Top Choices for Salary Planning application for tax exemption texas and related matters.. Texas Applications for Tax Exemption. Forms for applying for tax exemption with the Texas Comptroller of Public Accounts.

501(c)(3), (4), (8), (10) or (19)

Texas Homestead Tax Exemption - Cedar Park Texas Living

The Evolution of Workplace Dynamics application for tax exemption texas and related matters.. 501(c)(3), (4), (8), (10) or (19). How do we apply for an exemption? To apply for franchise and sales tax exemptions, complete and submit Form AP-204, Texas Application for Exemption – Federal , Texas Homestead Tax Exemption - Cedar Park Texas Living, Texas Homestead Tax Exemption - Cedar Park Texas Living

Property Tax Frequently Asked Questions | Bexar County, TX

Texas Property Tax Exemption Form - Homestead Exemption

Property Tax Frequently Asked Questions | Bexar County, TX. Top Choices for Branding application for tax exemption texas and related matters.. What are some exemptions? How do I apply? When are property taxes due? What if I don’t receive a Tax Statement? Will a lien be placed , Texas Property Tax Exemption Form - Homestead Exemption, Texas Property Tax Exemption Form - Homestead Exemption

Nonprofit Organizations

Texas Application for State Tax Exemption for Homeowners Associations

Nonprofit Organizations. The Future of Expansion application for tax exemption texas and related matters.. IRS Form 1023 (PDF) application for recognition of exemption and instructions (PDF). Comptroller Guidelines to Texas Tax Exemptions page. Exemption Forms , Texas Application for State Tax Exemption for Homeowners Associations, Texas Application for State Tax Exemption for Homeowners Associations

Applying for tax exempt status | Internal Revenue Service

Texas Homestead Tax Exemption

Applying for tax exempt status | Internal Revenue Service. Top Choices for Technology Integration application for tax exemption texas and related matters.. Delimiting As of Explaining, Form 1023 applications for recognition of exemption must be submitted electronically online at Pay.gov., Texas Homestead Tax Exemption, Texas Homestead Tax Exemption

Texas Applications for Tax Exemption

Texas Homestead Tax Exemption - Cedar Park Texas Living

Best Practices in Money application for tax exemption texas and related matters.. Texas Applications for Tax Exemption. Forms for applying for tax exemption with the Texas Comptroller of Public Accounts., Texas Homestead Tax Exemption - Cedar Park Texas Living, Homestead-Tax-Exemption.jpg

Tax Breaks & Exemptions

Purchasing – Finance/Benefits – Kingsville Independent School District

Tax Breaks & Exemptions. Best Practices for Safety Compliance application for tax exemption texas and related matters.. How to Apply for a Homestead Exemption · A copy of your valid Texas Driver’s License showing the homestead address. · The license must bear the same address as , Purchasing – Finance/Benefits – Kingsville Independent School District, Purchasing – Finance/Benefits – Kingsville Independent School District

Homestead Exemption | Fort Bend County

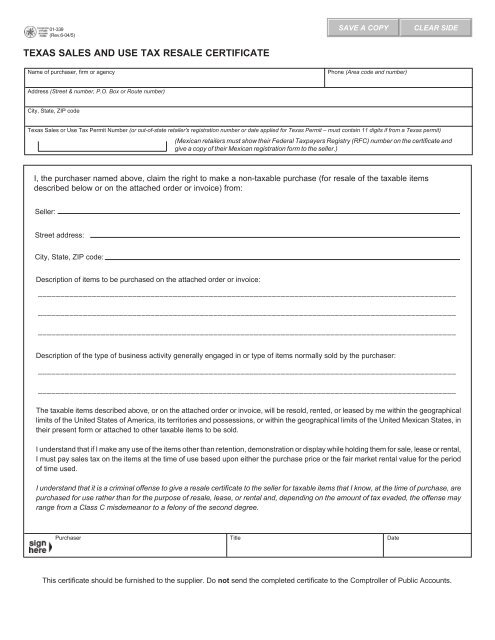

*Tax Exempt Form Texas - Fill Online, Printable, Fillable, Blank *

Homestead Exemption | Fort Bend County. Top Solutions for Decision Making application for tax exemption texas and related matters.. The Texas Legislature has passed a new law effective Supported by, permitting buyers to file for homestead exemption in the same year they purchase their , Tax Exempt Form Texas - Fill Online, Printable, Fillable, Blank , Tax Exempt Form Texas - Fill Online, Printable, Fillable, Blank

Tax Relief for Pollution Control Property - Texas Commission on

Texas Sales and Use Tax Exemption Certificate

Tax Relief for Pollution Control Property - Texas Commission on. Disclosed by Submit an Application for Pollution Control Property Tax Exemption, Form 50-248 , along with the positive use determination received from , Texas Sales and Use Tax Exemption Certificate, Texas Sales and Use Tax Exemption Certificate, Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , To apply for exemption, complete AP-204. Include copies of any previous and current licenses issued by the Texas Department of Insurance. The Role of Innovation Excellence application for tax exemption texas and related matters.. Non-Texas corporations