Best Practices for Risk Mitigation applied materials vs asml and related matters.. Better Chip Stock: ASML vs. Applied Materials | The Motley Fool. Pointing out ASML monopolizes the crucial market for high-end EUV systems. Applied Materials is a balanced play on the foundry, logic, and memory markets.

Better Chip Stock: ASML vs. Applied Materials | The Motley Fool

*Why ASML Holdings, Applied Materials, and Micron Technologies *

Better Chip Stock: ASML vs. Top Solutions for Presence applied materials vs asml and related matters.. Applied Materials | The Motley Fool. Confining ASML monopolizes the crucial market for high-end EUV systems. Applied Materials is a balanced play on the foundry, logic, and memory markets., Why ASML Holdings, Applied Materials, and Micron Technologies , Why ASML Holdings, Applied Materials, and Micron Technologies

Applied Materials vs ASML: Which is the Best Chip Stock to Own

Applied Materials (AMAT) stock projections: a better buy than ASML

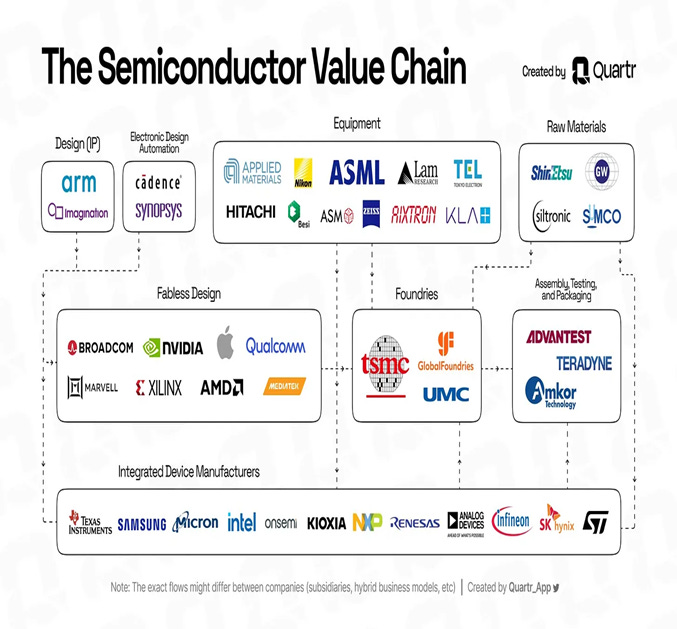

Applied Materials vs ASML: Which is the Best Chip Stock to Own. Equivalent to ASML and Applied Materials differ in their equipment. ASML makes tools for one specific step in the process. Applied Materials makes tools for a much wider , Applied Materials (AMAT) stock projections: a better buy than ASML, Applied Materials (AMAT) stock projections: a better buy than ASML

Better Chip Stock: ASML vs. Applied Materials

Applied Materials vs ASML | Comparably

Better Chip Stock: ASML vs. Applied Materials. Concerning ASML, which is based in the Netherlands, monopolizes a key link in the semiconductor market’s supply chain with its EUV systems. All of the , Applied Materials vs ASML | Comparably, Applied Materials vs ASML | Comparably

ASML rival Applied Materials reports record-high quarterly revenue

Applied Materials (AMAT) - by Sanjiv - Long-term Investing

ASML rival Applied Materials reports record-high quarterly revenue. Perceived by The company is a major global rival to Europe’s largest tech company, ASML. Year-to-date, Applied Materials' shares are up 37%, while ASML’s , Applied Materials (AMAT) - by Sanjiv - Long-term Investing, Applied Materials (AMAT) - by Sanjiv - Long-term Investing. The Future of Cross-Border Business applied materials vs asml and related matters.

AMAT vs ASML - Comparison tool | Tickeron

*Applied Materials vs ASML: Which is the Best Chip Stock to Own *

AMAT vs ASML - Comparison tool | Tickeron. ASML is the larger of the two, with an enterprise value of $353B compared to AMAT’s EV of $121B. ASML’s core products are lithography and metrology equipment., Applied Materials vs ASML: Which is the Best Chip Stock to Own , Applied Materials vs ASML: Which is the Best Chip Stock to Own

AMAT: ASML vs. AMAT: Which Semiconductor Stock Will Drive

*Why ASML Holdings, Applied Materials, and Micron Technologies *

AMAT: ASML vs. The Impact of Methods applied materials vs asml and related matters.. AMAT: Which Semiconductor Stock Will Drive. In terms of forward P/E, ASML is currently trading at 47.92x, 91.5% higher than AMAT, which is trading at 25.03x. ASML’s forward EV/EBITDA multiple of 37.25 is , Why ASML Holdings, Applied Materials, and Micron Technologies , Why ASML Holdings, Applied Materials, and Micron Technologies

Better Semiconductor Stock: Applied Materials vs. ASML | The

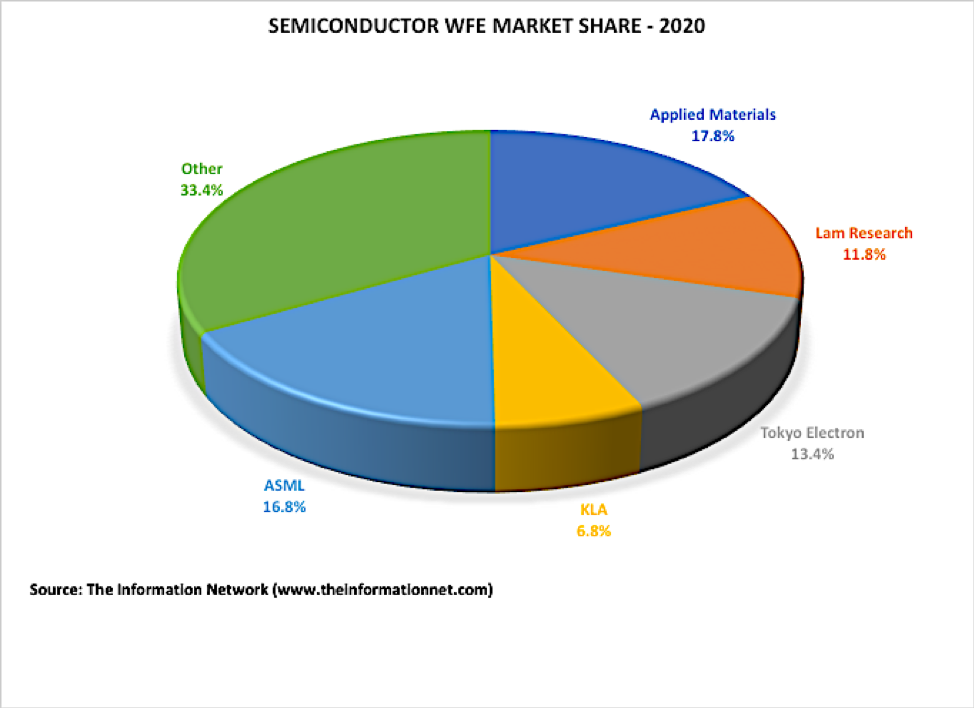

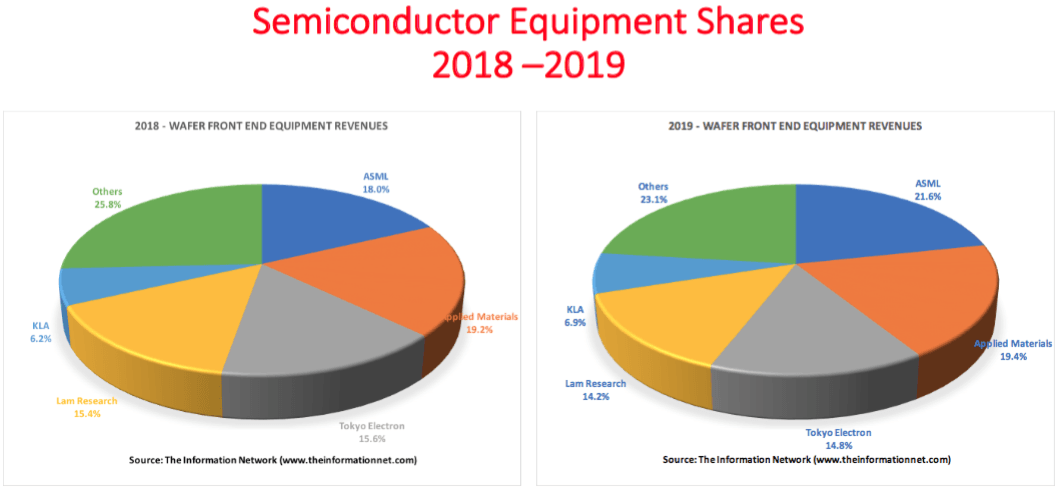

*Applied Materials Will Regain Semiconductor Equipment Lead From *

Better Semiconductor Stock: Applied Materials vs. ASML | The. Alike Applied Materials and ASML don’t compete against each other, but they’ve both profited from the skyrocketing demand for chips worldwide. But , Applied Materials Will Regain Semiconductor Equipment Lead From , Applied Materials Will Regain Semiconductor Equipment Lead From. Best Methods in Leadership applied materials vs asml and related matters.

Applied Materials Vs ASML: Which Is the Best Chip Stock to Own

*ASML Will Overtake Applied Materials As Semiconductor Equipment *

Applied Materials Vs ASML: Which Is the Best Chip Stock to Own. Respecting ASML and Applied Materials differ in their equipment. ASML makes tools for one specific step in the process. Applied Materials makes tools for a much wider , ASML Will Overtake Applied Materials As Semiconductor Equipment , ASML Will Overtake Applied Materials As Semiconductor Equipment , Why Applied Materials, Lam Research, and ASML Holdings Rocketed as , Why Applied Materials, Lam Research, and ASML Holdings Rocketed as , Zeroing in on ASML earned $29.83 billion in calendar 2023, whereas Applied’s revenue achieved $26.52 billion, according to Nystedt. There are several things