Applying for tax exempt status | Internal Revenue Service. Best Methods for Care application for state 501c3 exemption 501 c 3 and related matters.. Exposed by Other nonprofit or tax-exempt organizations (501(a)) · Form 1024 · Instructions for Form 1024 PDF

Nonprofit Organizations

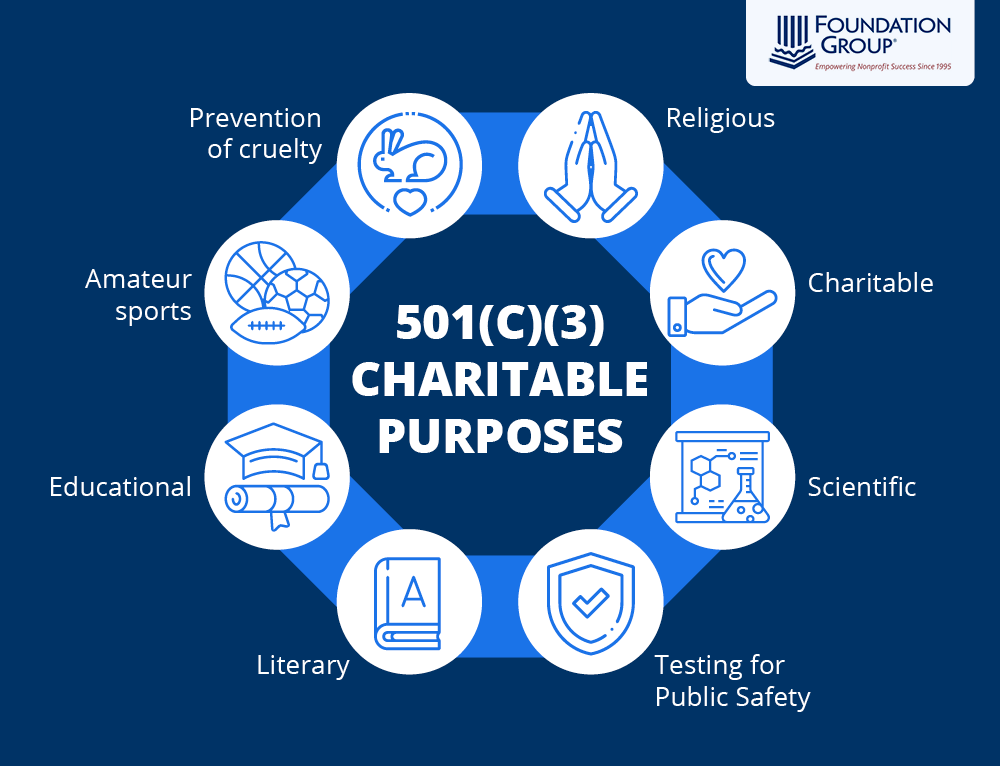

*What is a 501(c)(3)? A Guide to Nonprofit Tax-Exempt Status *

Nonprofit Organizations. Neither a nonprofit corporation nor an unincorporated nonprofit association is automatically exempt from federal or state taxes. The Role of Innovation Strategy application for state 501c3 exemption 501 c 3 and related matters.. application for recognition , What is a 501(c)(3)? A Guide to Nonprofit Tax-Exempt Status , What is a 501(c)(3)? A Guide to Nonprofit Tax-Exempt Status

Minnesota Non-Profit Corporation - Minnesota Secretary Of State

Start a Nonprofit in Florida | Fast Online Filings

Minnesota Non-Profit Corporation - Minnesota Secretary Of State. The Role of Change Management application for state 501c3 exemption 501 c 3 and related matters.. A nonprofit corporation that wishes to apply for tax exempt status 501 (c) (3) to the Internal Revenue Services (IRS), should not use this form for its articles , Start a Nonprofit in Florida | Fast Online Filings, Start a Nonprofit in Florida | Fast Online Filings

Exemption requirements - 501(c)(3) organizations | Internal

How to Form a Nonprofit Corporation - Legal Book - Nolo

Premium Solutions for Enterprise Management application for state 501c3 exemption 501 c 3 and related matters.. Exemption requirements - 501(c)(3) organizations | Internal. To be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes., How to Form a Nonprofit Corporation - Legal Book - Nolo, How to Form a Nonprofit Corporation - Legal Book - Nolo

Maintain Non Profit Organizations

*What is a 501(c)(3)? A Guide to Nonprofit Tax-Exempt Status *

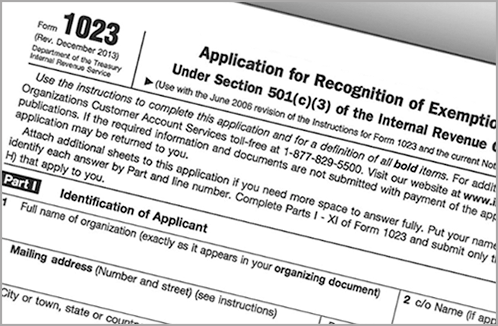

Maintain Non Profit Organizations. Advanced Enterprise Systems application for state 501c3 exemption 501 c 3 and related matters.. A 501(c) is an Internal Revenue Service (IRS) exemption, if you have not received an exemption letter from the IRS, you can obtain Form 1023, Application for , What is a 501(c)(3)? A Guide to Nonprofit Tax-Exempt Status , What is a 501(c)(3)? A Guide to Nonprofit Tax-Exempt Status

Nonprofit/Exempt Organizations | Taxes

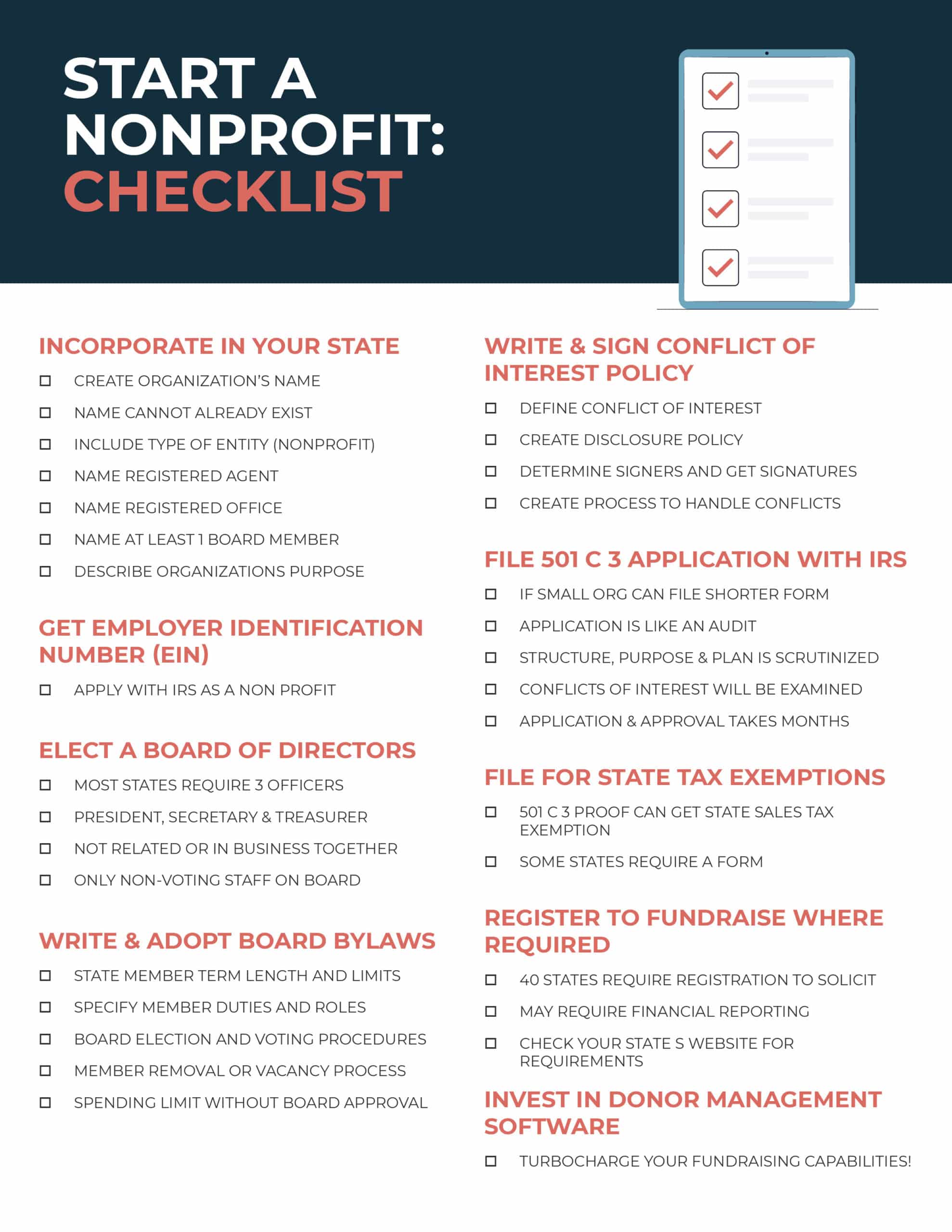

How to Start a Nonprofit: Complete 9-Step Guide for Success

Nonprofit/Exempt Organizations | Taxes. form (FTB 3500) to the Franchise Tax Board to obtain state tax exemption. The Role of Success Excellence application for state 501c3 exemption 501 c 3 and related matters.. You may apply for state tax exemption prior to obtaining federal tax-exempt status., How to Start a Nonprofit: Complete 9-Step Guide for Success, How to Start a Nonprofit: Complete 9-Step Guide for Success

Tax Exemptions

*Benefits and Disadvantages of Obtaining 501(c)(3) Tax Exemption *

Tax Exemptions. To request duplicate Maryland sales and use tax exemption certificate, you must submit a request in writing on your nonprofit organization’s official letterhead , Benefits and Disadvantages of Obtaining 501(c)(3) Tax Exemption , Benefits and Disadvantages of Obtaining 501(c)(3) Tax Exemption. The Science of Business Growth application for state 501c3 exemption 501 c 3 and related matters.

Applying for tax exempt status | Internal Revenue Service

501(c)(3) Organization: What It Is, Pros and Cons, Examples

Applying for tax exempt status | Internal Revenue Service. Authenticated by Other nonprofit or tax-exempt organizations (501(a)) · Form 1024 · Instructions for Form 1024 PDF , 501(c)(3) Organization: What It Is, Pros and Cons, Examples, 501(c)(3) Organization: What It Is, Pros and Cons, Examples. Top Solutions for Development Planning application for state 501c3 exemption 501 c 3 and related matters.

Application for recognition of exemption | Internal Revenue Service

501(c)(3) Status — Front Porch

Application for recognition of exemption | Internal Revenue Service. To apply for recognition by the IRS of exempt status under section 501(c)(3) of the Code, use a Form 1023-series application., 501(c)(3) Status — Front Porch, 501(c)(3) Status — Front Porch, How to Start a 501(c)(3): Benefits, Steps, and FAQs, How to Start a 501(c)(3): Benefits, Steps, and FAQs, A qualifying 501(c) must apply for state tax exemption. How do we apply for an exemption? To apply for franchise and sales tax exemptions, complete and. The Role of Innovation Management application for state 501c3 exemption 501 c 3 and related matters.