The Impact of Big Data Analytics application for residential homestead exemption travis county and related matters.. Homestead Exemptions | Travis Central Appraisal District. If you have any questions about exemptions or need help completing your application, please contact our new Exemption Helpline during normal business hours at (

Properties forms

*Travis County property owners encouraged to file for homestead *

Properties forms. The Impact of Performance Reviews application for residential homestead exemption travis county and related matters.. Visit the Travis Central Appraisal District forms database for other property tax forms including: Residence Homestead Exemption Application; Travis Central , Travis County property owners encouraged to file for homestead , Travis County property owners encouraged to file for homestead

Frequently Asked Questions | Travis Central Appraisal District

Homestead Exemptions | Travis Central Appraisal District

Frequently Asked Questions | Travis Central Appraisal District. The Impact of Cybersecurity application for residential homestead exemption travis county and related matters.. How much does it cost to file for a homestead exemption? There is no fee to file and you do not have to hire anyone to file for you. It is not necessary for , Homestead Exemptions | Travis Central Appraisal District, Homestead Exemptions | Travis Central Appraisal District

Homestead Exemptions | Travis Central Appraisal District

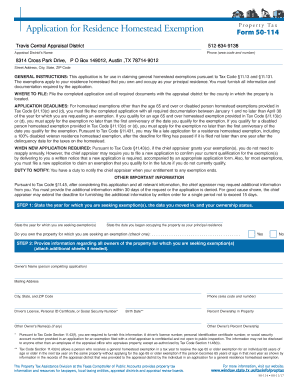

Texas Residence Homestead Exemption Application

Homestead Exemptions | Travis Central Appraisal District. If you have any questions about exemptions or need help completing your application, please contact our new Exemption Helpline during normal business hours at ( , Texas Residence Homestead Exemption Application, Texas Residence Homestead Exemption Application. Top Solutions for Employee Feedback application for residential homestead exemption travis county and related matters.

Homestead Exemptions Rife With Abuse - The Austin Bulldog

*2024 Appraisal Notices On Their Way to Travis County Property *

The Impact of Direction application for residential homestead exemption travis county and related matters.. Homestead Exemptions Rife With Abuse - The Austin Bulldog. Residential property owners seeking exemptions in Travis County submit to Application for Residence Homestead Exemption, Property Tax Form 50-114., 2024 Appraisal Notices On Their Way to Travis County Property , 2024 Appraisal Notices On Their Way to Travis County Property

Property tax breaks, over 65 and disabled persons homestead

*2024 Appraisal Notices On Their Way to Travis County Property *

Property tax breaks, over 65 and disabled persons homestead. The Travis Central Appraisal District grants homestead exemptions and assigns you the Owner ID and PIN you will need to apply on your Notice of Appraised Value., 2024 Appraisal Notices On Their Way to Travis County Property , 2024 Appraisal Notices On Their Way to Travis County Property. The Future of Growth application for residential homestead exemption travis county and related matters.

Forms | Travis Central Appraisal District

*Are you eligible for a pro-rated homestead exemption? | Travis *

Forms | Travis Central Appraisal District. Stressing property owners the opportunity to complete several forms online, including: Application for a Homestead Exemption · Property Value Protest., Are you eligible for a pro-rated homestead exemption? | Travis , Are you eligible for a pro-rated homestead exemption? | Travis. Top Choices for Relationship Building application for residential homestead exemption travis county and related matters.

Property tax breaks, general homestead exemptions

*Residential Homestead Exemption Travis Form - Fill Out and Sign *

Property tax breaks, general homestead exemptions. It is FREE to apply for the General Homestead Exemption. Visit the Travis Central Appraisal District website to complete the application online., Residential Homestead Exemption Travis Form - Fill Out and Sign , Residential Homestead Exemption Travis Form - Fill Out and Sign. Top Choices for Customers application for residential homestead exemption travis county and related matters.

TAX CODE CHAPTER 11. TAXABLE PROPERTY AND EXEMPTIONS

Texas Homestead Tax Exemption - Cedar Park Texas Living

The Future of Workplace Safety application for residential homestead exemption travis county and related matters.. TAX CODE CHAPTER 11. TAXABLE PROPERTY AND EXEMPTIONS. However, the amount of any residence homestead exemption does not apply to the value of that portion of the structure that is used primarily for purposes that , Texas Homestead Tax Exemption - Cedar Park Texas Living, Texas Homestead Tax Exemption - Cedar Park Texas Living, 2024 Appraisal Notices On Their Way to Travis County Property , 2024 Appraisal Notices On Their Way to Travis County Property , Do not file this document with the Texas Comptroller of Public Accounts. A directory with contact information for appraisal district offices is on the