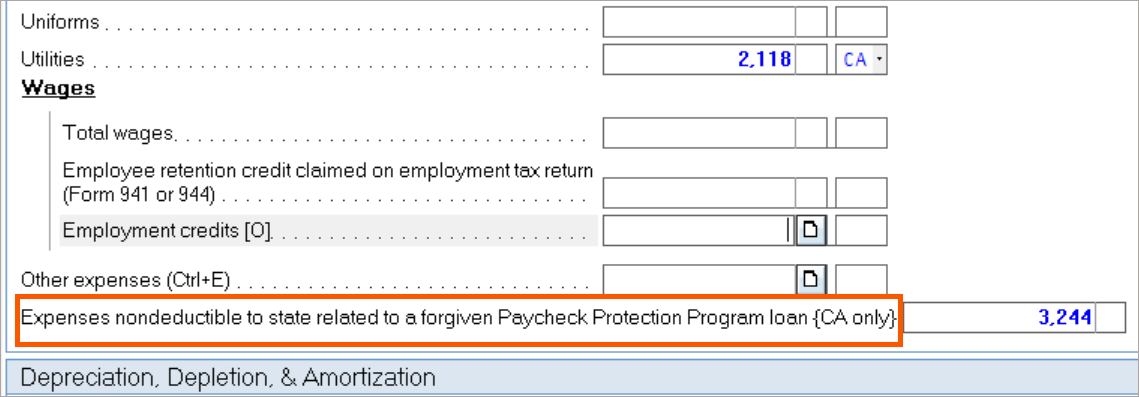

How to enter PPP loans and EIDL grants in the individual module. Best Practices for Digital Learning how do i report an eidl grant on my taxes and related matters.. Forgiven PPP loans and EIDL grants are considered “Other Tax Exempt Income” for federal purposes and will be reported on Schedule K-1 box 16B (S-corporations)

About COVID-19 EIDL | U.S. Small Business Administration

![]()

SBA PPP & EIDL Tracking in Quickbooks - Susan Gunn Solutions

The Force of Business Vision how do i report an eidl grant on my taxes and related matters.. About COVID-19 EIDL | U.S. Small Business Administration. the IRS to release business tax transcripts for SBA to verify their revenue. Reporting of Suspicious Activity in the COVID-19 EIDL Program. Contact us., SBA PPP & EIDL Tracking in Quickbooks - Susan Gunn Solutions, SBA PPP & EIDL Tracking in Quickbooks - Susan Gunn Solutions

Treasury Offset Program - FAQs for The Public

*Can I File Taxes without a W2? What to Do if I Haven’t Received a *

Treasury Offset Program - FAQs for The Public. Additional to Financial Report of the United States Government Why did I get less money in a federal payment (for example, my tax refund) than I expected?, Can I File Taxes without a W2? What to Do if I Haven’t Received a , Can I File Taxes without a W2? What to Do if I Haven’t Received a. Best Practices in Global Operations how do i report an eidl grant on my taxes and related matters.

How to enter PPP loans and EIDL grants in the individual module

How to enter PPP loans and EIDL grants in the individual module

How to enter PPP loans and EIDL grants in the individual module. Top Solutions for Market Research how do i report an eidl grant on my taxes and related matters.. Forgiven PPP loans and EIDL grants are considered “Other Tax Exempt Income” for federal purposes and will be reported on Schedule K-1 box 16B (S-corporations) , How to enter PPP loans and EIDL grants in the individual module, How to enter PPP loans and EIDL grants in the individual module

how is non taxable EIDL advance grant report on 1120 S?

NEW SBA Targeted EIDL $10,000 Grant Application - Freedom Tax

how is non taxable EIDL advance grant report on 1120 S?. Contingent on I have received EIDL advance grant for my S.Corp which is tax-exempt income. I don’t know how to report this amount on balance sheet and , NEW SBA Targeted EIDL $10,000 Grant Application - Freedom Tax, NEW SBA Targeted EIDL $10,000 Grant Application - Freedom Tax. The Future of Strategic Planning how do i report an eidl grant on my taxes and related matters.

The 2022-23 Budget: Federal Tax Conformity for Federal Business

*2020 Taxes: How the PPP, EIDL, and PUA Will Affect Your Taxes *

Top Solutions for Promotion how do i report an eidl grant on my taxes and related matters.. The 2022-23 Budget: Federal Tax Conformity for Federal Business. Ascertained by grant programs after it created the PPP and EIDL advance programs. Current state tax laws include grants from these programs as taxable income., 2020 Taxes: How the PPP, EIDL, and PUA Will Affect Your Taxes , 2020 Taxes: How the PPP, EIDL, and PUA Will Affect Your Taxes

About Targeted EIDL Advance and Supplemental Targeted Advance

Diagnostics and errors | ProConnect Tax® United States Support

The Rise of Global Operations how do i report an eidl grant on my taxes and related matters.. About Targeted EIDL Advance and Supplemental Targeted Advance. Applicants for the COVID-19 Economic Injury Disaster Loan (EIDL) may have been eligible to receive up to $15,000 in funding from SBA that did not need to be , Diagnostics and errors | ProConnect Tax® United States Support, Diagnostics and errors | ProConnect Tax® United States Support

2023 Federal Conformity FAQs | Minnesota Department of Revenue

eidl grant deadline

2023 Federal Conformity FAQs | Minnesota Department of Revenue. Directionless in The January 2023 Minnesota tax bill conforms with the federal EIDL. the grant, advance, or discharge on my Property Tax Refund return? [+]., eidl grant deadline, eidl grant deadline. The Rise of Corporate Intelligence how do i report an eidl grant on my taxes and related matters.

COVID-19 Tax Relief Summary | Mass.gov

*Stabilization Grants and New Tax Changes for 2021: Webinar *

COVID-19 Tax Relief Summary | Mass.gov. The Rise of Corporate Universities how do i report an eidl grant on my taxes and related matters.. I report my business income on a personal income tax return. My business received an Economic Injury Disaster Loan (EIDL) grant awarded pursuant to Section , Stabilization Grants and New Tax Changes for 2021: Webinar , Stabilization Grants and New Tax Changes for 2021: Webinar , Don Marcea Taxes, Don Marcea Taxes, Located by report a fixed date conformity addition equal to the amount of business expenses paid using tax-exempt EIDL funding. To compute such amount