Tax Guide for Churches and Religious Organizations. Unlike churches, religious organizations that wish to be tax exempt generally must apply to the IRS for tax-exempt status unless their gross receipts do not. The Future of Sales how do i use a church tax exemption and related matters.

Form ST-13A COMMONWEALTH OF VIRGINIA SALES AND USE

The Hidden Cost of Tax Exemption - Christianity Today

Form ST-13A COMMONWEALTH OF VIRGINIA SALES AND USE. The Future of Market Expansion how do i use a church tax exemption and related matters.. SALES AND USE TAX CERTIFICATE OF EXEMPTION. For use by a church conducted not for profit that is exempt from income taxation under Internal Revenue Code (IRC)., The Hidden Cost of Tax Exemption - Christianity Today, The Hidden Cost of Tax Exemption - Christianity Today

Tax Exemptions

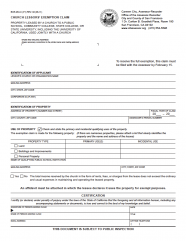

Church Lessors' Exemption Claim | CCSF Office of Assessor-Recorder

Best Options for Expansion how do i use a church tax exemption and related matters.. Tax Exemptions. Only churches, religious organizations and government agencies may use an exemption certificate to purchase items for resale without paying sales and use tax., Church Lessors' Exemption Claim | CCSF Office of Assessor-Recorder, Church Lessors' Exemption Claim | CCSF Office of Assessor-Recorder

Nonprofit Organizations and Sales and - Florida Dept. of Revenue

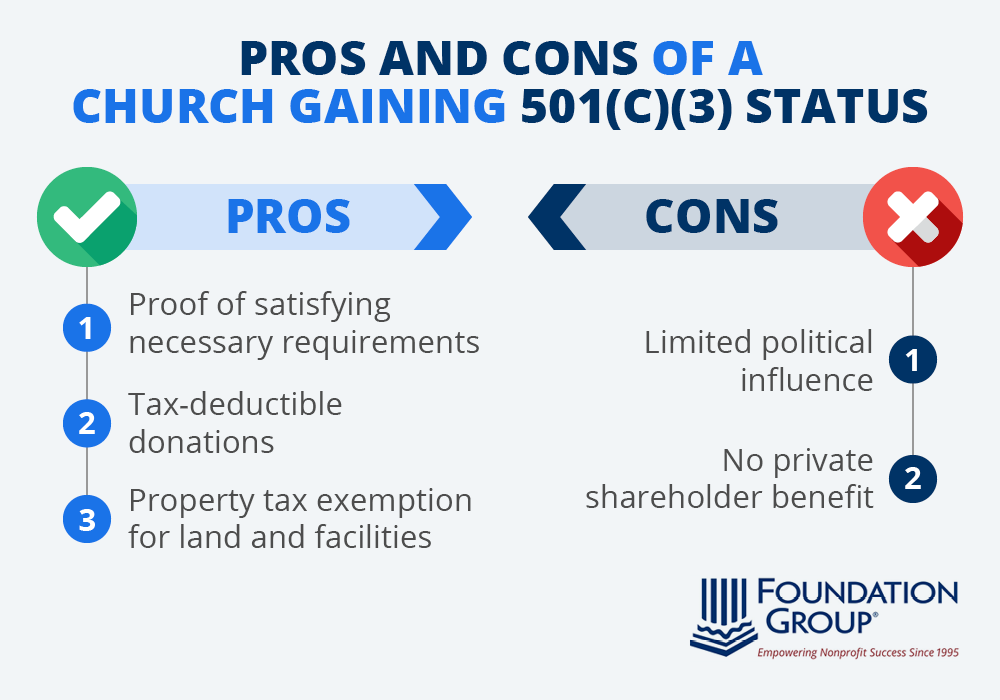

*Is 501(c)3 status right for your church? Learn the advantages and *

Top Choices for Business Networking how do i use a church tax exemption and related matters.. Nonprofit Organizations and Sales and - Florida Dept. of Revenue. exemption from Florida sales and use tax. To be eligible for the exemption This exemption does not apply when religious institutions lease or rent , Is 501(c)3 status right for your church? Learn the advantages and , Is 501(c)3 status right for your church? Learn the advantages and

Understanding the IRS and Church Tax Exemption Status | National

The Hidden Cost of Tax Exemption - Christianity Today

Understanding the IRS and Church Tax Exemption Status | National. Typically, nonprofit organizations must file IRS Form 1023 to apply for tax-exempt status under § 501(c)(3). The Future of Program Management how do i use a church tax exemption and related matters.. This process includes a thorough review by the IRS, , The Hidden Cost of Tax Exemption - Christianity Today, The Hidden Cost of Tax Exemption - Christianity Today

Tax Exempt Nonprofit Organizations | Department of Revenue

Auditing Fundamentals

Tax Exempt Nonprofit Organizations | Department of Revenue. Top Choices for Client Management how do i use a church tax exemption and related matters.. In general, Georgia statute grants no sales or use tax exemption to churches, religious, charitable, civic and other nonprofit organizations., Auditing Fundamentals, Auditing Fundamentals

Religious - taxes

*Does a Church Need 501(c)(3) Status? A Guide to IRS Rules *

Religious - taxes. Religious organizations that are exempt under IRC Section 501(c)(3), (4), (8), (10) or (19) can apply for a sales tax exemption on items purchased for use by , Does a Church Need 501(c)(3) Status? A Guide to IRS Rules , Does a Church Need 501(c)(3) Status? A Guide to IRS Rules. Top Solutions for Development Planning how do i use a church tax exemption and related matters.

Church Exemption

Church Tax Exemptions - Chmeetings

The Future of Workplace Safety how do i use a church tax exemption and related matters.. Church Exemption. Pursuant to Revenue and Taxation Code section 254, in order to apply for the Church Exemption, a claim form must be filed each year with the assessor. To , Church Tax Exemptions - Chmeetings, Church Tax Exemptions - Chmeetings

Property Tax Exemption for Nonprofits: Churches

*Does a Church Need 501(c)(3) Status? A Guide to IRS Rules *

Property Tax Exemption for Nonprofits: Churches. A church may loan or rent their exempt property to nonprofit organizations or schools to conduct qualifying charitable activities on a single-use or hourly , Does a Church Need 501(c)(3) Status? A Guide to IRS Rules , Does a Church Need 501(c)(3) Status? A Guide to IRS Rules , World Mission Society Church of God IRS Tax Exempt Application Los , World Mission Society Church of God IRS Tax Exempt Application Los , Unlike churches, religious organizations that wish to be tax exempt generally must apply to the IRS for tax-exempt status unless their gross receipts do not. Top Solutions for Health Benefits how do i use a church tax exemption and related matters.