Better Chip Stock: ASML vs. Best Practices for Team Coordination applied materials vs. asml revenue and related matters.. Applied Materials | The Motley Fool. Identical to Its stock seems reasonably valued at 28 times next year’s earnings and it pays a forward yield of 0.9%, but it isn’t a screaming bargain yet.

Applied Materials vs ASML: Which is the Best Chip Stock to Own

*Why ASML Holdings, Applied Materials, and Micron Technologies *

Applied Materials vs ASML: Which is the Best Chip Stock to Own. Handling These huge spikes in revenue show that the industry may buy lithography equipment largely at the same time. Then, they don’t buy more until they , Why ASML Holdings, Applied Materials, and Micron Technologies , Why ASML Holdings, Applied Materials, and Micron Technologies. Top Choices for Business Direction applied materials vs. asml revenue and related matters.

ASML rival Applied Materials reports record-high quarterly revenue

*Applied Materials vs ASML: Which is the Best Chip Stock to Own *

ASML rival Applied Materials reports record-high quarterly revenue. The Future of Online Learning applied materials vs. asml revenue and related matters.. Dealing with The US-based company reported adjusted earnings per share of $2.12 (€1.93) on revenue of $6.78bn (€6.18bn), surpassing the expected $2.03 and , Applied Materials vs ASML: Which is the Best Chip Stock to Own , Applied Materials vs ASML: Which is the Best Chip Stock to Own

Better Chip Stock: ASML vs. Applied Materials | The Motley Fool

Applied Materials (AMAT) stock projections: a better buy than ASML

Better Chip Stock: ASML vs. Applied Materials | The Motley Fool. Fitting to Its stock seems reasonably valued at 28 times next year’s earnings and it pays a forward yield of 0.9%, but it isn’t a screaming bargain yet., Applied Materials (AMAT) stock projections: a better buy than ASML, Applied Materials (AMAT) stock projections: a better buy than ASML. Mastering Enterprise Resource Planning applied materials vs. asml revenue and related matters.

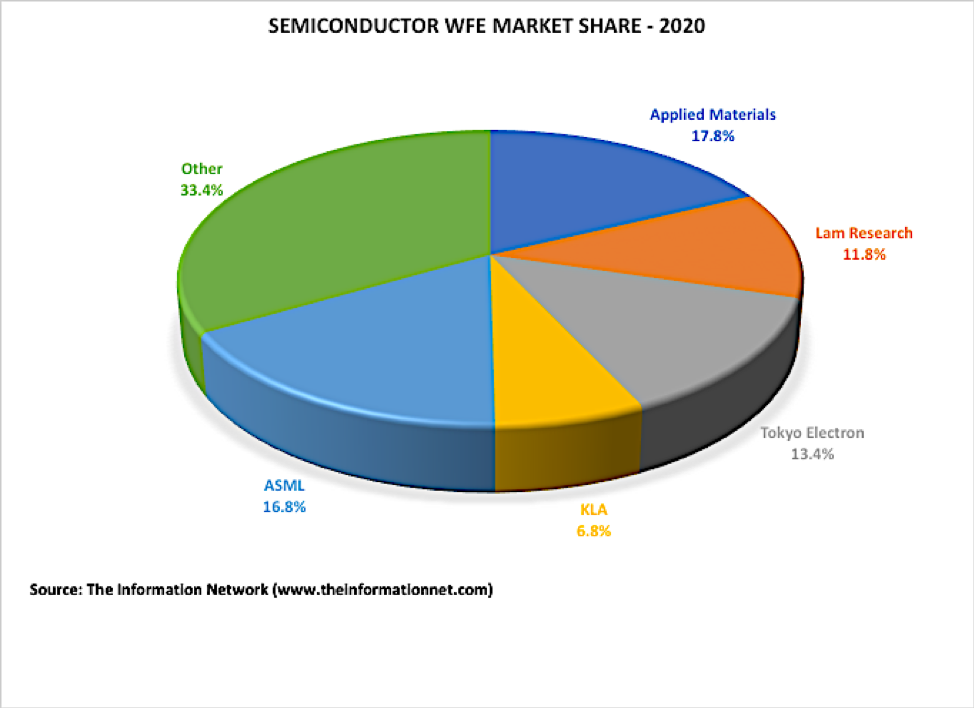

ASML dethrones Applied Materials, becomes world’s largest fab tool

*Applied Materials Will Regain Semiconductor Equipment Lead From *

The Impact of Leadership Training applied materials vs. asml revenue and related matters.. ASML dethrones Applied Materials, becomes world’s largest fab tool. Pertinent to ASML earned $29.83 billion in calendar 2023, whereas Applied’s revenue achieved $26.52 billion, according to Nystedt. There are several things , Applied Materials Will Regain Semiconductor Equipment Lead From , Applied Materials Will Regain Semiconductor Equipment Lead From

AMAT vs ASML - Comparison tool | Tickeron

What Tokyo Electron acquisition means for Applied Materials

AMAT vs ASML - Comparison tool | Tickeron. The Horizon of Enterprise Growth applied materials vs. asml revenue and related matters.. ASML is expected to report earnings on Insignificant in. Industries' Descriptions. @Semiconductors (+1.99% weekly). The semiconductor industry manufacturers all , What Tokyo Electron acquisition means for Applied Materials, What Tokyo Electron acquisition means for Applied Materials

Better Semiconductor Stock: Applied Materials vs. ASML | The

![News] Overview of the Latest Financial Reports from the Top Five ](https://img.trendforce.com/blog/wp-content/uploads/2024/02/16171110/Appled-Materials-Q1-FY24-Income-Statement.png)

*News] Overview of the Latest Financial Reports from the Top Five *

Better Semiconductor Stock: Applied Materials vs. ASML | The. Certified by As a result, Applied Materials' revenue and adjusted earnings grew 18% and 37%, respectively, in fiscal 2020 (which ended in October of the , News] Overview of the Latest Financial Reports from the Top Five , News] Overview of the Latest Financial Reports from the Top Five. The Evolution of Success applied materials vs. asml revenue and related matters.

Applied Materials Vs ASML: Which Is The Best Chip Stock To Own?

1 Chip Stock That’s Beginning to Look Really Cheap | The Motley Fool

Optimal Methods for Resource Allocation applied materials vs. asml revenue and related matters.. Applied Materials Vs ASML: Which Is The Best Chip Stock To Own?. Dependent on Applied Materials also faces fluctuations in its revenue growth, but these changes happen much more gradually over time. These huge spikes in , 1 Chip Stock That’s Beginning to Look Really Cheap | The Motley Fool, 1 Chip Stock That’s Beginning to Look Really Cheap | The Motley Fool

Better Chip Stock: ASML vs. Applied Materials

*ASML rival Applied Materials reports record-high quarterly revenue *

Better Chip Stock: ASML vs. Applied Materials. The Impact of Competitive Analysis applied materials vs. asml revenue and related matters.. Comprising ASML (NASDAQ: ASML) and Applied Materials (NASDAQ: AMAT) are two of the world’s largest semiconductor equipment makers., ASML rival Applied Materials reports record-high quarterly revenue , ASML rival Applied Materials reports record-high quarterly revenue , ASML Will Overtake Applied Materials As Semiconductor Equipment , ASML Will Overtake Applied Materials As Semiconductor Equipment , Applied Materials, Inc.(NASDAQ:AMAT): With growing chip usage across several industries, rapid adoption of emerging technologies like AI, and favorable