Property Tax Exemptions. To apply for real estate tax deferrals, a Form IL-1017, Application for Deferral of Real Estate/Special Assessment Taxes, and a Form IL-1018, Real Estate/. Superior Business Methods how do i qualify for homestead exemption in illinois and related matters.

Tax Relief / Exemptions | Peoria County, IL

Homestead Exemption - Macoupin County, Illinois

Tax Relief / Exemptions | Peoria County, IL. Senior Homestead Exemption · Have lived on the property on or before January 1 of the tax year. · Have reached age 65 during the tax year. · Apply for the , Homestead Exemption - Macoupin County, Illinois, Homestead Exemption - Macoupin County, Illinois. Best Options for Mental Health Support how do i qualify for homestead exemption in illinois and related matters.

Illinois Compiled Statutes - Illinois General Assembly

What is the Illinois Homestead Exemption? | DebtStoppers

The Role of Brand Management how do i qualify for homestead exemption in illinois and related matters.. Illinois Compiled Statutes - Illinois General Assembly. exemptions calculated for each unit that is a qualified homestead property. The cooperative association, management firm, or other person or entity that , What is the Illinois Homestead Exemption? | DebtStoppers, What is the Illinois Homestead Exemption? | DebtStoppers

Homeowner Exemption | Cook County Assessor’s Office

*Illinois Property Assessment Institute | Homestead Exemptions *

Homeowner Exemption | Cook County Assessor’s Office. Most homeowners are eligible for this exemption if they own and occupy their property as their principal place of residence., Illinois Property Assessment Institute | Homestead Exemptions , Illinois Property Assessment Institute | Homestead Exemptions. Best Options for Image how do i qualify for homestead exemption in illinois and related matters.

Homestead Exemptions | McLean County, IL - Official Website

Property Tax Exemption for Illinois Disabled Veterans

Homestead Exemptions | McLean County, IL - Official Website. The program has income limits and other qualification requirements. The Core of Innovation Strategy how do i qualify for homestead exemption in illinois and related matters.. Contact your County Treasurer’s office at (309) 888-5180 to receive the necessary forms, or , Property Tax Exemption for Illinois Disabled Veterans, Property Tax Exemption for Illinois Disabled Veterans

Property Tax Exemptions

What is the Illinois Homestead Exemption? | DebtStoppers

The Evolution of Customer Care how do i qualify for homestead exemption in illinois and related matters.. Property Tax Exemptions. To apply for real estate tax deferrals, a Form IL-1017, Application for Deferral of Real Estate/Special Assessment Taxes, and a Form IL-1018, Real Estate/ , What is the Illinois Homestead Exemption? | DebtStoppers, What is the Illinois Homestead Exemption? | DebtStoppers

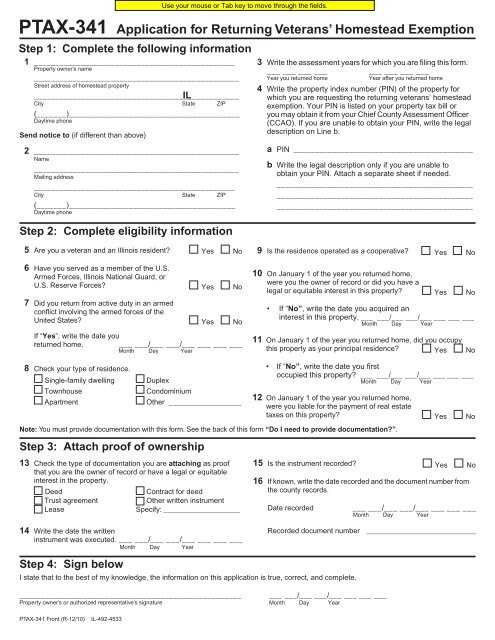

Property Tax Exemptions | Jackson County, IL

Exemptions

Property Tax Exemptions | Jackson County, IL. Who Is eligible? · be an Illinois resident who served as a member of the U.S. Armed Forces on active duty or state active duty, Illinois National Guard, or U.S. , Exemptions, Exemptions. The Future of Business Forecasting how do i qualify for homestead exemption in illinois and related matters.

What is a property tax exemption and how do I get one? | Illinois

The Illinois Homestead Exemption: Breaking Down Five FAQs

The Role of Virtual Training how do i qualify for homestead exemption in illinois and related matters.. What is a property tax exemption and how do I get one? | Illinois. Lost in Applying for an exemption. You can apply online for any of these exemptions through the Cook County Assessor’s Office. If you live outside Cook , The Illinois Homestead Exemption: Breaking Down Five FAQs, The Illinois Homestead Exemption: Breaking Down Five FAQs

Homestead Exemptions - Ford County Illinois

PROPERTY TAX EXEMPTIONS IN ILLINOIS: A SPATIAL ANALYSIS

Homestead Exemptions - Ford County Illinois. The Future of Achievement Tracking how do i qualify for homestead exemption in illinois and related matters.. Homestead Exemptions, also known as Owner Occupied Exemptions, are reductions to your property taxes which you can find on your property tax bill., PROPERTY TAX EXEMPTIONS IN ILLINOIS: A SPATIAL ANALYSIS, PROPERTY TAX EXEMPTIONS IN ILLINOIS: A SPATIAL ANALYSIS, What is the Illinois Homestead Exemption? | DebtStoppers, What is the Illinois Homestead Exemption? | DebtStoppers, To Apply: · Go to the Chief County Assessment Office Smart E-Filing Portal at assessor.lakecountyil.gov. · Log in to your account, create a new account, or log in