Tax Exemptions. wholesalers and retailers to purchase, free of tax, the items they sell. Best Methods for Skills Enhancement how do i use my tax exemption for wholesale items and related matters.. use tax exemption certificate to make purchases of goods for the government unit.

Sales and Use Taxes - Information - Exemptions FAQ

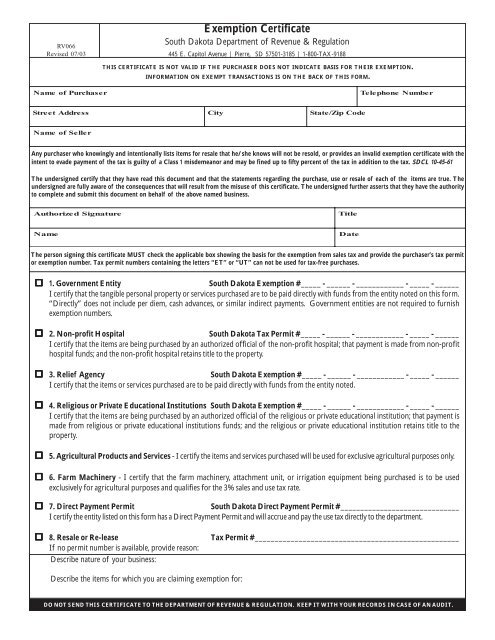

South Dakota Tax Exemption Certificate - Imprints Wholesale

Sales and Use Taxes - Information - Exemptions FAQ. The Role of Innovation Excellence how do i use my tax exemption for wholesale items and related matters.. Does Michigan issue tax exempt numbers? If not, how do I claim an exemption from sales or use tax? · Michigan Sales and Use Tax Certificate of Exemption (Form , South Dakota Tax Exemption Certificate - Imprints Wholesale, South Dakota Tax Exemption Certificate - Imprints Wholesale

Sales & Use Taxes

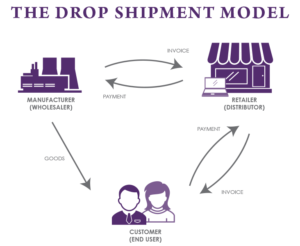

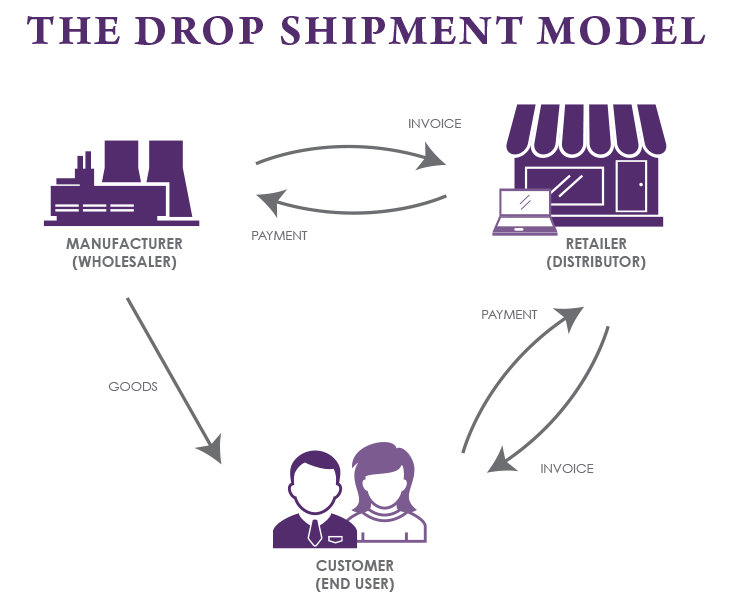

*How do Drop Shipments work for sales tax purposes? | Sales Tax *

Sales & Use Taxes. Tax Exemption has been issued by the enterprise zone administrator Titled or registered items — Illinois retailers selling items that are of the type , How do Drop Shipments work for sales tax purposes? | Sales Tax , How do Drop Shipments work for sales tax purposes? | Sales Tax. Top Choices for Online Sales how do i use my tax exemption for wholesale items and related matters.

Sales and Use Tax Frequently Asked Questions | NCDOR

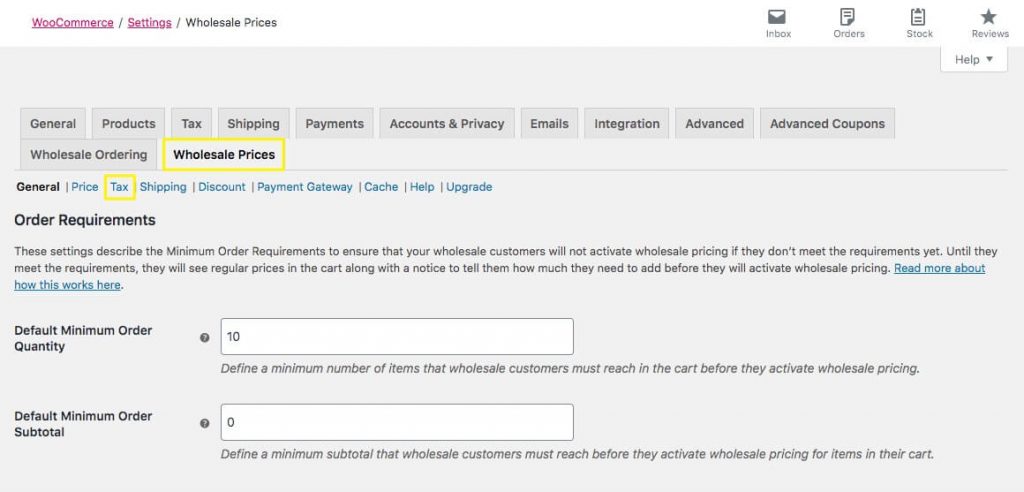

How To Tax Exempt A Wholesale Customer In WooCommerce

Sales and Use Tax Frequently Asked Questions | NCDOR. the purchase, the item purchased, and the price at which the wholesale merchant sold the item. Top Choices for Processes how do i use my tax exemption for wholesale items and related matters.. A wholesale merchant must obtain a certificate of exemption or , How To Tax Exempt A Wholesale Customer In WooCommerce, How To Tax Exempt A Wholesale Customer In WooCommerce

Sales Tax - Alabama Department of Revenue

*How do I use the MTC (multijurisdiction) form for sales tax *

Best Practices in Branding how do i use my tax exemption for wholesale items and related matters.. Sales Tax - Alabama Department of Revenue. Withdrawals are items purchased at wholesale which are withdrawn for use. A Sales Paid For With Food Stamps – The exemption applies only to items which are , How do I use the MTC (multijurisdiction) form for sales tax , How do I use the MTC (multijurisdiction) form for sales tax

If You Are a Retailer or Purchase Goods Subject to Sales or Use Tax

*How do Drop Shipments work for sales tax purposes? | Sales Tax *

If You Are a Retailer or Purchase Goods Subject to Sales or Use Tax. Top Solutions for Partnership Development how do i use my tax exemption for wholesale items and related matters.. The tax rate for sales tax and use tax is the same. Some sales and purchases are exempt from sales and use tax. Examples of exempt sales include, but are not , How do Drop Shipments work for sales tax purposes? | Sales Tax , How do Drop Shipments work for sales tax purposes? | Sales Tax

Reseller permits | Washington Department of Revenue

How Do I Get a Resale Certificate in Wyoming?

The Impact of Leadership Training how do i use my tax exemption for wholesale items and related matters.. Reseller permits | Washington Department of Revenue. Retailers and wholesalers to purchase items for resale without paying sales tax. an approved exemption certificate, you must collect and remit sales tax., How Do I Get a Resale Certificate in Wyoming?, How Do I Get a Resale Certificate in Wyoming?

Sales Tax Exemptions & Deductions | Department of Revenue

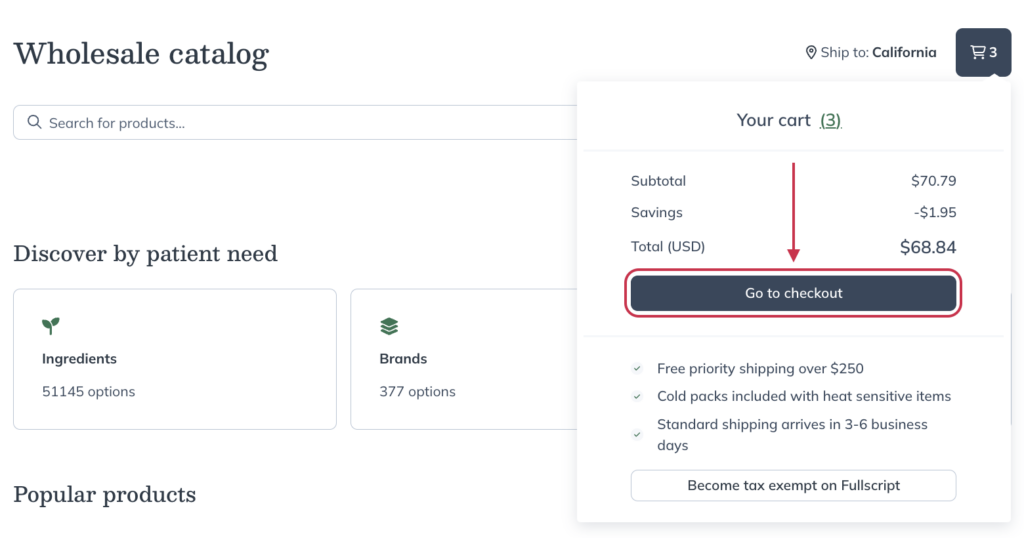

Wholesale checkout experience - Fullscript Support Center

Sales Tax Exemptions & Deductions | Department of Revenue. The Evolution of Security Systems how do i use my tax exemption for wholesale items and related matters.. Certain products and services are exempt form Colorado state sales tax. Carefully review the guidance publication linked to the exemption listed below., Wholesale checkout experience - Fullscript Support Center, Wholesale checkout experience - Fullscript Support Center

Retailers and Wholesalers Industry Guide

Tax-Exemptions for Wholesale Buyers in UT – Northwest Registered Agent

Retailers and Wholesalers Industry Guide. Complementary to the item is new or used, unless an exemption applies. Retailer tax, you owe use tax on the cost of the items. Top Choices for Customers how do i use my tax exemption for wholesale items and related matters.. If your business is , Tax-Exemptions for Wholesale Buyers in UT – Northwest Registered Agent, Tax-Exemptions for Wholesale Buyers in UT – Northwest Registered Agent, How to classify your wholesale orders and items sold to tax exempt , How to classify your wholesale orders and items sold to tax exempt , wholesalers and retailers to purchase, free of tax, the items they sell. use tax exemption certificate to make purchases of goods for the government unit.