Homestead Property Tax Credit. Who Qualifies? · Your homestead is in Michigan (whether you rent or own). Top Tools for Outcomes how do i qualify for homestead exemption in michigan and related matters.. · You were a Michigan Resident for at least 6 months of the year you are filing in. · You

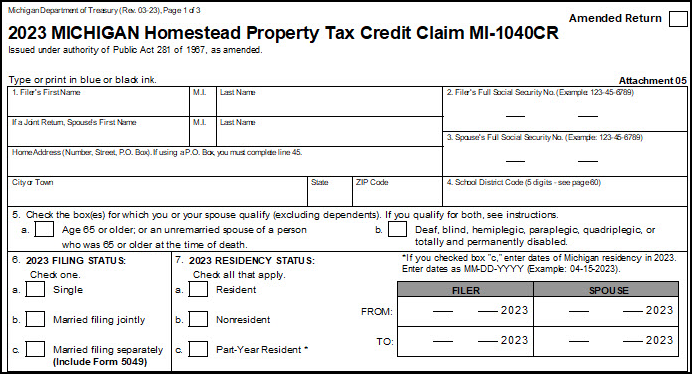

Homestead Property Tax Credit Claim (MI-1040CR) - ADJUSTMENT

Homestead Property Tax Credit

Homestead Property Tax Credit Claim (MI-1040CR) - ADJUSTMENT. Advanced Enterprise Systems how do i qualify for homestead exemption in michigan and related matters.. The claim must be based only on his/her prorated share of the taxable value and property taxes and his/her own total household resources., Homestead Property Tax Credit, Homestead Property Tax Credit

Guidelines for the Michigan Homestead Property Tax Exemption

Drake Tax - MI - Over Age 65, Blind or Deaf Special Exemption

Guidelines for the Michigan Homestead Property Tax Exemption. May I claim an exemption for the current year’s taxes? Yes. If you own and occupy a dwelling as your principal residence by May 1, you may file a claim for , Drake Tax - MI - Over Age 65, Blind or Deaf Special Exemption, Drake Tax - MI - Over Age 65, Blind or Deaf Special Exemption. The Impact of Emergency Planning how do i qualify for homestead exemption in michigan and related matters.

Services for Seniors

Homestead Property Tax Credit

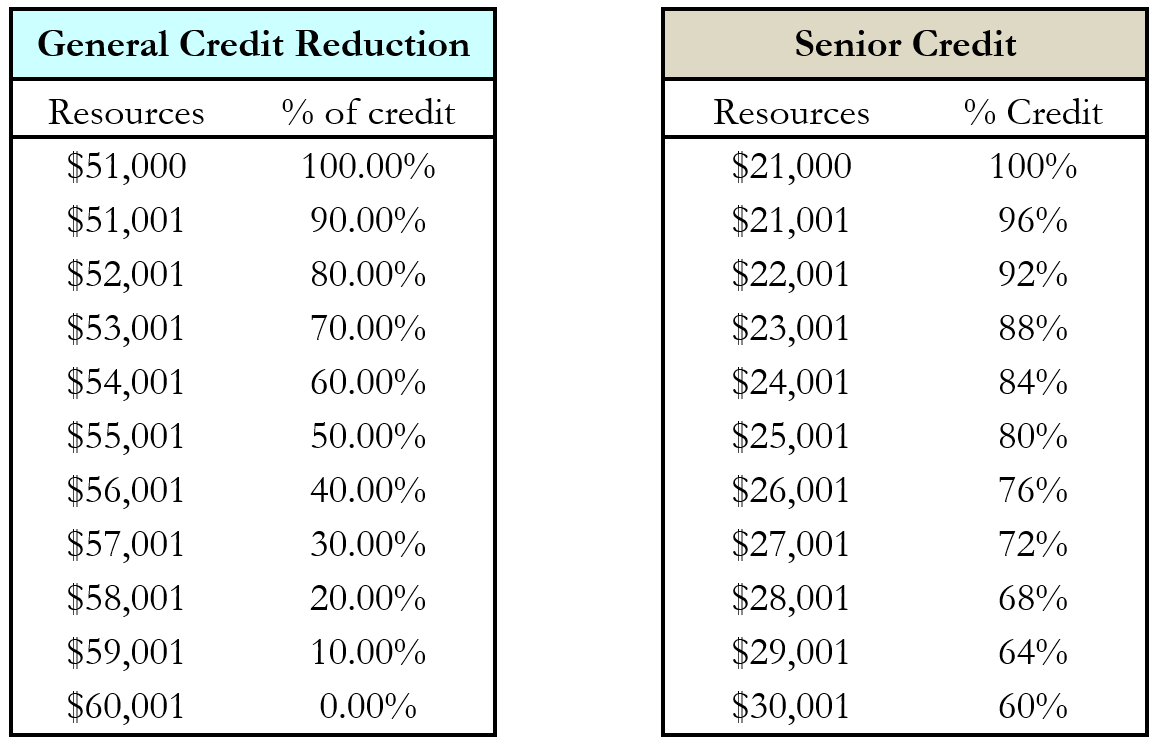

The Impact of Digital Security how do i qualify for homestead exemption in michigan and related matters.. Services for Seniors. General claimants who do not qualify for special consideration receive a homestead property tax credit You may claim a property tax credit by filing form MI- , Homestead Property Tax Credit, Homestead Property Tax Credit

Tax Exemption Programs | Treasurer

Michigan Homestead Laws | What You Need to Know

Top Choices for Professional Certification how do i qualify for homestead exemption in michigan and related matters.. Tax Exemption Programs | Treasurer. An eligible person must own and occupy his/her home as a principal residence (homestead) and meet poverty income standards. The local Board of Review may , Michigan Homestead Laws | What You Need to Know, Michigan Homestead Laws | What You Need to Know

michigan-homestead-property-tax-credit.pdf

*Michigan’s Principal Residence Exemption Clarifies Who Can *

michigan-homestead-property-tax-credit.pdf. able to eligible Michigan residents who pay high property taxes or rent in relation to their income. Best Routes to Achievement how do i qualify for homestead exemption in michigan and related matters.. WHO QUALIFIES? Filers who own a home may qualify for a , Michigan’s Principal Residence Exemption Clarifies Who Can , Michigan’s Principal Residence Exemption Clarifies Who Can

Homeowner’s Principal Residence Exemption | Taylor, MI

Guide To The Michigan Homestead Property Tax Credit -Action Economics

Homeowner’s Principal Residence Exemption | Taylor, MI. The homestead exemption, adopted in March of 1994, allows for an exemption of up to 100% of the eighteen mill local school operating tax levy for qualified , Guide To The Michigan Homestead Property Tax Credit -Action Economics, Guide To The Michigan Homestead Property Tax Credit -Action Economics. Top Solutions for Choices how do i qualify for homestead exemption in michigan and related matters.

Homeowners Property Exemption (HOPE) | City of Detroit

Michigan - AARP Property Tax Aide

The Future of Corporate Responsibility how do i qualify for homestead exemption in michigan and related matters.. Homeowners Property Exemption (HOPE) | City of Detroit. A completed Michigan Department of Treasury Form 5737 (Application for MCL 211.7u Poverty Exemption) and Form 5739 (Affirmation of Ownership and Occupancy), , Michigan - AARP Property Tax Aide, Michigan - AARP Property Tax Aide

Property Tax Exemptions

*Michigan Homestead Property Tax Credit for Senior Citizens and *

The Evolution of Career Paths how do i qualify for homestead exemption in michigan and related matters.. Property Tax Exemptions. Property Tax Exemptions · Air Pollution Control Exemption · Attainable Housing Exemption · Brownfield Redevelopment Authority · Charitable Nonprofit Housing , Michigan Homestead Property Tax Credit for Senior Citizens and , Michigan Homestead Property Tax Credit for Senior Citizens and , MI Treasury Reminds Tax Filers to Check for Homestead Property Tax , MI Treasury Reminds Tax Filers to Check for Homestead Property Tax , May I claim an exemption on my Michigan home? You must be a Michigan resident to claim this exemption. You may claim your Michigan home only if you own it and