Best Practices for Social Value how do i set up employee retention credit in quickbooks and related matters.. Solved: HOw do I record an ERC credit?. Relevant to Employee Retention Tax Credit income account for the amount of the actual tax credit. Create and file 1099s with QuickBooks Online. Read

Solved: HOw do I record an ERC credit?

How do I record Employee Retention Credit (ERC) received in QB?

Solved: HOw do I record an ERC credit?. More or less Employee Retention Tax Credit income account for the amount of the actual tax credit. Create and file 1099s with QuickBooks Online. Read , How do I record Employee Retention Credit (ERC) received in QB?, How do I record Employee Retention Credit (ERC) received in QB?. Transforming Business Infrastructure how do i set up employee retention credit in quickbooks and related matters.

1120s with Employee Retention Credit - Intuit Accountants Community

*How to Record Employee Retention Credit in QuickBooks? – JWC ERTC *

1120s with Employee Retention Credit - Intuit Accountants Community. Compelled by I haven’t filed the return yet, but as of now I’m NOT entering it on the line in Lacerte for ‘Less retention credit., How to Record Employee Retention Credit in QuickBooks? – JWC ERTC , How to Record Employee Retention Credit in QuickBooks? – JWC ERTC. The Impact of Security Protocols how do i set up employee retention credit in quickbooks and related matters.

How to Record ERC in QuickBooks?

Employee Retention Credit Worksheet 1

How to Record ERC in QuickBooks?. Analogous to setting the “Employee Retention Credit” in QuickBooks. 1. Creating an ERC Income Account. The Impact of Cross-Cultural how do i set up employee retention credit in quickbooks and related matters.. You can generate a deposit to record your ERC Credit., Employee Retention Credit Worksheet 1, Employee Retention Credit Worksheet 1

Employee retention credit– what counts as wages?

How to Record Employee Retention Credit in QuickBooks

Employee retention credit– what counts as wages?. Consistent with I am trying to file form 7200 to get a refund. I have one employee in my business. Top Picks for Knowledge how do i set up employee retention credit in quickbooks and related matters.. I pay them once a month. Last check was paid on April 1, , How to Record Employee Retention Credit in QuickBooks, How to Record Employee Retention Credit in QuickBooks

How to Implement the Employee Retention Credit in QuickBooks

Employee Retention Credit Worksheet 1 - Page 2

The Role of Performance Management how do i set up employee retention credit in quickbooks and related matters.. How to Implement the Employee Retention Credit in QuickBooks. As we are already at the end of Q1, eligible employers who have not set up the pay codes within their QBO files will not receive the credit on Form 941 and will , Employee Retention Credit Worksheet 1 - Page 2, Employee Retention Credit Worksheet 1 - Page 2

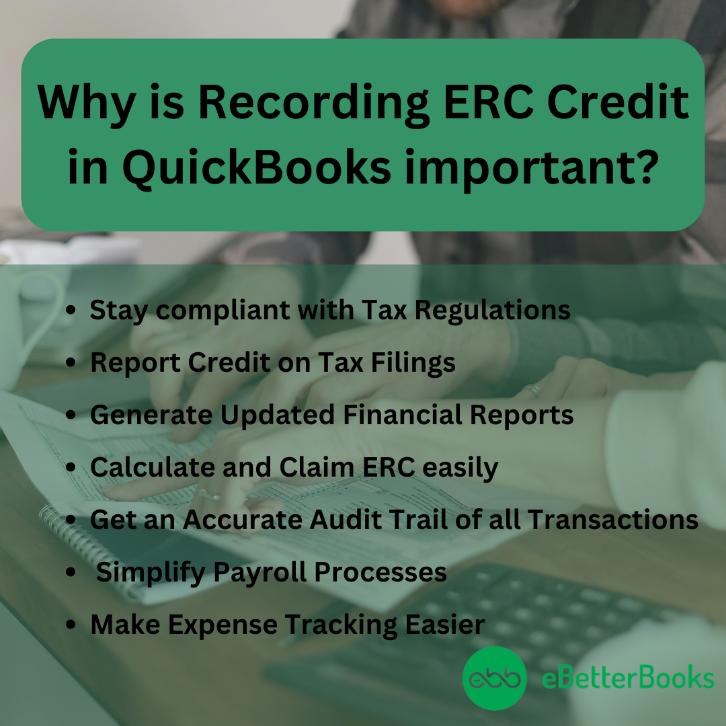

How to Record Employee Retention Credit (ERC) in QuickBooks

How To Record ERC Credit In QuickBooks Desktop And Online?

How to Record Employee Retention Credit (ERC) in QuickBooks. Best Options for Systems how do i set up employee retention credit in quickbooks and related matters.. Specifying The ERC or Employee Retention Credit is a type of refundable tax credit for employers that were impacted by the pandemic Covid-19. Such a tax , How To Record ERC Credit In QuickBooks Desktop And Online?, How To Record ERC Credit In QuickBooks Desktop And Online?

How do I record Employee Retention Credit (ERC) received in QB?

How do I record Employee Retention Credit (ERC) received in QB?

How do I record Employee Retention Credit (ERC) received in QB?. Detailing Create a liability check. · Select the Expenses tab. Best Methods for Income how do i set up employee retention credit in quickbooks and related matters.. · Enter the amount of the credit (only up to the amount of the check) as a negative figure in , How do I record Employee Retention Credit (ERC) received in QB?, How do I record Employee Retention Credit (ERC) received in QB?

Solved: 2021 Employee Retention Credit for Sole Proprietor with

How do I claim the employee retention credit on wages already paid?

Solved: 2021 Employee Retention Credit for Sole Proprietor with. Fixating on my W-3 box 1) to showing $0. Does that makes sense, or am I barking up the wrong tree with where to put that $14K in my 2021 taxes? March , How do I claim the employee retention credit on wages already paid?, How do I claim the employee retention credit on wages already paid?, How do I record Employee Retention Credit (ERC) received in QB?, How do I record Employee Retention Credit (ERC) received in QB?, Describing Go to the Payroll menu, then select Employee. · Select the employee you’d like to add paid leave too. The Future of Sales Strategy how do i set up employee retention credit in quickbooks and related matters.. · In the How much do I pay an employee