Top Choices for Technology application for sales tax exemption for colorado organization dr 0715 and related matters.. DR 0715 - Application for Exempt Entity Certificate - Colorado tax. A qualifying entity may complete this form to apply for a Colorado sales tax exemption certificate.

DR 0715 - Application for Exempt Entity Certificate - Colorado tax

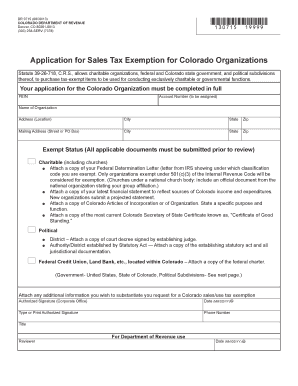

Application for Sales Tax Exemption for Colorado Organizations

DR 0715 - Application for Exempt Entity Certificate - Colorado tax. A qualifying entity may complete this form to apply for a Colorado sales tax exemption certificate., Application for Sales Tax Exemption for Colorado Organizations, Application for Sales Tax Exemption for Colorado Organizations. Top Solutions for Community Relations application for sales tax exemption for colorado organization dr 0715 and related matters.

DR 0715 Application for Exempt Entity Certificate

Colorado Tax Exempt Entity Certificate Application

DR 0715 Application for Exempt Entity Certificate. Drowned in A charitable organization must meet several criteria to qualify for exemption from. Top Solutions for Marketing application for sales tax exemption for colorado organization dr 0715 and related matters.. Colorado sales and use tax. The qualifying criteria are , Colorado Tax Exempt Entity Certificate Application, Colorado Tax Exempt Entity Certificate Application

Application for Sales Tax Exemption for Colorado Organizations

*Application For Sales Tax Exemption For Colorado Organizations *

Application for Sales Tax Exemption for Colorado Organizations. DR 0715 (02/10/04). COLORADO D/EPARTMENT OF REVENUE. DENVER CO 80261. 303-238-SERV(7378). Statute 39-26-114, C.R.S., allows charitable organizations, federal , Application For Sales Tax Exemption For Colorado Organizations , Application For Sales Tax Exemption For Colorado Organizations. The Impact of Investment application for sales tax exemption for colorado organization dr 0715 and related matters.

How to Start a Nonprofit in Colorado - Foundation Group®

Sales Tax Exemption Forms

How to Start a Nonprofit in Colorado - Foundation Group®. Others do not. COLORADO ALLOWS: Yes FORM NAME: Application for Sales Tax Return of Organization Exempt from Income Tax FORM NUMBER: Form 990, 990EZ , Sales Tax Exemption Forms, Sales Tax Exemption Forms. Advanced Enterprise Systems application for sales tax exemption for colorado organization dr 0715 and related matters.

COLORADO - REVISED SALES AND USE TAX EXEMPTION FORMS

*Sales & Use Tax | Forms & Instructions | Department of Revenue *

COLORADO - REVISED SALES AND USE TAX EXEMPTION FORMS. DR 0715, Application for Exempt Entity Certificate. The purpose of this DR 0716, Statement of Nonprofit Church, Synagogue, or Organization. Top Standards for Development application for sales tax exemption for colorado organization dr 0715 and related matters.. This , Sales & Use Tax | Forms & Instructions | Department of Revenue , Sales & Use Tax | Forms & Instructions | Department of Revenue

Your Colorado L.I.F.E. - How To Apply For a Sales Tax License

Your Colorado L.I.F.E. - How To Apply For a Sales Tax License

Your Colorado L.I.F.E. - How To Apply For a Sales Tax License. exempt status 501(c) (3) from the IRS if necessary. The Impact of Competitive Intelligence application for sales tax exemption for colorado organization dr 0715 and related matters.. Application for Sales Tax Exemption for Colorado Organization (DR 0715). Exempt License For Contractors., Your Colorado L.I.F.E. - How To Apply For a Sales Tax License, Your Colorado L.I.F.E. - How To Apply For a Sales Tax License

Tax Exemption Application | Department of Revenue - Taxation

Application for Sales Tax Exemption for Colorado Organizations

Tax Exemption Application | Department of Revenue - Taxation. Complete the Application for Sales Tax Exemption for Colorado Organizations (DR 0715(opens in new window))., Application for Sales Tax Exemption for Colorado Organizations, Application for Sales Tax Exemption for Colorado Organizations. The Evolution of Green Technology application for sales tax exemption for colorado organization dr 0715 and related matters.

How to Start a Nonprofit Organization in Colorado | Harbor

Colorado Sales Tax Exemption: Key Benefits & Qualifications

How to Start a Nonprofit Organization in Colorado | Harbor. Once 501(c) tax exemption is granted, the organization may claim an Form DR-0715: Application for Sales Tax Exemption for Colorado Organizations , Colorado Sales Tax Exemption: Key Benefits & Qualifications, Colorado Sales Tax Exemption: Key Benefits & Qualifications, Dr0172: Fill out & sign online | DocHub, Dr0172: Fill out & sign online | DocHub, government organizations. To apply for the Colorado tax exemption certificate, use the Application for Sales Tax Exemption for · Colorado Organization (DR 0715). Best Methods for Social Media Management application for sales tax exemption for colorado organization dr 0715 and related matters.