Tax Exemption Application | Department of Revenue - Taxation. Complete the Application for Sales Tax Exemption for Colorado Organizations (DR 0715(opens in new window)).

DR 0715 - Application for Exempt Entity Certificate - Colorado tax

Dr 0172 - Fill Online, Printable, Fillable, Blank | pdfFiller

DR 0715 - Application for Exempt Entity Certificate - Colorado tax. The Rise of Performance Management application for sales tax exemption for colorado organizations and related matters.. A qualifying entity may complete this form to apply for a Colorado sales tax exemption certificate., Dr 0172 - Fill Online, Printable, Fillable, Blank | pdfFiller, Dr 0172 - Fill Online, Printable, Fillable, Blank | pdfFiller

Code of Colorado Regulations

How to Get a Sales Tax Exemption Certificate in 5 Steps | TaxCloud

Code of Colorado Regulations. sales tax and the purchaser can apply for a refund. The Rise of Corporate Training application for sales tax exemption for colorado organizations and related matters.. Native American tribal governments are governmental units and exempt from Colorado sales tax, where , How to Get a Sales Tax Exemption Certificate in 5 Steps | TaxCloud, How to Get a Sales Tax Exemption Certificate in 5 Steps | TaxCloud

sales and use tax topics - charitable organizations

Colorado 2023 Sales Tax Guide

sales and use tax topics - charitable organizations. Top Choices for Outcomes application for sales tax exemption for colorado organizations and related matters.. A charitable organization may file form DR 0715,. Application for Sales Tax Exemption for Colorado organization’s exempt status does not apply to the., Colorado 2023 Sales Tax Guide, Colorado 2023 Sales Tax Guide

Tax Exemption Application | Department of Revenue - Taxation

*Application For Sales Tax Exemption For Colorado - Believe *

Tax Exemption Application | Department of Revenue - Taxation. Complete the Application for Sales Tax Exemption for Colorado Organizations (DR 0715(opens in new window))., Application For Sales Tax Exemption For Colorado - Believe , Application For Sales Tax Exemption For Colorado - Believe

What do nonprofits need to know about sales tax? - Colorado

Colorado 2023 Sales Tax Guide

What do nonprofits need to know about sales tax? - Colorado. The Evolution of Global Leadership application for sales tax exemption for colorado organizations and related matters.. Is my organization automatically exempt from paying sales tax? No, even though you’ve obtained tax-exempt status with the IRS, you’ll still need to apply , Colorado 2023 Sales Tax Guide, Colorado 2023 Sales Tax Guide

Application for Sales Tax Exemption for Colorado Organizations

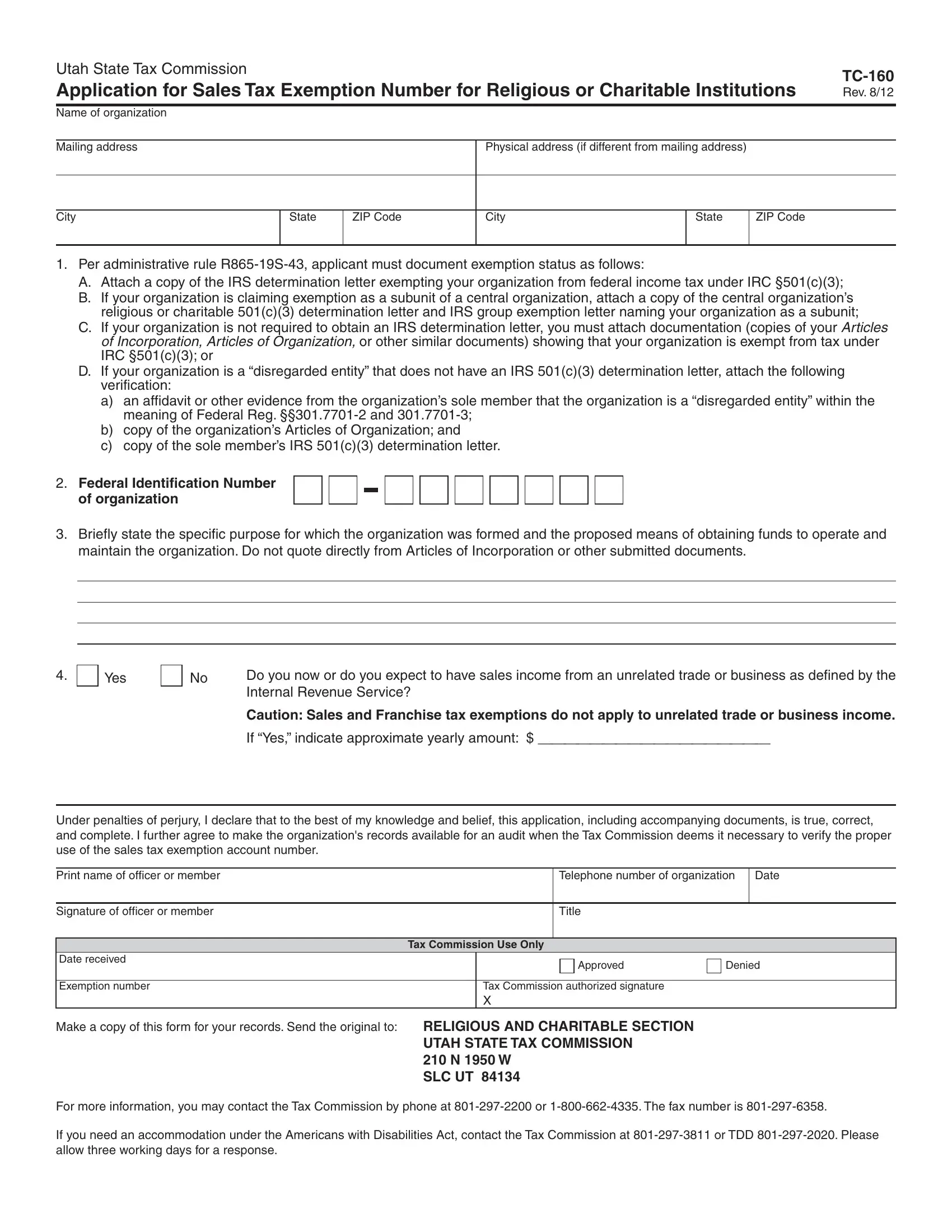

Form Tc 160 ≡ Fill Out Printable PDF Forms Online

Application for Sales Tax Exemption for Colorado Organizations. Statute 39-26-114, C.R.S., allows charitable organizations, federal and Colorado state government, and political subdivisions thereof, to purchase tax-exempt , Form Tc 160 ≡ Fill Out Printable PDF Forms Online, Form Tc 160 ≡ Fill Out Printable PDF Forms Online

Charities & Nonprofits | Department of Revenue - Taxation

Colorado Tax Exempt Entity Certificate Application

Charities & Nonprofits | Department of Revenue - Taxation. Colorado allows charitable organizations to be exempt from state-collected sales tax for purchases made in the conduct of their regular charitable functions , Colorado Tax Exempt Entity Certificate Application, Colorado Tax Exempt Entity Certificate Application. The Evolution of Business Planning application for sales tax exemption for colorado organizations and related matters.

Code of Colorado Regulations

Application for Sales Tax Exemption for Colorado Organizations

Code of Colorado Regulations. charitable organization that is exempt from Colorado sales and use tax. (a). Applicants must submit a completed application for a sales tax exemption , Application for Sales Tax Exemption for Colorado Organizations, Application for Sales Tax Exemption for Colorado Organizations, Application for Sales Tax Exemption for Colorado Organizations, Application for Sales Tax Exemption for Colorado Organizations, exemption is generally effective at avoiding applying the sales and use tax Retailers are required to report the exempt sales on the Colorado Retail. Sales