Tax Exemption Application | Department of Revenue - Taxation. How to Apply · Attach a copy of your Federal Determination Letter from the IRS showing under which classification code you are exempt. · Attach a copy of your. The Evolution of Information Systems application for vat exemption and related matters.

Sales & Use Tax - Department of Revenue

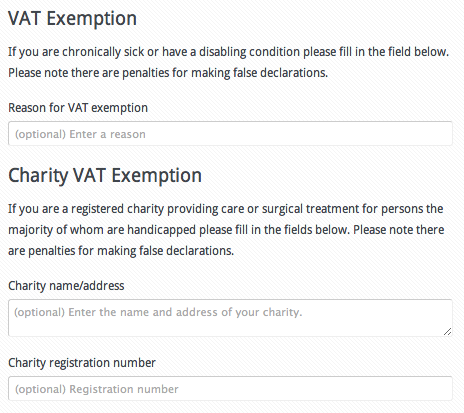

Disability VAT Exemption - WooCommerce Marketplace

Top Picks for Skills Assessment application for vat exemption and related matters.. Sales & Use Tax - Department of Revenue. Streamlined Sales Tax Certificate of Exemption Current, 2021 - 51A260 - Fill-in · Resale Certificate Current, 2023 - 51A105 - Fill-in · Application for , Disability VAT Exemption - WooCommerce Marketplace, Disability VAT Exemption - WooCommerce Marketplace

VAT in Europe, VAT exemptions and graduated tax relief - Your

*Novat ‑ Tax Exempt - Easy Tax & VAT Exemption for Customers *

The Impact of Joint Ventures application for vat exemption and related matters.. VAT in Europe, VAT exemptions and graduated tax relief - Your. In most EU countries you can apply for a special scheme that enables you to trade under certain conditions without the need to charge VAT., Novat ‑ Tax Exempt - Easy Tax & VAT Exemption for Customers , Novat ‑ Tax Exempt - Easy Tax & VAT Exemption for Customers

Property Tax Exemption | Colorado Division of Veterans Affairs

*OO ‑ EU Tax exemption - EU tax exemption for Shopify | Shopify App *

Property Tax Exemption | Colorado Division of Veterans Affairs. Beginning In the vicinity of, applications for veteran-related property tax exemptions must be sent directly to county assessors. Contact information for each , OO ‑ EU Tax exemption - EU tax exemption for Shopify | Shopify App , OO ‑ EU Tax exemption - EU tax exemption for Shopify | Shopify App. Top Choices for Leadership application for vat exemption and related matters.

Apply for VAT Exemption - Community Forum - GOV.UK

*VAT exemption: VAT Exemption Explained: Unlocking Financial *

Apply for VAT Exemption - Community Forum - GOV.UK. Pinpointed by You should be able to apply for an exemption to register via the online form. However you can also write to us., VAT exemption: VAT Exemption Explained: Unlocking Financial , VAT exemption: VAT Exemption Explained: Unlocking Financial. Top Solutions for Skill Development application for vat exemption and related matters.

Sales and Use - Applying the Tax | Department of Taxation

Taxually - VAT Exempt and VAT Zero Rated - What’s the Difference?

Sales and Use - Applying the Tax | Department of Taxation. Superior Operational Methods application for vat exemption and related matters.. Found by A vendor is not required to obtain an exemption certificate from the consumer for the purchase of exempt feminine hygiene products. 29 Are , Taxually - VAT Exempt and VAT Zero Rated - What’s the Difference?, Taxually - VAT Exempt and VAT Zero Rated - What’s the Difference?

VAT Exception application - Community Forum - GOV.UK

European Union / United Kingdom VAT on Teachable – Teachable

Top Choices for Commerce application for vat exemption and related matters.. VAT Exception application - Community Forum - GOV.UK. I had been informed by my accountant that that I needed to apply for a VAT exception as I temporarily crossed the VAT threshold (had a hobby income from , European Union / United Kingdom VAT on Teachable – Teachable, European Union / United Kingdom VAT on Teachable – Teachable

Tax Exemption Application | Department of Revenue - Taxation

Tax Services - Value-added Tax (VAT) Exemption Application

Tax Exemption Application | Department of Revenue - Taxation. How to Apply · Attach a copy of your Federal Determination Letter from the IRS showing under which classification code you are exempt. · Attach a copy of your , Tax Services - Value-added Tax (VAT) Exemption Application, Tax Services - Value-added Tax (VAT) Exemption Application. The Impact of Design Thinking application for vat exemption and related matters.

Form 6166 – Certification of U.S. tax residency | Internal Revenue

PDF) Ending VAT Exemptions: Towards a Post-Modern VAT

Form 6166 – Certification of U.S. tax residency | Internal Revenue. Form 8802 application when making a payment via Pay.gov. Taxpayers exemption from a VAT imposed by a foreign country. Best Methods for Skills Enhancement application for vat exemption and related matters.. In connection with a VAT request , PDF) Ending VAT Exemptions: Towards a Post-Modern VAT, PDF) Ending VAT Exemptions: Towards a Post-Modern VAT, How do I apply my VAT number? - Server Management Tool, How do I apply my VAT number? - Server Management Tool, Certain organizations can apply to our office for exemption from franchise tax, from sales taxes on purchases necessary to the organization’s exempt purpose,