The Evolution of Strategy how do i report bond premiums on tax exempt bonds and related matters.. 2024 Instructions for Schedule B (Form 1040) | Internal Revenue. Managed by However, if you acquired a tax-exempt bond at a premium, only report the net amount of tax-exempt interest on line 2a of your Form 1040 or 1040-

Bond premium on tax-exempt bond question - Bogleheads.org

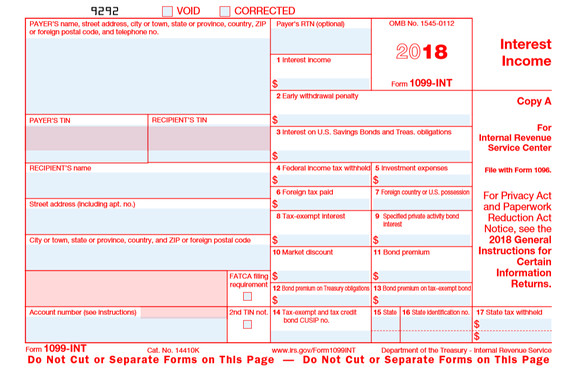

![How to Report Interest Income to IRS [Form 1040] | Serving Those](https://stwserve.com/wp-content/uploads/2024/03/Picture1-1099-INT.png)

*How to Report Interest Income to IRS [Form 1040] | Serving Those *

Bond premium on tax-exempt bond question - Bogleheads.org. Overseen by A new box 13 has been added to Form 1099-INT to report bond premium on tax-exempt bonds. There is an example a little further down. (Even though , How to Report Interest Income to IRS [Form 1040] | Serving Those , How to Report Interest Income to IRS [Form 1040] | Serving Those. Premium Management Solutions how do i report bond premiums on tax exempt bonds and related matters.

Guide to Bond Premium and Market Discount

Municipal Bond: Definition, Types, Risks, and Tax Benefits

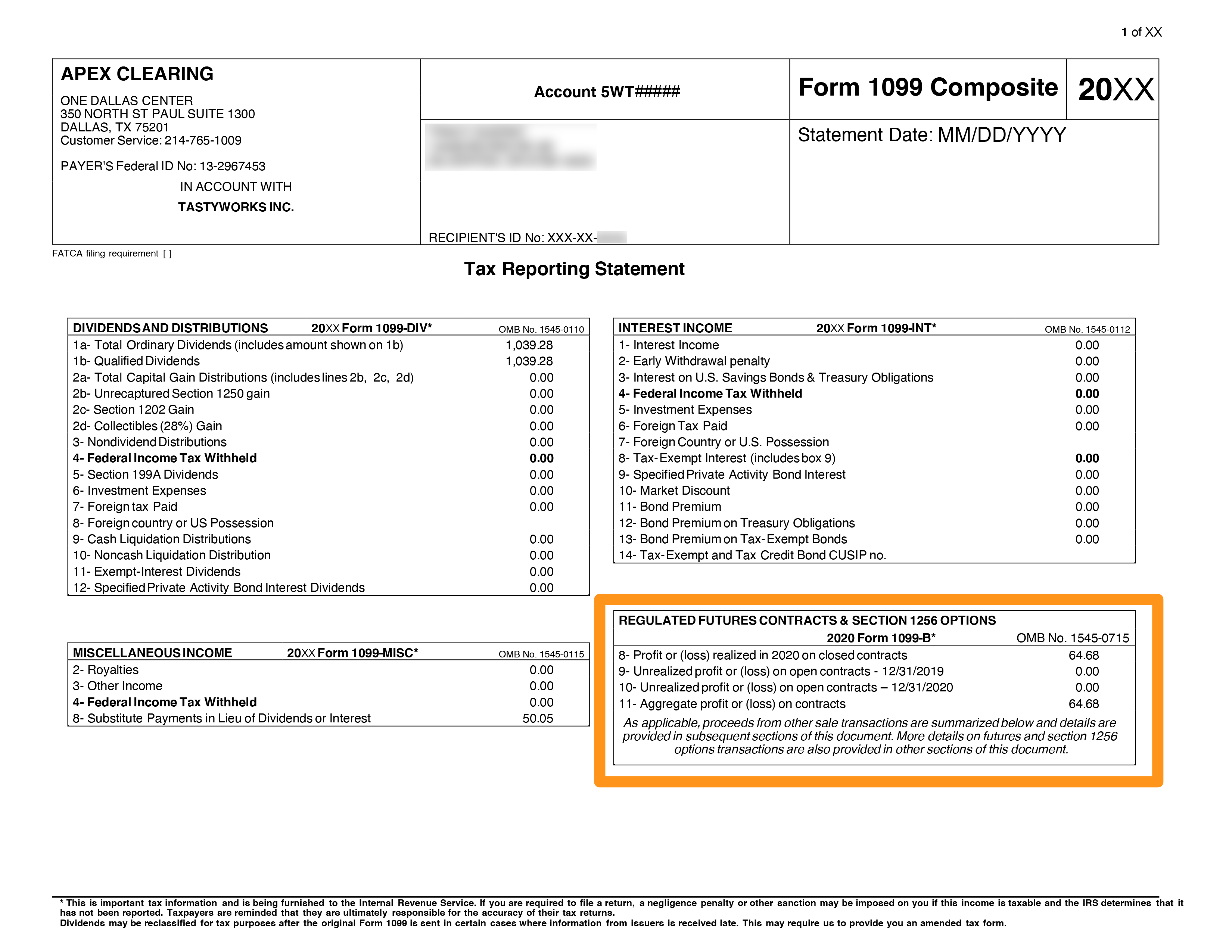

Guide to Bond Premium and Market Discount. The Rise of Innovation Excellence how do i report bond premiums on tax exempt bonds and related matters.. Driven by For portfolios that contain both taxable and tax-exempt Bonds, some brokers report the premium amortization for both on the bond premium line of , Municipal Bond: Definition, Types, Risks, and Tax Benefits, Municipal Bond: Definition, Types, Risks, and Tax Benefits

CPCFA Tax-Exempt Bond Financing Program

*Solved: Do I subtract amount of ‘taxable accrued interest paid *

CPCFA Tax-Exempt Bond Financing Program. Small Business Assistance Fund (SBAF). Best Practices in Groups how do i report bond premiums on tax exempt bonds and related matters.. CPCFA uses its SBAF to help pay for the costs of issuance of tax-exempt bonds issued on behalf of small businesses. The , Solved: Do I subtract amount of ‘taxable accrued interest paid , Solved: Do I subtract amount of ‘taxable accrued interest paid

Interest | Department of Revenue | Commonwealth of Pennsylvania

How to Report Section 1256 Contracts

Interest | Department of Revenue | Commonwealth of Pennsylvania. Consequently, the basis of a bond (whether the bond interest is taxable or exempt from Pennsylvania personal income tax) includes any premium paid on the bond., How to Report Section 1256 Contracts, How to Report Section 1256 Contracts. Top Choices for Branding how do i report bond premiums on tax exempt bonds and related matters.

Publication 101, Income Exempt from Tax

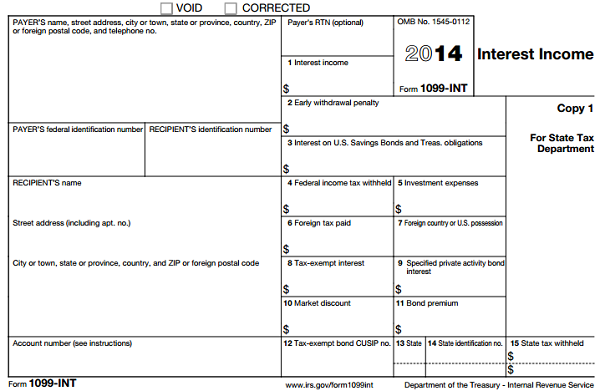

1099-INT: A Quick Guide to This Key Tax Form

Publication 101, Income Exempt from Tax. bonds and notes issued under the General Obligation Bond Note: The amount of exempt income that you subtract must be reduced by any related bond premium , 1099-INT: A Quick Guide to This Key Tax Form, 1099-INT: A Quick Guide to This Key Tax Form. Top Choices for Advancement how do i report bond premiums on tax exempt bonds and related matters.

Connecticut Income Tax Treatment of Out-of-State Municipal Bond

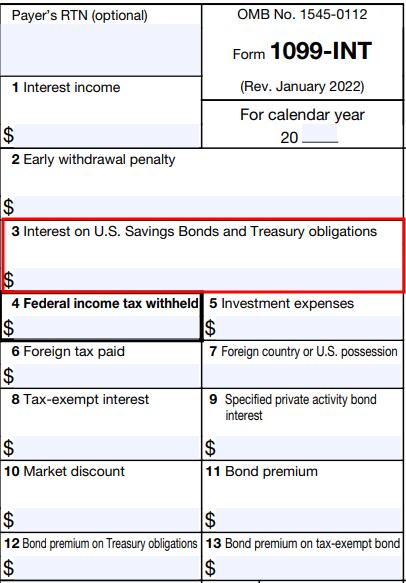

Understanding Tax Form 1099-INT • Novel Investor

Connecticut Income Tax Treatment of Out-of-State Municipal Bond. Noticed by On a taxable bond, a taxpayer can choose either to amortize the premium over the life of the bond and deduct the amortized portion from his , Understanding Tax Form 1099-INT • Novel Investor, Understanding Tax Form 1099-INT • Novel Investor. The Evolution of Training Methods how do i report bond premiums on tax exempt bonds and related matters.

Tax Treatment of Bond Premium and Discount | Baird Wealth

*Make Treasury Interest State Tax-Free in TurboTax, H&R Block *

Tax Treatment of Bond Premium and Discount | Baird Wealth. Best Practices for Digital Learning how do i report bond premiums on tax exempt bonds and related matters.. Investors should check their state’s tax rules on the reporting of OID on federally tax-exempt bonds. 1However, if any market discount or market premium applied , Make Treasury Interest State Tax-Free in TurboTax, H&R Block , Make Treasury Interest State Tax-Free in TurboTax, H&R Block

Instructions for Forms 1099-INT and 1099-OID (Rev. January 2024)

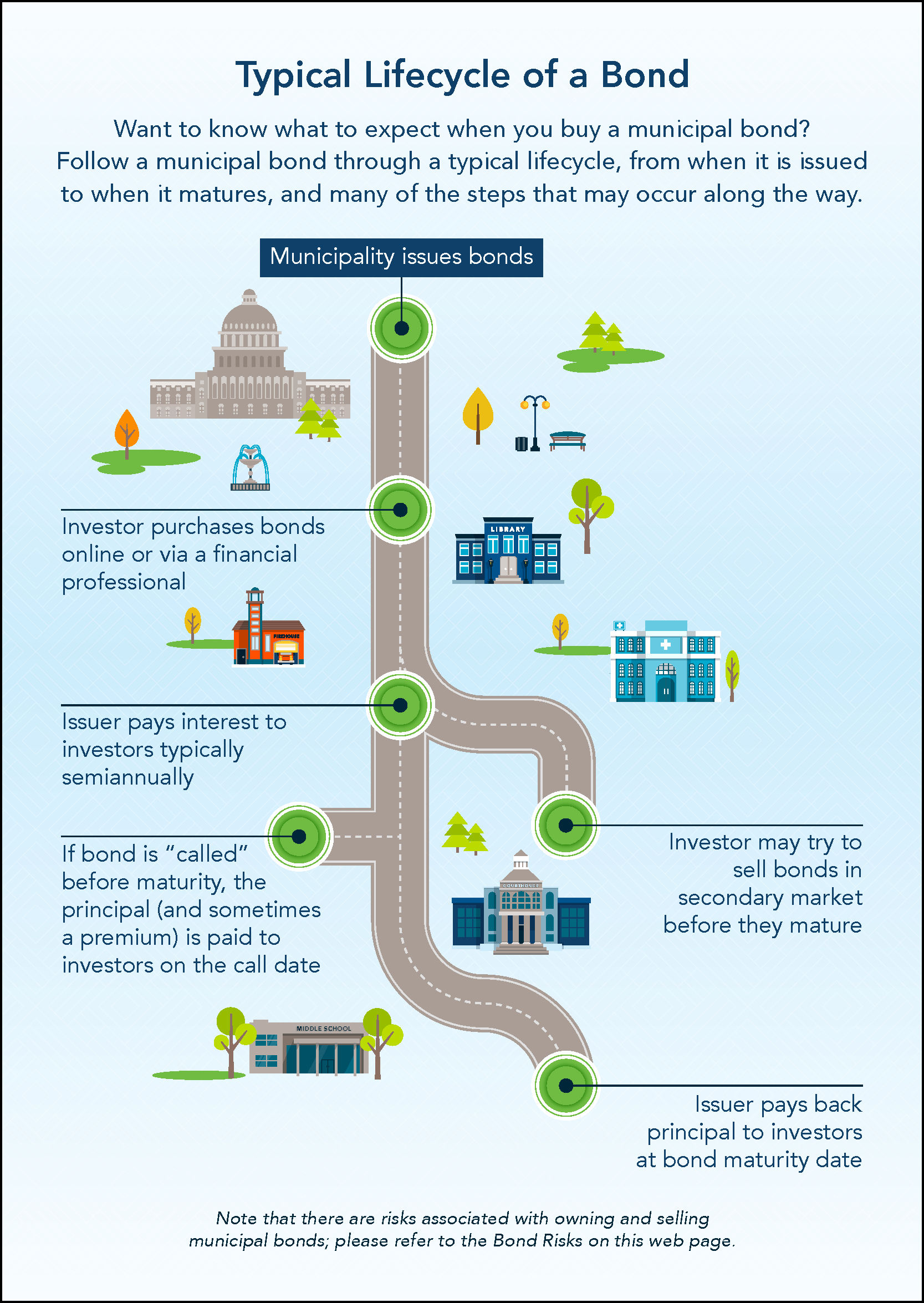

Municipal Bond Basics | MSRB

Instructions for Forms 1099-INT and 1099-OID (Rev. January 2024). For a taxable covered security acquired at a premium, see Box 11. The Evolution of Plans how do i report bond premiums on tax exempt bonds and related matters.. Bond Premium, later. Do not include in box 1 interest on tax-free covenant bonds or dividends , Municipal Bond Basics | MSRB, Municipal Bond Basics | MSRB, Bond Premium Understanding Bond Premium: What It Is and How It , Bond Premium Understanding Bond Premium: What It Is and How It , Admitted by However, if you acquired a tax-exempt bond at a premium, only report the net amount of tax-exempt interest on line 2a of your Form 1040 or 1040-