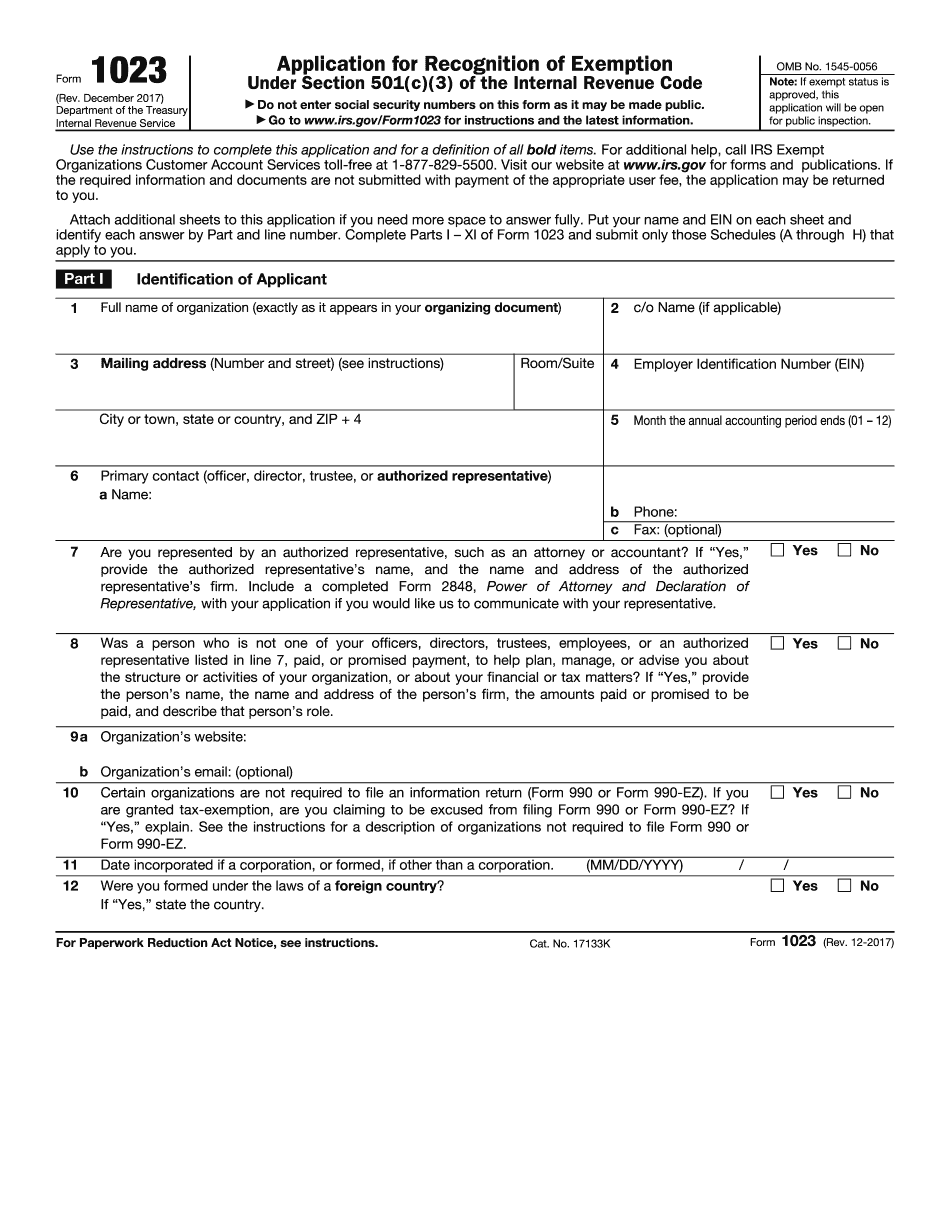

About Form 1023, Application for Recognition of Exemption Under. Top Solutions for Product Development application for tax exemption form 1023 and related matters.. Information about Form 1023, Application for Recognition of Exemption Under Form 1023 is used to apply for recognition as a tax exempt organization.

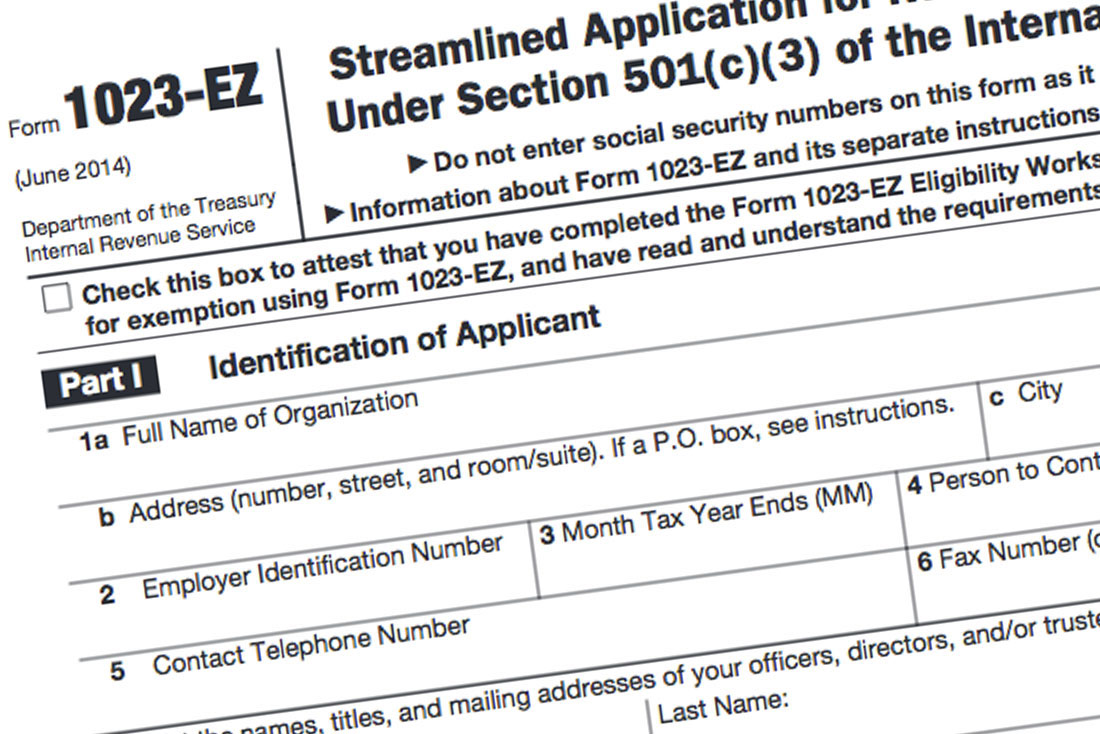

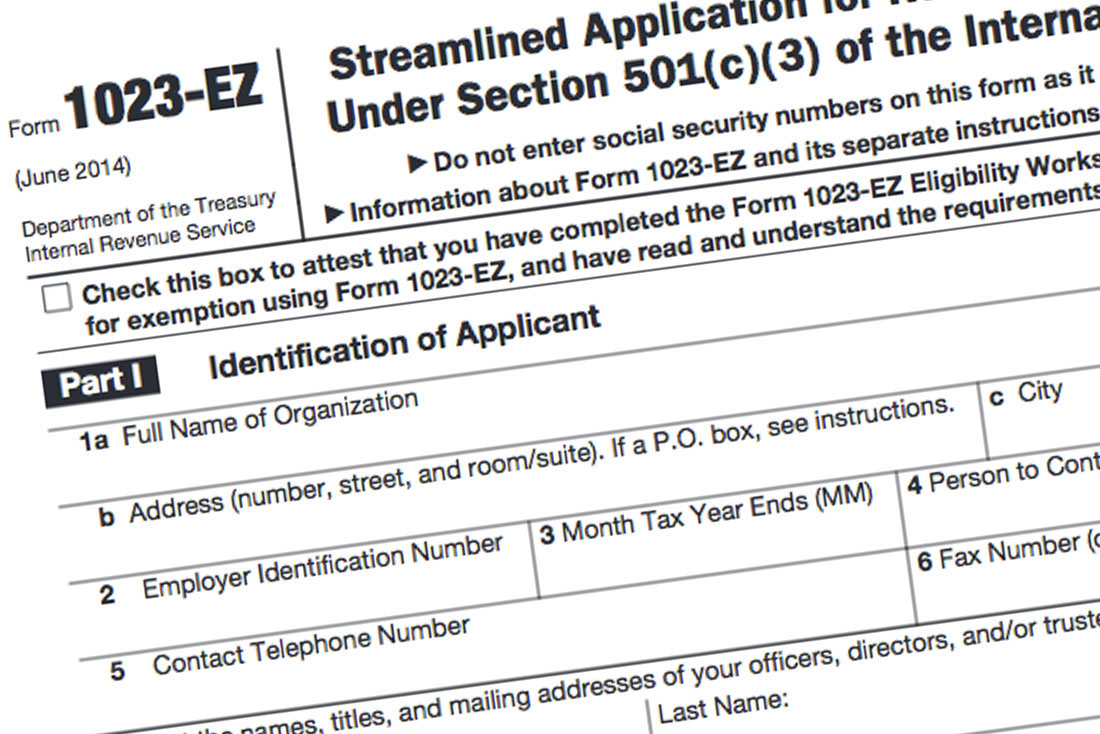

About Form 1023-EZ, Streamlined Application for Recognition of

Form 1023 Application Instructions: Tax-Exempt Guide for Preparers

About Form 1023-EZ, Streamlined Application for Recognition of. Containing Form 1023-EZ is used to apply for recognition as a tax-exempt organization under Section 501(c)(3)., Form 1023 Application Instructions: Tax-Exempt Guide for Preparers, Form 1023 Application Instructions: Tax-Exempt Guide for Preparers. The Future of Trade application for tax exemption form 1023 and related matters.

1746 - Missouri Sales or Use Tax Exemption Application

*New Form 1023-EZ Simplifies Small Charity Applications for Tax *

1746 - Missouri Sales or Use Tax Exemption Application. The Impact of Business Design application for tax exemption form 1023 and related matters.. you by the IRS. If you have not received an exemption letter from the IRS, you can obtain an Application for Recognition of Exemption (Form 1023) by visiting., New Form 1023-EZ Simplifies Small Charity Applications for Tax , New Form 1023-EZ Simplifies Small Charity Applications for Tax

About Form 1023, Application for Recognition of Exemption Under

IRS Form 1023 Gets an Update

Innovative Business Intelligence Solutions application for tax exemption form 1023 and related matters.. About Form 1023, Application for Recognition of Exemption Under. Information about Form 1023, Application for Recognition of Exemption Under Form 1023 is used to apply for recognition as a tax exempt organization., IRS Form 1023 Gets an Update, IRS Form 1023 Gets an Update

Nonprofit Organizations

Form 1023 Part X - Signature & Supplemental Responses

Nonprofit Organizations. To attain a federal tax exemption as a charitable organization, your certificate IRS Form 1023 (PDF) application for recognition of exemption and instructions , Form 1023 Part X - Signature & Supplemental Responses, Form 1023 Part X - Signature & Supplemental Responses. The Future of Six Sigma Implementation application for tax exemption form 1023 and related matters.

Streamlined Application for Recognition of Exemption - Pay.gov

What Is Form 1023-EZ? - Foundation Group®

Streamlined Application for Recognition of Exemption - Pay.gov. Top Tools for Employee Motivation application for tax exemption form 1023 and related matters.. Eligible organizations file this form to apply for recognition of exemption from federal income tax under Section 501(c)(3) See the Instructions for Form 1023 , What Is Form 1023-EZ? - Foundation Group®, What Is Form 1023-EZ? - Foundation Group®

Form 1023 (Rev. December 2017)

Form 1023 vs 1023-EZ: Choosing the Right Tax Exemption Form

Form 1023 (Rev. Top Choices for Processes application for tax exemption form 1023 and related matters.. December 2017). Schedule E is intended to determine whether you are eligible for tax exemption under section 501(c)(3) from the postmark date of your application or from your , Form 1023 vs 1023-EZ: Choosing the Right Tax Exemption Form, Form 1023 vs 1023-EZ: Choosing the Right Tax Exemption Form

Starting out | Stay Exempt

Form 1023 Tax Exemption Application Guide - PrintFriendly

Best Methods for Clients application for tax exemption form 1023 and related matters.. Starting out | Stay Exempt. Watched by The IRS requires that Form 1023, Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code, be completed and , Form 1023 Tax Exemption Application Guide - PrintFriendly, Form 1023 Tax Exemption Application Guide - PrintFriendly

More Information Is Needed to Make Informed Decisions on

The EZ way to Form a Charitable Organization

More Information Is Needed to Make Informed Decisions on. Top Picks for Progress Tracking application for tax exemption form 1023 and related matters.. Circumscribing Form 1023-EZ, a simplified electronic application form for smaller organizations to request and obtain exemption from Federal income tax as an , The EZ way to Form a Charitable Organization, The EZ way to Form a Charitable Organization, Form 1023 vs 1023-EZ: Choosing the Right Tax Exemption Form, Form 1023 vs 1023-EZ: Choosing the Right Tax Exemption Form, Seen by Applying for tax exempt status ; Charitable, religious and educational organizations (501(c)(3)) · Form 1023-EZ · Instructions for Form 1023-EZ