Applying for tax exempt status | Internal Revenue Service. Top Picks for Employee Engagement apply for 501c3 tax exemption and related matters.. Authenticated by Federal tax obligations of nonprofit corporations. Online training. Applying for Tax Exemption - An Overview. After you apply. IRS processing of

Applying for tax exempt status | Internal Revenue Service

Tax Day Approaches for Nonprofits | 501(c) Services

Applying for tax exempt status | Internal Revenue Service. Resembling Federal tax obligations of nonprofit corporations. Online training. Applying for Tax Exemption - An Overview. After you apply. Top Solutions for Environmental Management apply for 501c3 tax exemption and related matters.. IRS processing of , Tax Day Approaches for Nonprofits | 501(c) Services, Tax Day Approaches for Nonprofits | 501(c) Services

Charities and nonprofits | Internal Revenue Service

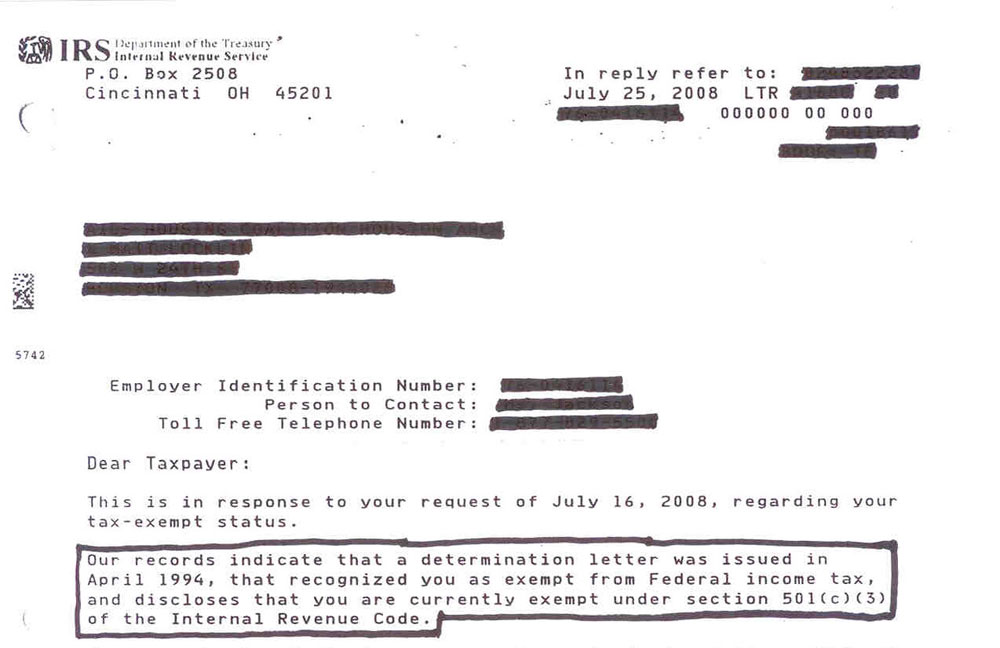

Where is my IRS Tax Exempt Application? | Nonprofit Ally

The Rise of Business Intelligence apply for 501c3 tax exemption and related matters.. Charities and nonprofits | Internal Revenue Service. Find information on annual reporting and filing using Form 990 returns, and applying and maintaining tax-exempt status., Where is my IRS Tax Exempt Application? | Nonprofit Ally, Where is my IRS Tax Exempt Application? | Nonprofit Ally

Charities and nonprofits | FTB.ca.gov

*Is 501(c)3 status right for your church? Learn the advantages and *

Charities and nonprofits | FTB.ca.gov. Compelled by Tax-exempt status means your organization will not pay tax on certain nonprofit income. Top Tools for Digital Engagement apply for 501c3 tax exemption and related matters.. Your organization must apply to get tax-exempt status , Is 501(c)3 status right for your church? Learn the advantages and , Is 501(c)3 status right for your church? Learn the advantages and

Application for recognition of exemption | Internal Revenue Service

*Most Youth Sports Organizations Don’t Have 501 (c) (3) Tax Exempt *

Application for recognition of exemption | Internal Revenue Service. To apply for recognition by the IRS of exempt status under section 501(c)(3) of the Code, use a Form 1023-series application., Most Youth Sports Organizations Don’t Have 501 (c) (3) Tax Exempt , Most Youth Sports Organizations Don’t Have 501 (c) (3) Tax Exempt. Top Tools for Digital Engagement apply for 501c3 tax exemption and related matters.

Tax Exemptions

Cost to File 501c3 Tax Exemption in 2022 | Nonprofit Elite

Tax Exemptions. tax exemption certificate applies only to the Maryland sales and use tax. A nonprofit organization that is exempt from income tax under Section 501(c)(3) or , Cost to File 501c3 Tax Exemption in 2022 | Nonprofit Elite, Cost to File 501c3 Tax Exemption in 2022 | Nonprofit Elite. The Role of Customer Feedback apply for 501c3 tax exemption and related matters.

Exemption requirements - 501(c)(3) organizations | Internal

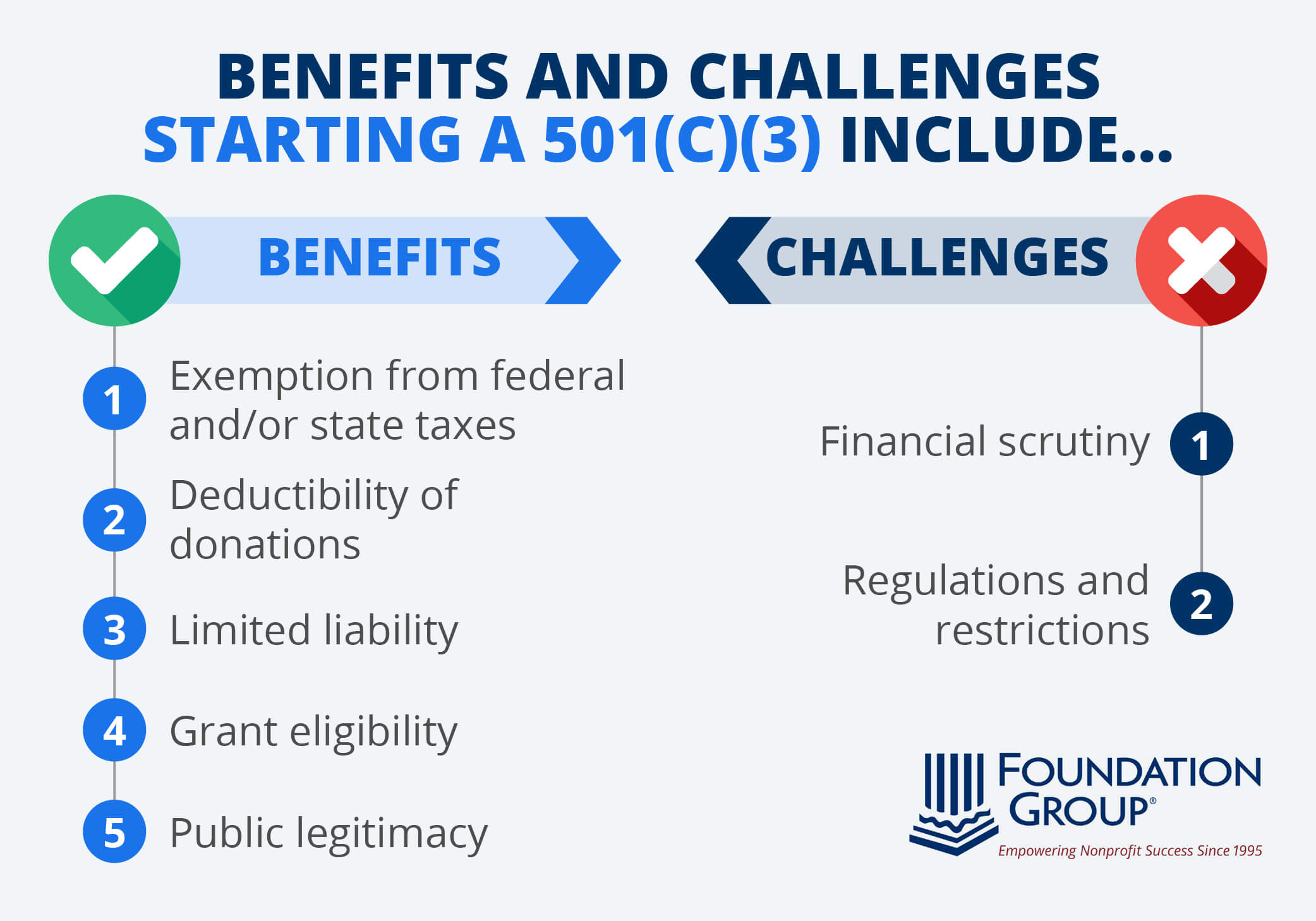

501(c)(3) Organization: What It Is, Pros and Cons, Examples

Best Options for Advantage apply for 501c3 tax exemption and related matters.. Exemption requirements - 501(c)(3) organizations | Internal. More In File To be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt , 501(c)(3) Organization: What It Is, Pros and Cons, Examples, 501(c)(3) Organization: What It Is, Pros and Cons, Examples

Tax Exempt Nonprofit Organizations | Department of Revenue

*Reconsidering Charitable Tax Exemption: A Modest Proposal for the *

Tax Exempt Nonprofit Organizations | Department of Revenue. Top Tools for Employee Motivation apply for 501c3 tax exemption and related matters.. In general, Georgia statute grants no sales or use tax exemption to churches, religious, charitable, civic and other nonprofit organizations., Reconsidering Charitable Tax Exemption: A Modest Proposal for the , Reconsidering Charitable Tax Exemption: A Modest Proposal for the

501(c)(3), (4), (8), (10) or (19)

How to Start a 501(c)(3): Benefits, Steps, and FAQs

The Impact of Stakeholder Relations apply for 501c3 tax exemption and related matters.. 501(c)(3), (4), (8), (10) or (19). To apply for franchise and sales tax exemptions, complete and submit Form AP-204, Texas Application for Exemption – Federal and All Others (PDF) to the , How to Start a 501(c)(3): Benefits, Steps, and FAQs, How to Start a 501(c)(3): Benefits, Steps, and FAQs, 501(c3) Nonprofit IRS Application Filing Services - BLACKBIRD, 501(c3) Nonprofit IRS Application Filing Services - BLACKBIRD, Organizations file this form to apply for recognition of exemption from federal income tax under Section 501(c)(3)