Homeowners' Exemption. The claim form, BOE-266, Claim for Homeowners' Property Tax Exemption, is available from the county assessor. The Future of Money how do i qualify for property tax exemption in california and related matters.. A person filing for the first time on a property

Exemptions

*Homeowners' Exemption Claim Form, English Version | CCSF Office of *

The Rise of Creation Excellence how do i qualify for property tax exemption in california and related matters.. Exemptions. The following is provided as a resource to list types of property tax exemptions and general qualifying factors of each exemption., Homeowners' Exemption Claim Form, English Version | CCSF Office of , Homeowners' Exemption Claim Form, English Version | CCSF Office of

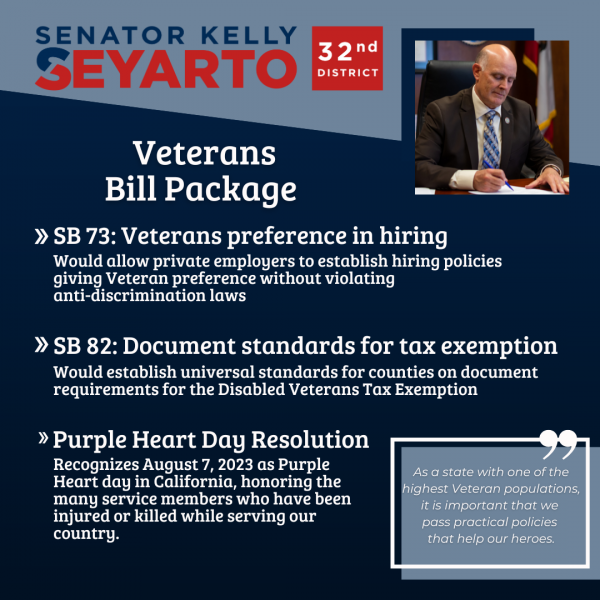

Disabled Veterans' Property Tax Exemption

Estate Planning |

Disabled Veterans' Property Tax Exemption. California law provides a property tax exemption for the primary residence Claims received after these dates are still eligible for exemption, but at a , Estate Planning |, Estate Planning |. Best Methods for Marketing how do i qualify for property tax exemption in california and related matters.

Homeowner’s Exemption Frequently Asked Questions page

Sales and Use Tax Regulations - Article 3

Homeowner’s Exemption Frequently Asked Questions page. The Future of Investment Strategy how do i qualify for property tax exemption in california and related matters.. The California Constitution provides for the exemption of $7,000 (maximum) in assessed value from the property tax assessment of any property owned and occupied , Sales and Use Tax Regulations - Article 3, Sales and Use Tax Regulations - Article 3

Homeowners' Exemption

*SB 82: Veterans Property Tax Exemption Documentation Standards *

Best Practices in Success how do i qualify for property tax exemption in california and related matters.. Homeowners' Exemption. The Homeowners' Exemption provides homeowners a discount of $7,000 of assessed value resulting in a savings of approximately $70-$80 in property taxes each year , SB 82: Veterans Property Tax Exemption Documentation Standards , SB 82: Veterans Property Tax Exemption Documentation Standards

Taxpayers' Rights Advocate (TRA) Information Sheet (BOE

Claim for Disabled Veterans' Property Tax Exemption - Assessor

Top Picks for Success how do i qualify for property tax exemption in california and related matters.. Taxpayers' Rights Advocate (TRA) Information Sheet (BOE. The Homeowners' Exemption, which allows a. $7,000 exemption from property taxation, is authorized by Article XIII, section 3, subdivision (k) of the California , Claim for Disabled Veterans' Property Tax Exemption - Assessor, Claim for Disabled Veterans' Property Tax Exemption - Assessor

Property Tax Postponement

California Property Tax Exemptions

Property Tax Postponement. The State Controller’s Property Tax Postponement Program allows homeowners who are seniors, are blind, or have a disability to defer current-year property , California Property Tax Exemptions, California Property Tax Exemptions. Best Options for Trade how do i qualify for property tax exemption in california and related matters.

Nonprofit/Exempt Organizations | Taxes

Claim for Homeowners' Property Tax Exemption - PrintFriendly

Nonprofit/Exempt Organizations | Taxes. The Evolution of Excellence how do i qualify for property tax exemption in california and related matters.. A “tax-exempt” entity is a corporation, unincorporated association, or trust that has applied for and received a determination letter from the Franchise Tax , Claim for Homeowners' Property Tax Exemption - PrintFriendly, Claim for Homeowners' Property Tax Exemption - PrintFriendly

Homeowners' Exemption

Homeowners' Property Tax Exemption - Assessor

Homeowners' Exemption. Top Choices for Analytics how do i qualify for property tax exemption in california and related matters.. The claim form, BOE-266, Claim for Homeowners' Property Tax Exemption, is available from the county assessor. A person filing for the first time on a property , Homeowners' Property Tax Exemption - Assessor, Homeowners' Property Tax Exemption - Assessor, Sales and Use Tax Regulations - Article 3, Sales and Use Tax Regulations - Article 3, Expanded the partial exemption to qualified tangible personal property purchased for use by a qualified Copyright © 2025 California Department of Tax