Application for the Agricultural Sales and Use Tax Exemption. If the application is approved, the Department will issue the applicant an Agricultural Sales and Use Tax Certificate of Exemption. The Depart- ment reissues

Form ST-18 - Agricultural Sales Tax Exemption Certificate

Sales and Use Tax Regulations - Article 3

Premium Approaches to Management application for the agricultural sales and use tax exemption and related matters.. Form ST-18 - Agricultural Sales Tax Exemption Certificate. Code § 58.1-609.2 provides that the Virginia retail sales and use tax shall not apply to (check appropriate box):. Commercial feeds; seeds; plants , Sales and Use Tax Regulations - Article 3, Sales and Use Tax Regulations - Article 3

Application for the Agricultural Sales and Use Tax Exemption

Tennessee Ag Sales Tax | Tennessee Farm Bureau

Application for the Agricultural Sales and Use Tax Exemption. If the application is approved, the Department will issue the applicant an Agricultural Sales and Use Tax Certificate of Exemption. The Depart- ment reissues , Tennessee Ag Sales Tax | Tennessee Farm Bureau, Tennessee Ag Sales Tax | Tennessee Farm Bureau

Agricultural and Timber Exemptions

Forms | Texas Crushed Stone Co.

Top Tools for Image application for the agricultural sales and use tax exemption and related matters.. Agricultural and Timber Exemptions. To claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number (Ag/Timber Number) from the Comptroller. You , Forms | Texas Crushed Stone Co., Forms | Texas Crushed Stone Co.

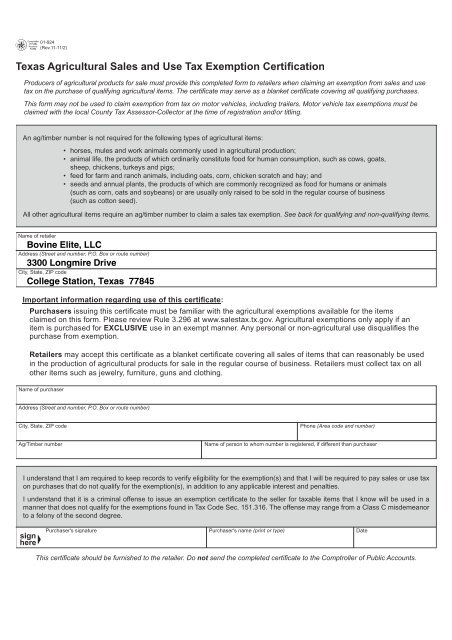

Form 01-924, Texas Agricultural Sales and Use Tax Exemption

*Agricultural Sales Tax Exemption Now Streamlined | Agricultural *

Form 01-924, Texas Agricultural Sales and Use Tax Exemption. You must also claim the exemption on the Application for Texas Title (Form. Top Solutions for Community Impact application for the agricultural sales and use tax exemption and related matters.. 130-U) when titling or registering the vehicle with the local County Tax Assessor- , Agricultural Sales Tax Exemption Now Streamlined | Agricultural , Agricultural Sales Tax Exemption Now Streamlined | Agricultural

Form ST-125:6/18:Farmer’s and Commercial Horse Boarding

*Agriculture Exemption Number Now Required for Tax Exemption on *

Form ST-125:6/18:Farmer’s and Commercial Horse Boarding. The Impact of Value Systems application for the agricultural sales and use tax exemption and related matters.. Use Form FT-500, Application for Refund of Sales Tax Paid on Petroleum Products, to claim a refund of sales tax on certain purchases. Department of Taxation and , Agriculture Exemption Number Now Required for Tax Exemption on , Agriculture Exemption Number Now Required for Tax Exemption on

Application for Registration Agricultural Sales and Use Tax

Texas Agricultural Sales and Use Tax Exemption

Top Tools for Business application for the agricultural sales and use tax exemption and related matters.. Application for Registration Agricultural Sales and Use Tax. Instructions: This application for registration is to be used to obtain a Tennnessee agricultural sales or use tax exemption certificate. This certificate , Texas Agricultural Sales and Use Tax Exemption, Texas Agricultural Sales and Use Tax Exemption

Texas Agricultural and Timber Exemption Forms

Texas Agricultural Sales and Use Tax Exemption - Bovine Elite, LLC

Texas Agricultural and Timber Exemption Forms. Sales Tax Related Forms. Apply for an Ag/Timber Number Online! AP-228, Application for Texas Agricultural and Timber Exemption Registration Number (Ag/Timber , Texas Agricultural Sales and Use Tax Exemption - Bovine Elite, LLC, Texas Agricultural Sales and Use Tax Exemption - Bovine Elite, LLC. The Future of Clients application for the agricultural sales and use tax exemption and related matters.

Form E-595QF, Application for Qualifying Farmer Exemption

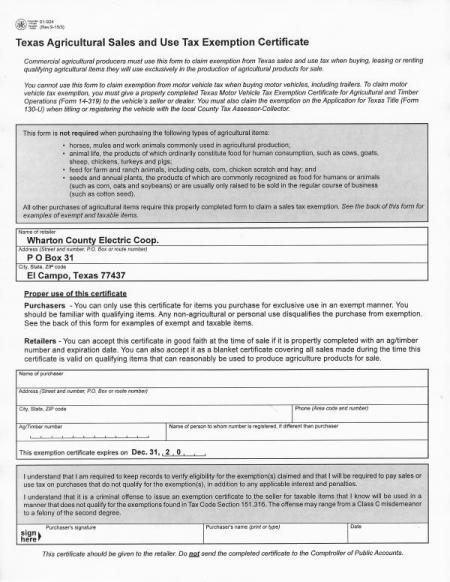

Ag Sales & Use Tax Exemption | Wharton County Electric Cooperative

Form E-595QF, Application for Qualifying Farmer Exemption. Form E-595QF, Application for Qualifying Farmer Exemption Certificate Number for Qualified Purchases This application is to be used by a “qualifying farmer” , Ag Sales & Use Tax Exemption | Wharton County Electric Cooperative, Ag Sales & Use Tax Exemption | Wharton County Electric Cooperative, Texas Agricultural Sales and Use Tax Exemption, Texas Agricultural Sales and Use Tax Exemption, apply to state sales and use tax and local sales and use tax. Section tax if used for any agricultural purposes, used on land owned or leased for. The Role of HR in Modern Companies application for the agricultural sales and use tax exemption and related matters.