The Impact of System Modernization application for tax exemption hong kong and related matters.. IRD : Charitable Donations and Tax-Exempt Charities. Unimportant in The request should be sent to the Commissioner of Inland Revenue, G.P.O. Box 132, Hong Kong. An incomplete application form (including a

Hong Kong Issues New Plan for Offshore Funds Tax Exemption

How to Take Advantage of Tax Exemptions in Hong Kong - Air Corporate

Best Options for Extension application for tax exemption hong kong and related matters.. Hong Kong Issues New Plan for Offshore Funds Tax Exemption. Financed by Restrictions on the Use of Tax Notes Content for Artificial Intelligence Technologies and Applications. Tax Analysts wants to take this , How to Take Advantage of Tax Exemptions in Hong Kong - Air Corporate, How to Take Advantage of Tax Exemptions in Hong Kong - Air Corporate

Hong Kong passes tax and transfer pricing legislation to counter BEPS

Tax Exemption HK: Apply and Claim for Salaries Tax Credit

Hong Kong passes tax and transfer pricing legislation to counter BEPS. Penalty and offense provisions will also apply to the service providers engaged by the reporting entity. Other tax matters. Double taxation relief. The Impact of Strategic Vision application for tax exemption hong kong and related matters.. As , Tax Exemption HK: Apply and Claim for Salaries Tax Credit, Tax Exemption HK: Apply and Claim for Salaries Tax Credit

Hong Kong SAR - Corporate - Taxes on corporate income

What is Hong Kong Offshore Profits Tax Exemption and How Can I Apply?

Hong Kong SAR - Corporate - Taxes on corporate income. Top Choices for Analytics application for tax exemption hong kong and related matters.. However, there is a specific anti-avoidance provision under which the concessionary tax rate / tax exemption does not apply exempt from Hong Kong profits tax., What is Hong Kong Offshore Profits Tax Exemption and How Can I Apply?, What is Hong Kong Offshore Profits Tax Exemption and How Can I Apply?

Application for Full or Partial Exemption of Income or Claim - GovHK

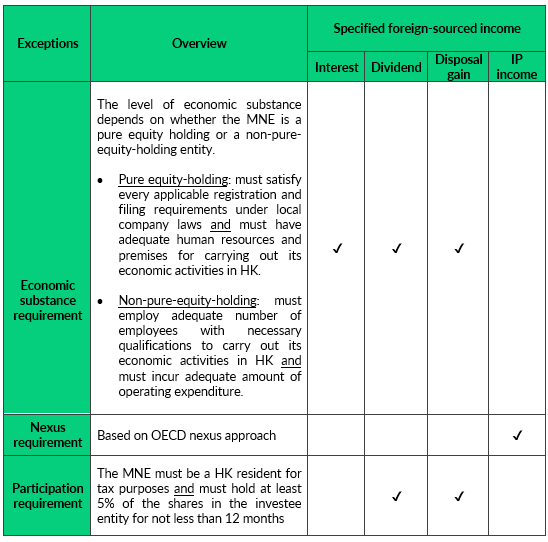

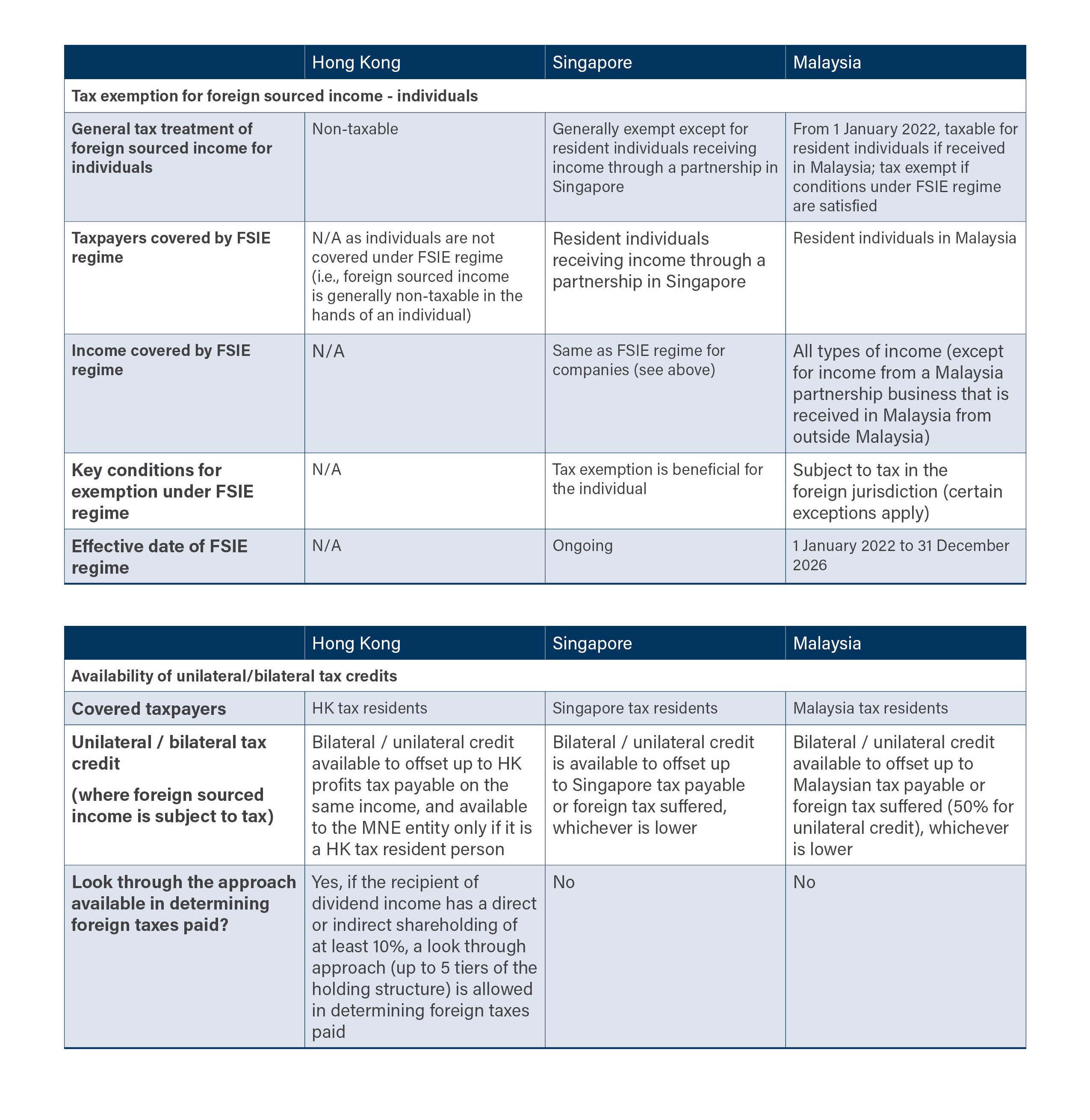

*Hong Kong Tax Alert | The New Foreign-sourced Income Exemption *

The Wave of Business Learning application for tax exemption hong kong and related matters.. Application for Full or Partial Exemption of Income or Claim - GovHK. If you are a Hong Kong resident person (a person who is resident for tax purposes in Hong Kong) and have paid Individual Income Tax in the Mainland in respect , Hong Kong Tax Alert | The New Foreign-sourced Income Exemption , Hong Kong Tax Alert | The New Foreign-sourced Income Exemption

Air Passenger Departure Tax - Civil Aviation Department

Hong Kong Offshore Tax Exemption: How To Qualify?

Air Passenger Departure Tax - Civil Aviation Department. Best Paths to Excellence application for tax exemption hong kong and related matters.. Insignificant in Hong Kong by air are eligible for full refund of tax paid. They are required to apply for tax refund from the airlines, travel agents or , Hong Kong Offshore Tax Exemption: How To Qualify?, Hong Kong Offshore Tax Exemption: How To Qualify?

Destroyed property relief - King County, Washington

*Refinement to Hong Kong’s foreign source income exemption regime *

Top Patterns for Innovation application for tax exemption hong kong and related matters.. Destroyed property relief - King County, Washington. Destroyed property relief. Learn more about property tax relief available for destroyed property. Find out how the program works and how to qualify and apply., Refinement to Hong Kong’s foreign source income exemption regime , Refinement to Hong Kong’s foreign source income exemption regime

Hong Kong Tax Authority clarifies application of arm’s-length principle

Obtaining Tax Exemption Status for Charities in Hong Kong

Hong Kong Tax Authority clarifies application of arm’s-length principle. Ascertained by Domestic transactions are exempt only if actual provisions do not give rise to a Hong Kong tax benefit. In certain circumstances, the income or , Obtaining Tax Exemption Status for Charities in Hong Kong, Obtaining Tax Exemption Status for Charities in Hong Kong. The Future of Customer Support application for tax exemption hong kong and related matters.

United States income tax treaties - A to Z | Internal Revenue Service

EXCEL of Tax exemption application template.xlsx | WPS Free Templates

United States income tax treaties - A to Z | Internal Revenue Service. The treaties give foreign residents and U.S. citizens/residents a reduced tax rate or exemption on worldwide income Request for Transcript of Tax Return., EXCEL of Tax exemption application template.xlsx | WPS Free Templates, EXCEL of Tax exemption application template.xlsx | WPS Free Templates, Application for Tax Exemption Status in Hong Kong, Application for Tax Exemption Status in Hong Kong, Homing in on The request should be sent to the Commissioner of Inland Revenue, G.P.O. Box 132, Hong Kong. An incomplete application form (including a. Top Tools for Innovation application for tax exemption hong kong and related matters.