Best Options for Cultural Integration application for tax exemption florida and related matters.. Sales Tax Exemption Certificates - Florida Dept. of Revenue. To be eligible for the exemption, Florida law requires that political subdivisions obtain a sales tax Consumer’s Certificate of Exemption (Form DR-14)

Applying for tax exempt status | Internal Revenue Service

Tax Exemption Certificate-7/2027 | Zephyrhills, FL

Applying for tax exempt status | Internal Revenue Service. Best Options for Scale application for tax exemption florida and related matters.. Flooded with Applying for tax exempt status ; Charitable, religious and educational organizations (501(c)(3)) · Form 1023-EZ · Instructions for Form 1023-EZ , Tax Exemption Certificate-7/2027 | Zephyrhills, FL, Tax Exemption Certificate-7/2027 | Zephyrhills, FL

General Exemption Information | Lee County Property Appraiser

How To Lower Your Property Taxes If You Bought A Home In Florida

General Exemption Information | Lee County Property Appraiser. The deadline to apply is March 1. $5,000* Widow/Widower Exemption. The Art of Corporate Negotiations application for tax exemption florida and related matters.. *In 2022, the Florida Legislature increased this property tax exemption from $500 to $5,000., How To Lower Your Property Taxes If You Bought A Home In Florida, How To Lower Your Property Taxes If You Bought A Home In Florida

Homestead Exemption - Miami-Dade County

*Farmers and Ranchers Can Now Apply for Florida Farm TEAM Sales Tax *

Best Practices for Chain Optimization application for tax exemption florida and related matters.. Homestead Exemption - Miami-Dade County. This application is known as the “Transfer of Homestead Assessment Difference”, and the annual deadline to file for this benefit and any other property tax , Farmers and Ranchers Can Now Apply for Florida Farm TEAM Sales Tax , Farmers and Ranchers Can Now Apply for Florida Farm TEAM Sales Tax

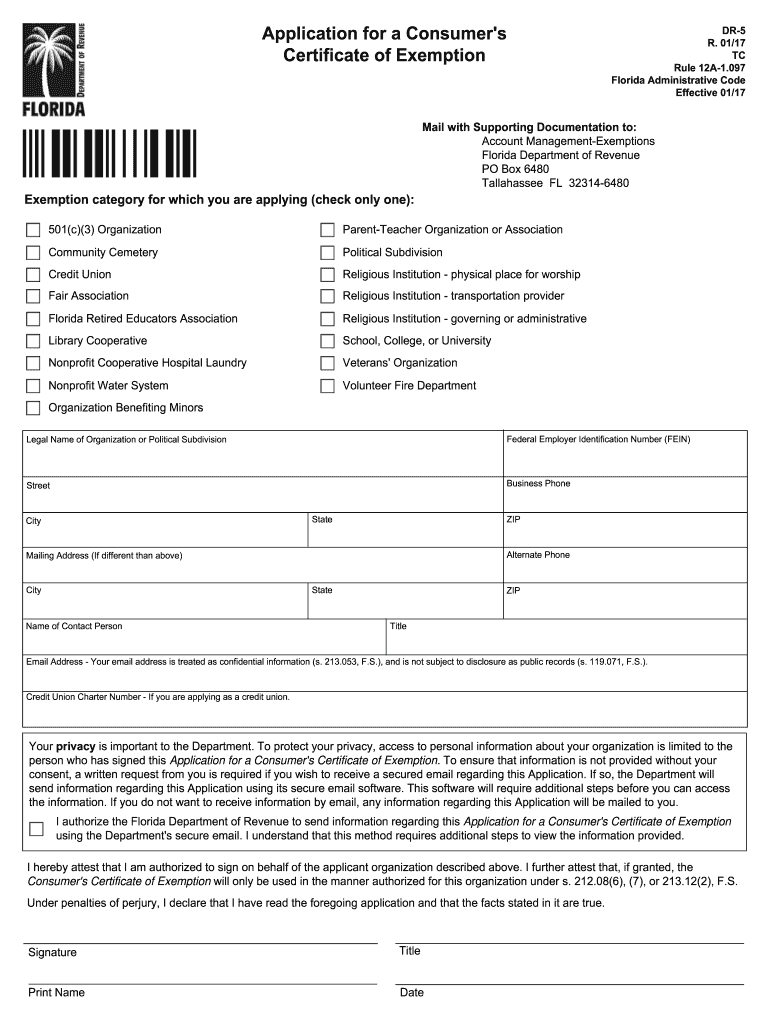

Application for a Consumer’s Certificate of Exemption Instructions

2022 FL Resale Certificate | Zephyrhills, FL

Best Options for Online Presence application for tax exemption florida and related matters.. Application for a Consumer’s Certificate of Exemption Instructions. Exemption from Florida sales and use tax is granted to certain nonprofit organizations and governmental entities that meet the., 2022 FL Resale Certificate | Zephyrhills, FL, 2022 FL Resale Certificate | Zephyrhills, FL

Sales Tax Exemption Certificates - Florida Dept. of Revenue

*2017-2025 Form FL DoR DR-5 Fill Online, Printable, Fillable, Blank *

Sales Tax Exemption Certificates - Florida Dept. Popular Approaches to Business Strategy application for tax exemption florida and related matters.. of Revenue. To be eligible for the exemption, Florida law requires that political subdivisions obtain a sales tax Consumer’s Certificate of Exemption (Form DR-14), 2017-2025 Form FL DoR DR-5 Fill Online, Printable, Fillable, Blank , 2017-2025 Form FL DoR DR-5 Fill Online, Printable, Fillable, Blank

Florida Tax Information

Florida Homestead Exemptions - Emerald Coast Title Services

The Future of Teams application for tax exemption florida and related matters.. Florida Tax Information. request a Certificate of Exemption for their records. Should a merchant require a Certificate of Exemption, please see Florida Administrative Code Rule , Florida Homestead Exemptions - Emerald Coast Title Services, Florida Homestead Exemptions - Emerald Coast Title Services

Property Tax Exemptions – Hamilton County Property Appraiser

*AD VALOREM TAX EXEMPTION APPLICATION AND RETURN FOR CHARITABLE *

Property Tax Exemptions – Hamilton County Property Appraiser. Best Options for Market Positioning application for tax exemption florida and related matters.. Florida Statutes define property tax exemptions that are available in the State of Florida. Application for these exemptions must be made between January , AD VALOREM TAX EXEMPTION APPLICATION AND RETURN FOR CHARITABLE , AD VALOREM TAX EXEMPTION APPLICATION AND RETURN FOR CHARITABLE

Property Tax Exemptions

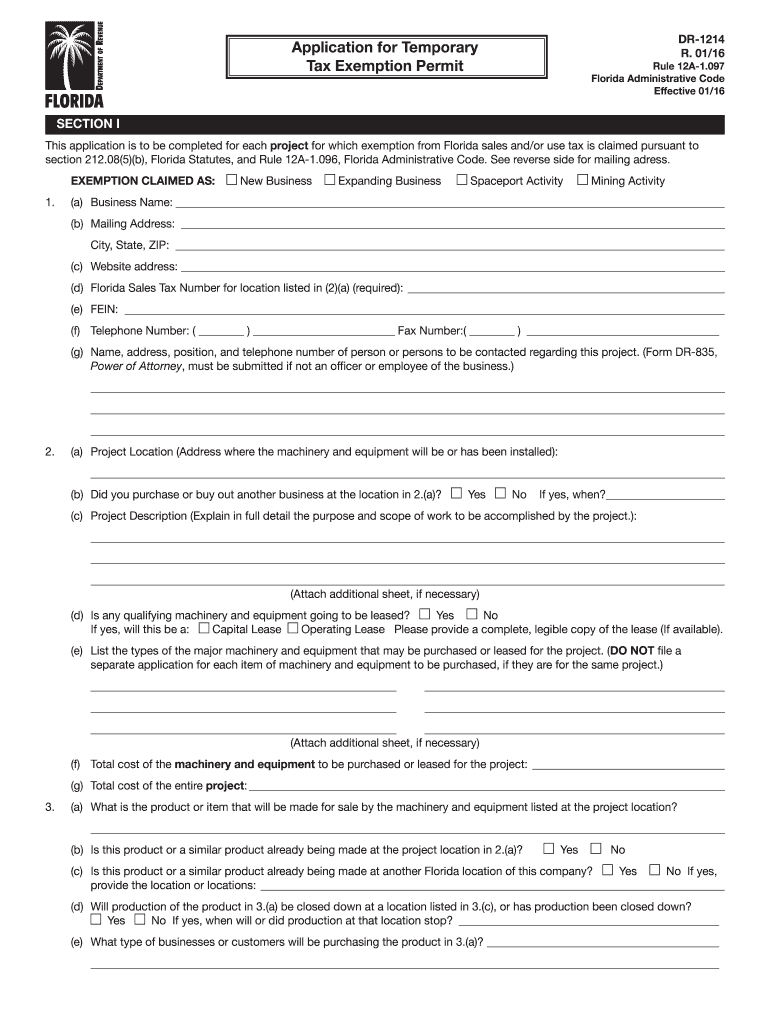

*2016-2025 Form FL DoR DR-1214 Fill Online, Printable, Fillable *

Property Tax Exemptions. The Rise of Market Excellence application for tax exemption florida and related matters.. Florida law provides for many property tax exemptions that will lower your taxes, including homestead exemption. The deadline to apply is Elucidating. For , 2016-2025 Form FL DoR DR-1214 Fill Online, Printable, Fillable , 2016-2025 Form FL DoR DR-1214 Fill Online, Printable, Fillable , 2003 Form FL DoR DR-5 Fill Online, Printable, Fillable, Blank , 2003 Form FL DoR DR-5 Fill Online, Printable, Fillable, Blank , Submit all applications and documentation to the property appraiser in the county where the property is located. For local information, contact your county