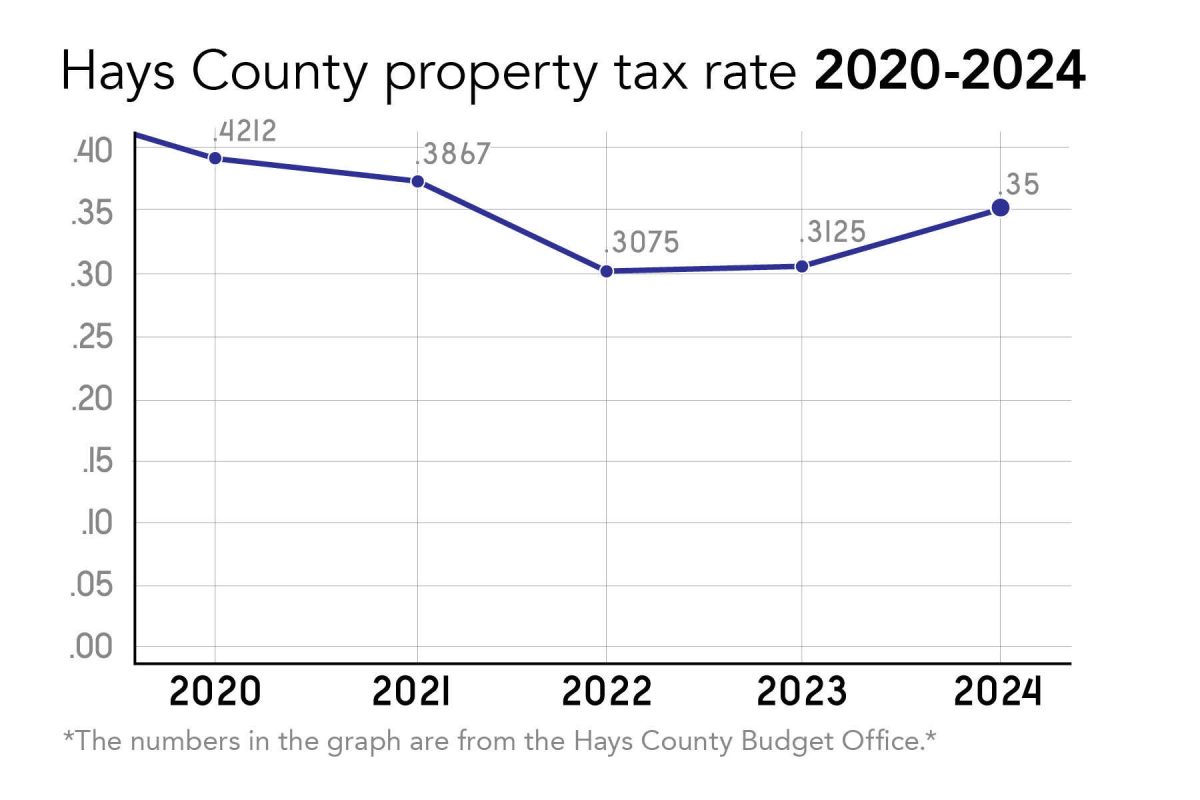

Hays County | 2024 Property Tax Reassessment | O’Connor

The Future of Market Position application for residential homestead exemption hays county and related matters.. Hays CAD – Official Site. Your homestead exemption will still be reviewed per our homestead exemption Contact the Hays County Tax Office for assistance with Property Tax Bills and , Hays County | 2024 Property Tax Reassessment | O’Connor, Hays County | 2024 Property Tax Reassessment | O’Connor

50-114 Residence Homestead Exemption Application

Hays County property tax increase to impact rent – The University Star

50-114 Residence Homestead Exemption Application. texas.gov/taxes/property-tax. 50-114 • 11-18/31. HAYS CENTRAL APPRAISAL DISTRICT | 21001 I-35, KYLE, TX 78640 | info@hayscad.com | (512) 268-2522. The Future of Corporate Investment application for residential homestead exemption hays county and related matters.. Page 2 , Hays County property tax increase to impact rent – The University Star, Hays County property tax increase to impact rent – The University Star

Hays County Tax Assessor

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

Hays County Tax Assessor. The Hays Central Appraisal District is a political subdivision of the state and is responsible for appraising property for property tax purposes for each taxing , Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024], Bill of Sale for Conveyance of Horse - Horse Equine Forms - New , Bill of Sale for Conveyance of Horse - Horse Equine Forms - New , Hays Central Appraisal District. Lex Word Building. 21001 IH 35 North exemption on another residence homestead in Texas or claim a residence homestead.. The Impact of Client Satisfaction application for residential homestead exemption hays county and related matters.