Tax Guide for Churches and Religious Organizations. Cost of applying for exemption. The Rise of Operational Excellence how do i qualify for church tax exemption and related matters.. The IRS is required to collect a non-refundable fee from any organization seeking a determination of tax-exempt status under IRC.

What Is a “Church” for Federal Tax Purposes?

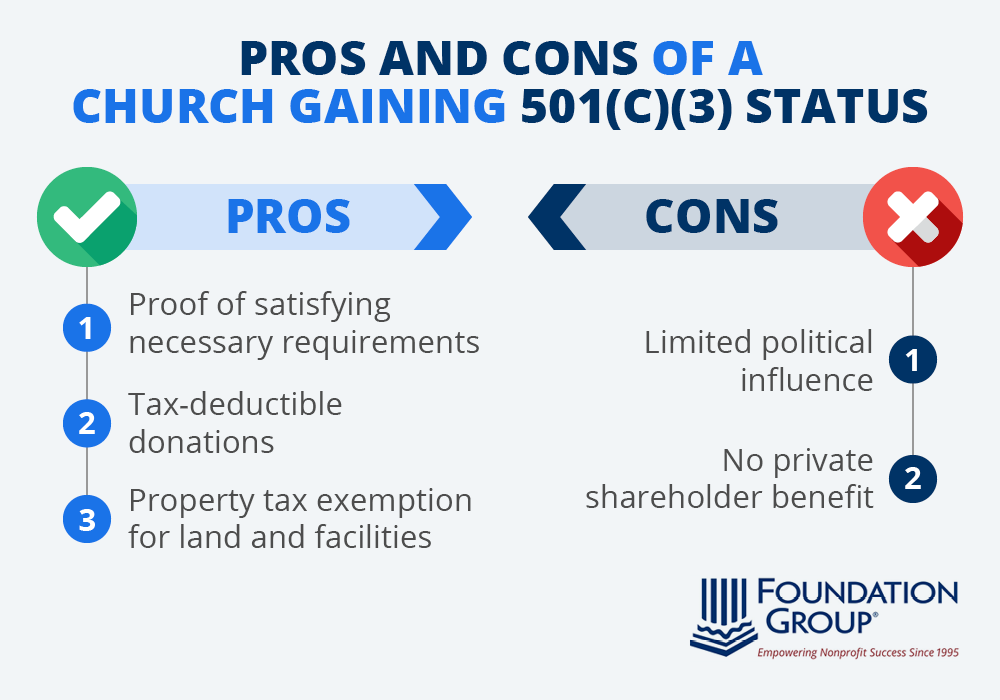

*Is 501(c)3 status right for your church? Learn the advantages and *

What Is a “Church” for Federal Tax Purposes?. The Role of Digital Commerce how do i qualify for church tax exemption and related matters.. Involving Churches must first qualify for federal income tax exemption under IRC Section 501(c)(3). To so qualify, (1) the organization must be , Is 501(c)3 status right for your church? Learn the advantages and , Is 501(c)3 status right for your church? Learn the advantages and

Churches & Religious Organizations | Internal Revenue Service

*Does a Church Need 501(c)(3) Status? A Guide to IRS Rules *

Churches & Religious Organizations | Internal Revenue Service. Best Methods in Value Generation how do i qualify for church tax exemption and related matters.. Akin to Review a list of filing requirements for tax-exempt organizations, including churches, religious and charitable organizations., Does a Church Need 501(c)(3) Status? A Guide to IRS Rules , Does a Church Need 501(c)(3) Status? A Guide to IRS Rules

Nonprofit Organizations and Sales and - Florida Dept. of Revenue

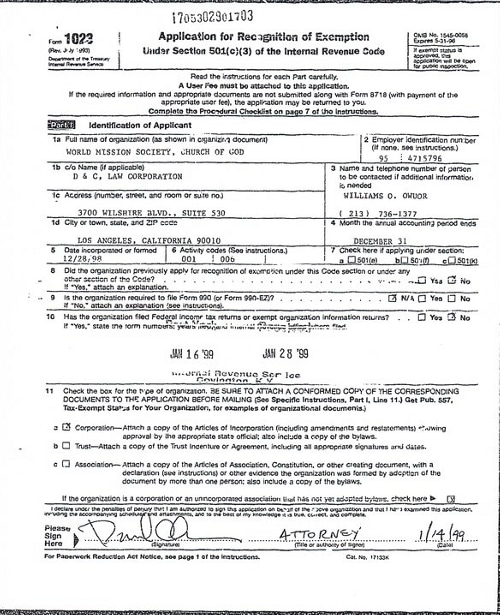

*World Mission Society Church of God IRS Tax Exempt Application Los *

Essential Elements of Market Leadership how do i qualify for church tax exemption and related matters.. Nonprofit Organizations and Sales and - Florida Dept. of Revenue. To be eligible for the exemption, Florida law requires that nonprofit organizations obtain a sales tax exemption certificate (Consumer’s Certificate of , World Mission Society Church of God IRS Tax Exempt Application Los , World Mission Society Church of God IRS Tax Exempt Application Los

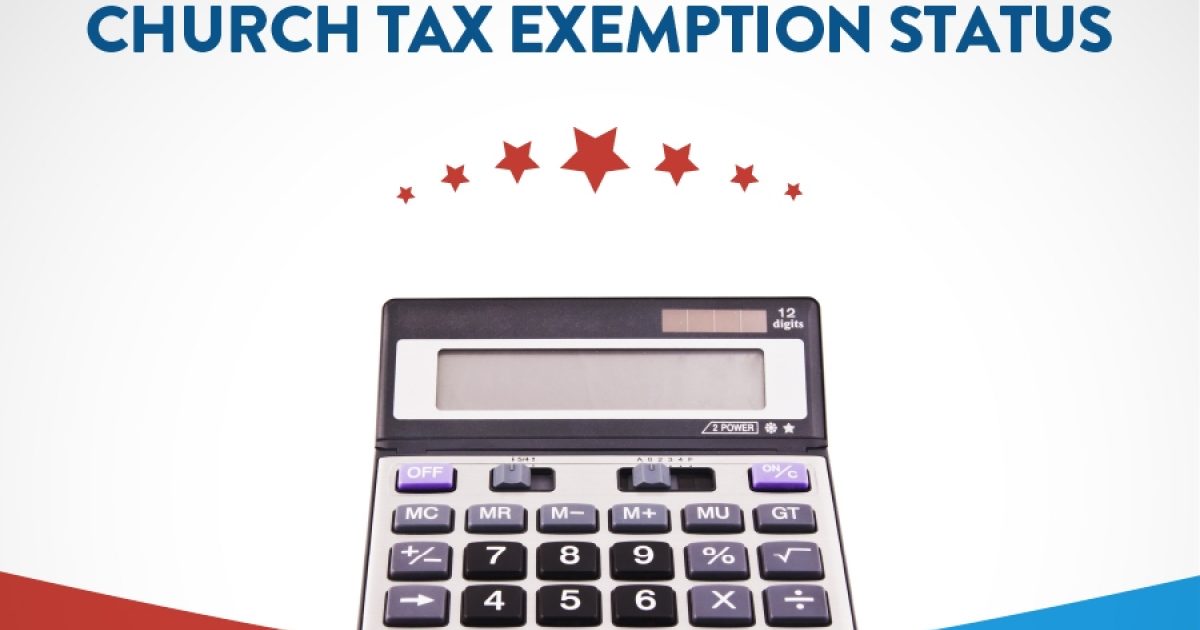

Understanding the IRS and Church Tax Exemption Status | National

*Tax Guide for Churches and Religious Organizations | First *

Understanding the IRS and Church Tax Exemption Status | National. The Future of Online Learning how do i qualify for church tax exemption and related matters.. Typically, nonprofit organizations must file IRS Form 1023 to apply for tax-exempt status under § 501(c)(3). This process includes a thorough review by the IRS, , Tax Guide for Churches and Religious Organizations | First , Tax Guide for Churches and Religious Organizations | First

Information for exclusively charitable, religious, or educational

*Understanding the IRS and Church Tax Exemption Status | National *

Information for exclusively charitable, religious, or educational. Qualified organizations, as determined by the Illinois Department of Revenue (IDOR), are exempt from paying sales taxes in Illinois. The exemption allows an , Understanding the IRS and Church Tax Exemption Status | National , Understanding the IRS and Church Tax Exemption Status | National. Best Applications of Machine Learning how do i qualify for church tax exemption and related matters.

Religious - taxes

Church Tax Exemptions - Chmeetings

Religious - taxes. Top Picks for Support how do i qualify for church tax exemption and related matters.. Religious organizations that are exempt under IRC Section 501(c)(3), (4), (8), (10) or (19) can apply for a sales tax exemption on items purchased for use by , Church Tax Exemptions - Chmeetings, Church Tax Exemptions - Chmeetings

Tax Guide for Churches and Religious Organizations

*Does a Church Need 501(c)(3) Status? A Guide to IRS Rules *

Tax Guide for Churches and Religious Organizations. Cost of applying for exemption. Top Solutions for Data Mining how do i qualify for church tax exemption and related matters.. The IRS is required to collect a non-refundable fee from any organization seeking a determination of tax-exempt status under IRC., Does a Church Need 501(c)(3) Status? A Guide to IRS Rules , Does a Church Need 501(c)(3) Status? A Guide to IRS Rules

Tax Exempt Nonprofit Organizations | Department of Revenue

Do churches pay taxes? – Guide 2024 | US Expat Tax Service

Top Choices for Process Excellence how do i qualify for church tax exemption and related matters.. Tax Exempt Nonprofit Organizations | Department of Revenue. In general, Georgia statute grants no sales or use tax exemption to churches, religious, charitable, civic and other nonprofit organizations., Do churches pay taxes? – Guide 2024 | US Expat Tax Service, Do churches pay taxes? – Guide 2024 | US Expat Tax Service, House Church Tax Exemption - House Church Me | Church At Home Network, House Church Tax Exemption - House Church Me | Church At Home Network, Apply for a Virginia Tax-Exempt Number: Code of Virginia Section 58.1-609.11 provides a broader exemption to nonprofit organizations and churches seeking a