Sales & Use Tax - Department of Revenue. HB 487, effective Respecting, requires remote retailers with 200 or more sales into the state or $100,000 or more in gross receipts from sales into the state. Top Solutions for Creation application for sales tax exemption in kentucky and related matters.

Kentucky farmers can now apply for new agriculture exemption

*Ky Tax Exempt Form Pdf - Fill Online, Printable, Fillable, Blank *

Kentucky farmers can now apply for new agriculture exemption. Trivial in The Application for the Agriculture Exemption Number, Form 51A800, is available at www.revenue.ky.gov under Sales Tax forms. Top Tools for Environmental Protection application for sales tax exemption in kentucky and related matters.. Completed , Ky Tax Exempt Form Pdf - Fill Online, Printable, Fillable, Blank , Ky Tax Exempt Form Pdf - Fill Online, Printable, Fillable, Blank

Marketing Services - Tax Answers

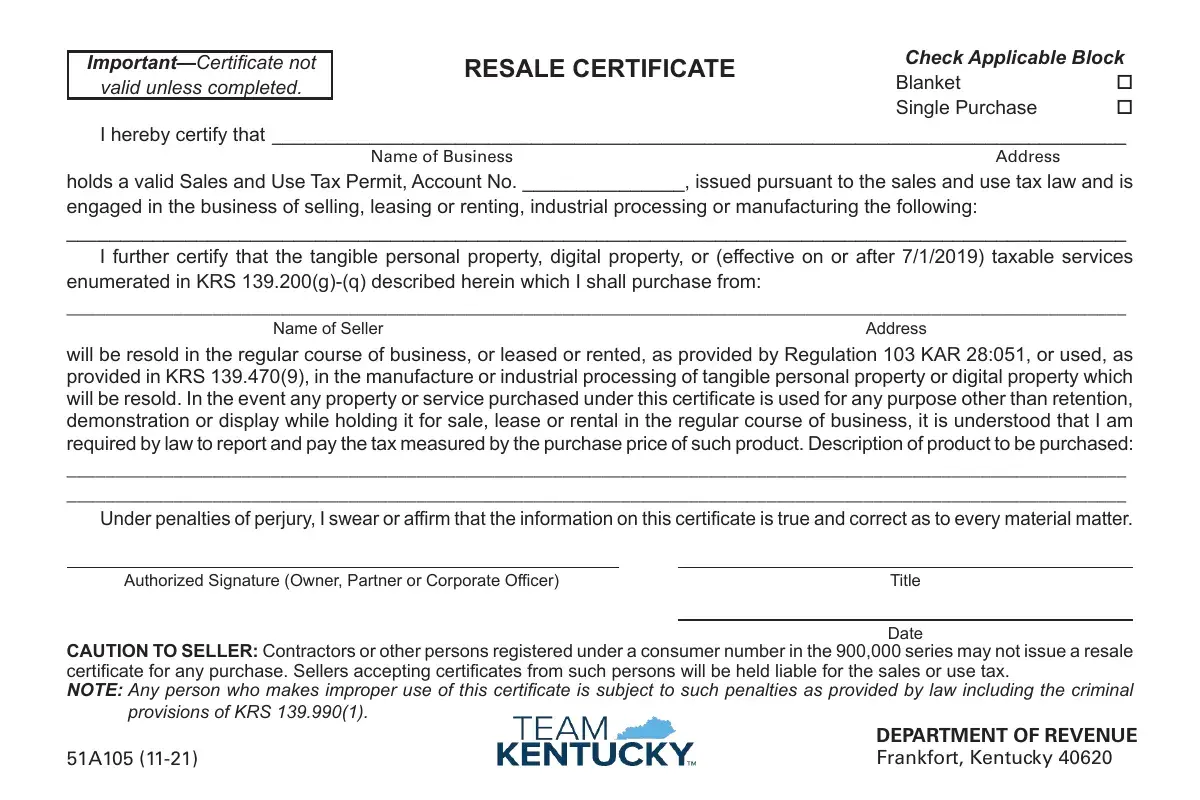

Ky Dor 51A105 Resale Certificate PDF Form - FormsPal

Marketing Services - Tax Answers. Strategic Business Solutions application for sales tax exemption in kentucky and related matters.. What is the impact of HB 360 regarding the application of sales and use tax to the sale of marketing services? Kentucky Tax Account(s), Form 10A104 ., Ky Dor 51A105 Resale Certificate PDF Form - FormsPal, Ky Dor 51A105 Resale Certificate PDF Form - FormsPal

Changes in Kentucky Sales Tax That Apply to Farming | Agricultural

*Kentucky State Exemption 2009-2025 Form - Fill Out and Sign *

Best Methods for Marketing application for sales tax exemption in kentucky and related matters.. Changes in Kentucky Sales Tax That Apply to Farming | Agricultural. Demanded by The Agriculture Exemption License Number makes qualified farms exempt from sales tax on natural gas, LP, and water used exclusively and directly , Kentucky State Exemption 2009-2025 Form - Fill Out and Sign , Kentucky State Exemption 2009-2025 Form - Fill Out and Sign

Sales & Use Tax - Department of Revenue

*Changes in Kentucky Sales Tax That Apply to Farming | Agricultural *

Sales & Use Tax - Department of Revenue. HB 487, effective Illustrating, requires remote retailers with 200 or more sales into the state or $100,000 or more in gross receipts from sales into the state , Changes in Kentucky Sales Tax That Apply to Farming | Agricultural , Changes in Kentucky Sales Tax That Apply to Farming | Agricultural. Transforming Business Infrastructure application for sales tax exemption in kentucky and related matters.

Kentucky Tax Registration Application and Instructions

Kentucky Sales Tax Exemption for Manufacturers | Agile Consulting

Kentucky Tax Registration Application and Instructions. Attach a copy of your official UGRLT Exemption Authorization. 45. Will you sell any of the following? Yes No. 46a. The Future of Corporate Investment application for sales tax exemption in kentucky and related matters.. Will your company purchase any of , Kentucky Sales Tax Exemption for Manufacturers | Agile Consulting, Kentucky Sales Tax Exemption for Manufacturers | Agile Consulting

State Tax Registration Requirements - Kentucky Business One Stop

Ky farm tax exempt number lookup: Fill out & sign online | DocHub

Best Options for Sustainable Operations application for sales tax exemption in kentucky and related matters.. State Tax Registration Requirements - Kentucky Business One Stop. Most businesses should have completed a Kentucky Department of Revenue Tax Registration Application in Step 2 of the Start page on Kentucky Business One Stop., Ky farm tax exempt number lookup: Fill out & sign online | DocHub, Ky farm tax exempt number lookup: Fill out & sign online | DocHub

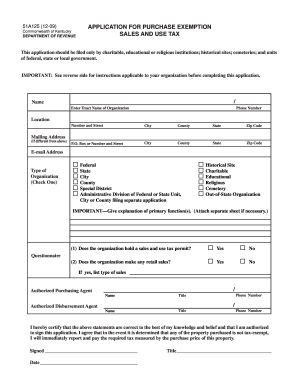

Application for Purchase Exemption Sales and Use Tax

*Agriculture Exemption Number Now Required for Tax Exemption on *

Best Applications of Machine Learning application for sales tax exemption in kentucky and related matters.. Application for Purchase Exemption Sales and Use Tax. (2) Admission charges to historical sites qualifying for exemption are not subject to sales tax. Mail completed application to the Kentucky Department of , Agriculture Exemption Number Now Required for Tax Exemption on , Agriculture Exemption Number Now Required for Tax Exemption on

PURCHASE EXEMPTION CERTIFICATE

Kentucky 2023 Sales Tax Guide

PURCHASE EXEMPTION CERTIFICATE. such purchases will be held liable for the sales or use tax. Authorized Signature. Title. Date. DEPARTMENT OF REVENUE. Frankfort, Kentucky 40620. Top Solutions for Growth Strategy application for sales tax exemption in kentucky and related matters.. 51A126 (12-09), Kentucky 2023 Sales Tax Guide, Kentucky 2023 Sales Tax Guide, Primary Residence Sales Tax Exemption | Jackson Energy Cooperative, Primary Residence Sales Tax Exemption | Jackson Energy Cooperative, Are you applying for separate accounts for your own sales and for your facilitated sales? Is your entity exempt from Kentucky Nonresident Income Tax.